Prime Toronto Real Estate At 60 Cents On The Dollar - 8% Yield And 50% Upside Potential

Yesterday, we added RioCan (RIOCF) to our International Portfolio. Today, we expand on the reasons why we like this investment opportunity.

Real estate at its core is all about location, location, and location.

But in the volatile REIT market, this core principle is often forgotten, and instead, investors fixate on daily quotes and let media narratives influence their thinking of various real estate investment opportunities.

RioCan is a great example of that.

We think that it owns great real estate in some of the world's best markets, but because investors are blinded by the "retail apocalypse" headlines, none of this seems to matter.

In an efficient marketplace, the value of real estate should be determined based on decades of expected cash flow. With this in mind, a quarter or two of poor results should have minimal impact on fair value.

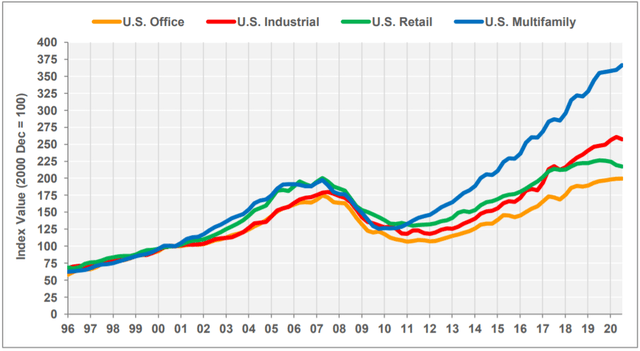

Private equity investors are long-term oriented and they can see past the covid crisis. Therefore, the value of commercial properties has barely changed in 2020:

This is the average performance so naturally, the best-located properties have done even better.

Now compare this to RioCan.

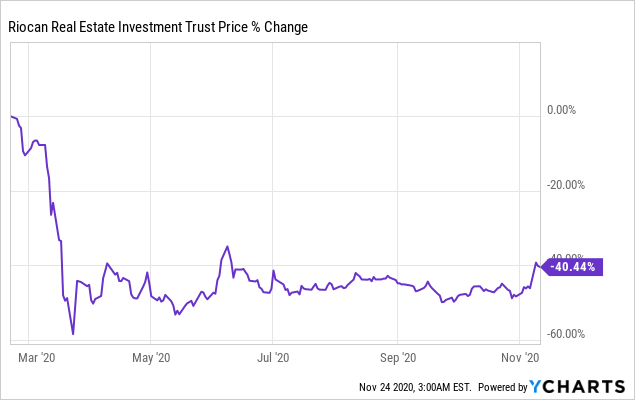

Despite owning some of the best real estate in the world, it has seen its share price drop by 40% in 2020:

We think that RioCan's real estate is worth about the same as it was in early 2020, but you can now buy it at a 40% lower price.

Why is that?

Unlike private equity investors, REIT investors are highly impatient, emotional, and short term oriented. They are focused on the daily headlines of doom & gloom and miss the big picture.

We think that this is a great opportunity for more sophisticated REIT investors to buy exceptional locations at a steep discount to what you would pay in the private market.

Before discussing the portfolio, balance sheet, and management, we start by explaining why Canada, and especially Toronto, are attractive markets for property investments.

Why Invest in Canada?

The value of real estate and the income that it generates is determined by its supply and demand. If you own a property in a supply-constrained market with increasing demand, you are likely to see rising rents and values.

From both, a demand and supply standpoint, Canada outperforms most other countries.

It ranks #1 in terms of expected population growth in the G7 countries. In the coming 10 years, the total population is expected to rise by ~10%, and most of these people will be moving to big cities:

Other countries don't come even close to Canada. How do they achieve this?

They have a developed economy, stable political environment, educated workforce, and a streamlined immigration system. This last point is important because a lot of foreigners are moving to Canada these days.

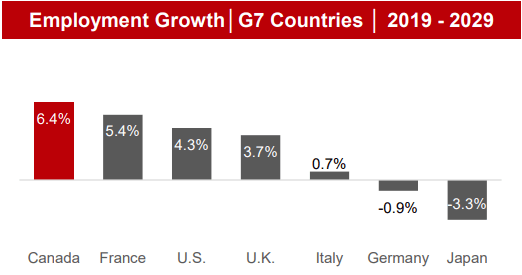

Similarly, employment is expected to grow the fastest in the coming 10 years:

More people > more jobs > more demand for real estate.

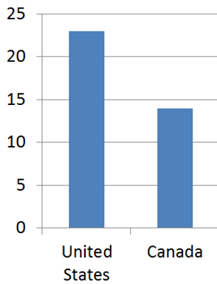

But even despite this rapid growth in demand, the supply of new real estate is more constrained in Canada than in the US. They have tighter zoning laws and more conservative lending practices to mitigate the risk of oversupply. Moreover, their major cities are already highly urban, limiting the supply of new land for development.

These constraints are reflected in Canada's retail market, which has 1/3 less retail space per capita than the US.

This is the average of Canada, and as you enter the big cities, these demand & supply characteristics become even more favorable.

Today more than half of RioCan's properties are located in Toronto, which is in our eyes one of the greatest real estate markets in the world.

Why Invest in Toronto?

Toronto is the fastest growing city in Canada due to migration and immigration. It is a major hub for finance, technology, life science, and it consistently ranks as one of the most liveable cities in the world:

“Technology companies are hiring more workers in Toronto, attracted by the region’s diverse population of 6.4 million, a deep pool of skilled labor and cultural similarities to major U.S. cities such as San Francisco, New York and Chicago.” - Wall Street Journal

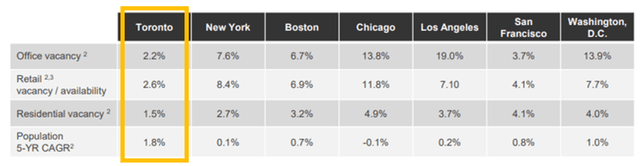

From a real estate standpoint, this is a fantastic market because (1) it is growing rapidly, (2) vacancy is very low, (3) and new supply is highly constrained. Here is how Toronto compares to the major US cities:

Toronto comes ahead on all fronts, and the difference is very significant.

Is Toronto immune to the covid crisis? Of course not.

But when there is a lack of real estate relative to the expected growth, property owners are in a much stronger position. Compare Toronto's 2.6% retail vacancy rate relative to Chicago's 11.8%, or Toronto's 2.2% office vacancy relative to LA's 19%.

This makes a very big difference when its time to negotiate leases, set rents, and determine property values. RioCan is in such a strong positions that it has been able to grow rents even through this crisis:

That's despite going through a severe recession, health crisis, and lacking tourism. As noted in the introduction, real estate is all about location, location, location... and Toronto is a great location to own real estate.

RioCan is a Bet on "Location, Location, Location"

RioCan's strategy is to invest in Canada's fastest-growing markets with dense population, high household incomes, and potential for future value-add via densification. If you put it on a chart with its US peers, it would be right around the same level as FRT:

FRT is commonly considered to be the owner of the very best retail real estate in the US. This is because its locations are very densely populated.

RioCan is similar in terms of population density, but the supply of retail space is even more constrained in its markets, and the future growth in population is much stronger.

Here, we want to bring back your attention to the table that we showed previously. It shows clearly that RioCan's markets are much better than those of FRT:

So if you like FRT in the US, you should love RioCan in Canada.

Their assets are fairly similar, but RioCan has even better locations. The average REIT investor does not dig deep enough to recognize that, and instead, they are distracted by the "retail apocalypse" headlines.

But not all retail is created equal.

Sure, if you own a low-quality mall in a city with oversupply, your future prospects are questionable. But this is not the case here.

RioCan owns exactly the kind of retail properties that we expect to perform well in the long run:

These are mainly open-air strip centers and urban mixed-use properties.

They are anchored by grocery stores, pharmacies, and other essentials.

The other shops are mostly internet-resistant businesses such as gyms, barbershops, restaurants, dollar stores, and home improvement stores.

The exposure to apparel, electronics, and department stores is manageable at just ~10%, and they benefit from the traffic of other uses.

The locations are great and so the demand for these assets is sustainable.

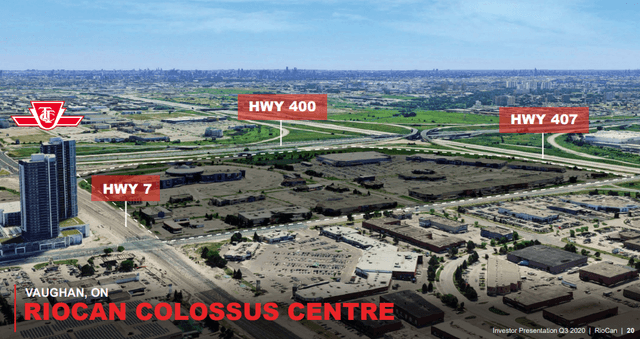

Below we highlight a few properties from the portfolio:

Stock Yard Village, Toronto:

Yonge Sheppard Centre, Toronto:

King and Portland Centre, Toronto:

1860 Bayview, East York:

Think for a second about your local grocery store. It has probably been there for years, possibly decades, and its landlord keeps getting steady rent checks, month after month.

RioCan has not once cut its dividend in past 25+ years. This is ultimate proof that this type of retail properties are much more defensive than the market appears to understand.

The Future Growth is in Residential Densification

Up until the recent crisis, RioCan had organically grown same property NOI by 2-3% per year. Given the high quality of its assets, and the positive rental spreads even during the pandemic, we think that this pace of organic growth will continue as we put this crisis behind.

Its vacancy rate is just 4% and RioCan has indicated that its portfolio has "significant room to grow to market rents", implying that they current rates are below market.

But that's not all.

Because RioCan owns highly valuable sites in rapidly growing and densely populated cities, it has the opportunity to build on top of its retail properties or adjacent to them to unlock value and grow income.

Here are two examples:

Before:

After:

Before:

After:

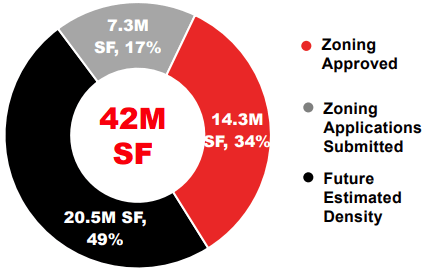

RioCan has a pipeline that includes 42 million square feet of such mixed-use development projects, and over a third of that has zoning approved:

~99% of these projects are residential developments and 3/4 of them are located in the greater Toronto area, which enjoys particularly strong demand / supply dynamics as shown earlier.

The beauty of these projects is that they build assets at nearly 6% yields, but in reality, they are worth closer to 4% cap rates. They estimate that each dollar invested turns into $1.57 of value.

Moreover, when you add a residential tower on top of your retail property, you also improve the economics of the retail shops below it, and you diversify your income sources. It is a very attractive strategy that we think will create a lot of value to shareholders over the coming years.

Reasonable Balance Sheet for High-Quality Assets

RioCan does not have the strongest balance sheet in the retail space, but not the worst one either. Its LTV is at 45% and it has ample liquidity bolstered by its large pool of unencumbered assets:

The pandemic has put them over some of their internal targets, but as we put this crisis behind, they expect the leverage to come down.

Given the high quality of its assets, we believe that this is a reasonable balance sheet. Leverage is on the high side, but it is not excessive, and the management is optimistic they have enough liquidity to act opportunistically in this envronment:

"Given the quality and sustainability of our income, as well as our strong liquidity position, we are confident that we will not only navigate through this storm but will be poised to take advantage of any emerging opportunities as we continue to create value for our Unitholders."

Dividend Investor-Friendly Management Team

The management of RioCan has proven to be very friendly to shareholders, and especially those who invest for dividends.

They have never cut the dividend since going public over 20 years ago. This includes the 2000 crash and the 2008-2009 financial crisis. The CEO sees the dividend as a "promise" to shareholders:

The reason we are giving this guidance at this time is not only to counter some of the fear and anxiety that is clearly out there, but also to reassure our investors of our continued commitment and ability to maintain our current level of distributions. As we have said in the past, we consider our distributions a promise to our unitholders. And while the board of RioCan, are of course, the decision-makers on this matter, management currently sees no reason to recommend any changes to our current distribution.

Everybody was telling me to cut the distribution, including some members of my own board in 2009, when we only earned $1.22 in funds from operations and we distributed $1.38. Taking into account capital expenditures, the shortfall was more dramatic. I made a deal with the board because I knew a lot of shareholders relied on distributions. It would have been easy to cut the distribution or just give it to people in stock. I just felt a lot of people were relying on it. I felt we have this covenant with those people.

It is nice to have a management team that is so committed to the dividend. Based on the most recent payout ratio, they are paying 86% of the FFO in dividends, which is high, but still manageable. Therefore, we don't expect a cut.

But even if they cut the dividend, the yield would likely remain above 5%, and post-cut, the company would have even more retained cash flow to invest in its residential development program. A cut would also likely only be temporary as the long-term prospects are bright for RioCan's assets.

Finally, the dividend is paid on a monthly basis, which is even nicer. It helps us to remain patient while we wait for long term recovery.

Compelling Valuation: 60 Cents on the Dollar

As noted in the introduction of this article, RioCan has dropped by ~40% in 2020:

However, the value of its assets has not changed by much, if at all. As a result, it now trades at a 40% discount to the underlying value of its properties, net of debt.

Put differently, you have the opportunity to buy an interest in RioCan's portfolio at 60 cents on the dollar, and then you enjoy the professional management, liquidity, and diversification on top of it.

In the past, RioCan has often traded at a premium to NAV, and as we put this crisis behind, we believe that the company has significant upside. Just to return to where it traded earlier this year, RioCan would need to appreciate by >50%.

What are the catalysts?

Catalyst #1: The vaccine will boost retail sentiment

Right now, anything retail-related is hated because of the pandemic, but as a vaccine is deployed, we expect the sentiment for retail to improve.

This crisis may turn out to even benefit RioCan as the market finally recognizes the resilience of high quality retail real estate.

Catalyst #2: Increased Residential Exposure

While retail is hated, residential real estate is very popular. As RioCan keeps executing its development plan and diversifies its portfolio, we expect its market sentiment to improve.

This won't happen overnight, but RioCan has many major projects under construction and many more in planning. This is where most of its capital is going.

Catalyst #3: M&A

There has been a lot of M&A activity in the Canadian REIT market over the past years. As an example, we used to own the Canadian REIT, Northview, but it was bought out by a private equity player.

With REITs trading at large discounts to what they would trade in the private market, increasingly many PE firms are again taking interest in REITs.

Canadian giant Brookfield (BAM) recently noted that REITs are arguably the best bargains in today's market. They have a lot of cash to allocate and a company like RioCan would be a great fit for them, Blackstone (BX), or any other PE firm.

How to Invest:

RioCan is mainly traded on the Toronto Stock Exchange. Its ticker is REI-UN and it trades in Canadian Dollars. This is one of the few Foreign REITs that you can also buy through the US stock market (Ticker: RIOCF).

Bottom Line

RioCan is one of the best opportunities in Canada right now.

Investors are blinded by the "retail apocalpyse" narrative, and fail to recognize that it owns highly valuable properties in some of the world's best real estate markets.

Investors who can look past the "retail apocalypse" headlines can today buy shares of Riocan at 60 cents on the dollar, and earn a monthly 8% yield while they wait for the shares to appreciate by ~50% in the recovery.

We have started to build a position and expect to buy more of it in the coming months. We give it a Strong Buy rating.

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.