RE-THINK Conference Observations

RE-THINK Conference Observations

Yesterday, I had the pleasure to attend the RETHINK REAL ESTATE CONFERENCE in Madrid, Spain. It is one of the leading real estate investment conferences in Europe – bringing together REIT executives and other private equity leaders to discuss future trends and opportunities in real estate markets.

Our objective is to expand our coverage of International REIT opportunities and so this conference was essential for us. It allowed us to meet with REIT management teams from France, Spain, Germany, Singapore, South Africa, the UAE, Israel, and many other foreign countries. We got to discuss individual strategies as well as the latest opportunities with other local investors.

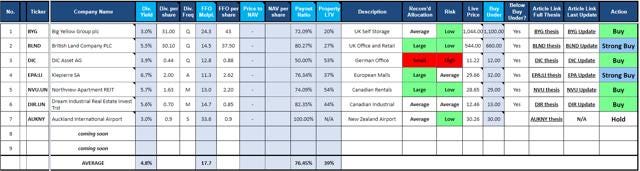

Our International Portfolio currently holds 7 REITs (or REIT-equivalents). By the end of 2019 – our objective would be to expand it closer to 15 companies:

Below we discuss the main take-aways from the conference. We first cover more general trends in real estate markets, then discuss how these apply to our REIT investment strategy, and finally, we shortly discuss two new Foreign opportunities that we are currently researching for future investment.

Major Trends in Real Estate Investment Markets

Retail is Hot: The investment market is very pessimistic on Retail REITs. Share prices have crashed, and valuations are historically low. However, if you listen to the REIT executives and other conference attendees, you would never guess that Retail is so hated. All we heard was positive. “Malls are transforming, they are not dying”. Sales are rising, traffic is up, and new uses are fortifying long term sustainability. Class A malls are becoming social hubs with entertainment and services that the e-commerce cannot compete with. REIT investors are shying away from retail – private investors are doubling down on it – whether that is in Spain, Germany, or even Israel.

Even Lower-Quality Retail is Hot: Interestingly, we heard a German REIT (Demire AG) explain that they are targeting secondary market malls that are dominant in their catchment areas. These malls are very similar to those of CBL (CBL) in the US and they are paying ~7% cap rates to buy them. They showed several examples, and these are at best Class B assets and arguably even Class C malls in tiny German towns. They argue that they are cash cows that will continue to produce high income as long as people live in those towns. They include grocery stores, services, fashion, and any other daily goods that residents of these towns may need. They enjoy moats, defensive cash flow, and long-term resilience – whereas Class A malls suffer from greater competition.

Value-add is Key: Cap rates are exceptionally low today and so simply buying stabilized properties is not enough to generate attractive returns. REITs explain that they have switched the office tie and suits to construction helmets to create value. Many REITs are becoming developers of new properties, undertaking densification projects and/or redeveloping distressed properties to boost returns in 2019.

Urbanization to Impact Returns: There was a lot of discussions about how rural areas in Europe are set for further population decreases – whereas larger cities are growing rapidly. Similar trends exists all over the world and REITs are proudly show-casing how “urban” their portfolios have become to enjoy stronger long term appreciation.

Digitalization to Also Impact Returns: Most property sectors are today impacted by the rise of digitalization with new competitors entering the market. Retail is impacted by e-commerce. Offices by co-working and remote working. Hotels by Airbnb… While some properties suffer from digitalization – others are better insulated or even profit from it. Specialty, net lease, storage, residential and industrial are among the most resilient sectors.

What This All Means for Us

Retail – The Opportunity of the Decade: We have been vocal on the “Retail REIT” opportunity for quite some time now. It is arguably the most discounted property sector today and we have built a large position in Class A malls through MAC in the US and KlePierre in Europe. We also complement our Class A mall investment with a small speculative position in the preferred shares of CBL-E to boost our yield with some Class B mall exposure. Coming out of this conference, our confidence in the long term potential of these investments is at its highest level ever. We continue to seek counter arguments to test our bull thesis – but all we find is further evidence that malls will remain resilient long-term businesses.

More Cap Rate Compression Potential in the US: American investors commonly complain that cap rates are low at ~6%. If they knew what is happening in Europe, they would complain less. Cap rates over here are at right around 3% for quality office and residential assets in major cities. We believe that this is a preview of what is to come in the US if and when interest rates head even lower. Yield-starved have no options other than real estate to generate income – and as they bid up property prices, cap rates could still come down quite a bit from the current levels. This means higher NAVs and appreciation potential for REITs over the coming years.

Risk-taking is On the Rise in Europe: We were not particularly happy to see so many REITs move into development projects to seek greater rewards. The European economy is fragile and when it finally turns south, these development projects could quickly come bite investors. We are very careful to not get overexposed to speculative development projects and favor REITs with pre-let properties before construction work even begins. British Land is a good example of that as we explain in our recent article.

Our Favorite “Urbanization” Investment: Our most urban investment today is arguably MAC and its Class A Mall portfolio. According to Green Street Advisors, Macerich is the most ‘urban’ of the mall owners they measure. Their properties have nearly 2.5 million people in a 15-mile radius and this number is expected to grow at 5% per year over the coming years. With increasing demand for real estate, but very minimal new supply (in-fill locations) – these Class A locations are set to appreciate further in the long run.

We are Prepared for Digitalization: The vast majority of our portfolio is today invested in technology-resistant property sectors. At the conference, they explain that Specialty assets, net lease properties, storage, and residential are among the best protected. These also happen to be our four largest sectors in the Core Portfolio at over 50% of total assets. We are very well positioned and will continue to favor sectors that present lower disruption risk from technological innovations.

Two Foreign Opportunities That Caught My Attention

Each REIT provided a ~10 min pitch about why investors should consider their company. I was familiar with most companies and most of them failed to convince me (we have high standards…).

However, there was two new companies that caught my attention. We are very interested in these and currently doing further due diligence to determine whether we want to invest or not. Detailed reports are in preparation right now. Here is a preview of each opportunity:

Grit Real Estate Income Group: Pioneer in Africa

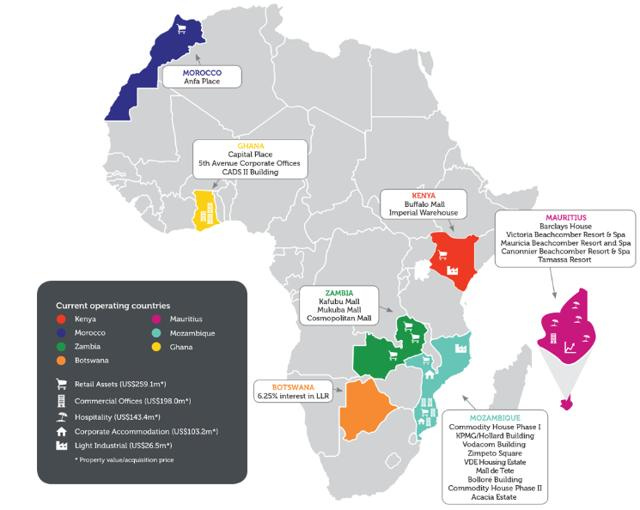

There exists today over 50 REITs in South Africa. There are however only a few companies that primarily invests in other African countries which may have greater long term growth potential.

Grit Real Estate is one of them with diverse property investments in Morocco, Ghana, Kenya, Zambia, Botswana, Mozambique and Mauritius:

Most importantly, this REIT is targeted for Foreign investors and they have done a great job at de-risking their portfolio and cash flow.

First off, they only deal with multi-national tenants such as ExxonMobil, Vodacom, Barclay’s, US Embassy and other. Secondly, their rents are paid in US Dollar or Euro. Finally, they have insured their cash flow and property against political risks by Lloyds.

As such, Grit is able to earn African yield levels (close to 10%) and enjoy the superior long-term growth potential of the continent – with a greatly mitigated risk profile.

This is really what caught our attention. They enjoy African yields that have been de-risked. Investing in African assets is opportunistic, but it comes with great risks. However, investing in a diversified portfolio of assets underpinned by predominantly US$ and Euro denominated long term leases with high-quality multinational tenants – and a strong insurance against political issues – is a different story!

Their current portfolio is valued at just shy of $800 million and they expect to double in size in the near term through accretive equity raises. They are internally managed and focused on cutting the admin cost in half through economies of scale (target cost 0.7% of assets). They expect to do a first corporate bond raise which could greatly lower interest cost. They pay an 8-9% dividend yield, expect 3-5% annual dividend growth, and target a US dollar total return of 12-16% per year. LTV is at 43%, lease terms over 7 years and fixed rent increases at 3.4%. They also have a listing on the London Stock Exchange (LON:GR1T) and pay dividends in US Dollar (They currently also have a listing in South Africa and Mauritius, but explained that they are thinking about closing those to refocus on London to increase liquidity and reduce cost).

Overall, it looks like a solid vehicle for those of you who may want to diversify abroad and invest in Africa – the continent with the fastest population and economic growth – but also the highest property yields in the world.

We are currently trying to organize an exclusive interview with the CEO for members of High Yield landlord. In the meantime, you can review their investor presentation here:

Cromwell European REIT: Tax-advantaged 8% Yield

Most Office REITs in Europe pay low dividend yields because they have been bid up by yield-starved investors. Also, since cap rates are low, even at a discount to NAV – the dividend yield is unlikely to reach very high levels as we often see in the US.

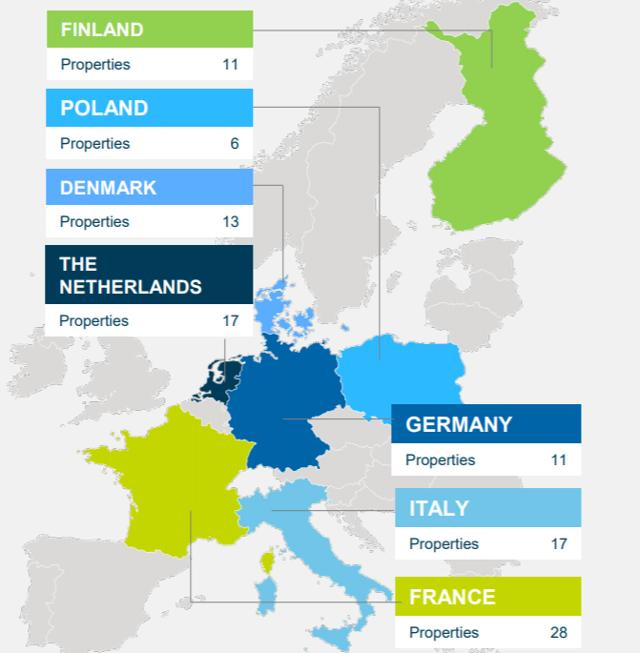

Here we have an interesting exception in Cromwell European REIT which pays an ~8% dividend yield that is fully covered and growing at ~3% per year. One key reason for this higher yield is that this REIT is actually structured in Singapore and designed for investors from Singapore. We believe that this different investor base may undervalue the company as compared to peers that are listed in Europe.

Even better, because the REIT is structured in Singapore, there is no withholding tax. It allows investors from the US and Europe to invest in European office and logistic properties – without being diluted by any local taxes:

This REIT is externally managed by Cromwell Property Group – a manager asset manager in Australia. The asset managers owns 31% of the shares which aligns interests very nicely. The shares are traded in Euro on the Singapore stock exchange with the ticker: SGX:CNNU

Same here – we are currently trying to get an interview of the CEO for members of High Yield Landlord. In the meantime, you can review their investor presentation here:

CROMWELL INVESTOR PRESENTATION

Bottom Line

We have many exciting new opportunities coming your way. On top of these two opportunities – we are preparing a 3-months long trip to Asia during which we will meet with local management teams, visit properties and present several Asian opportunities for members (October - December).

We will be a full month in Singapore – which has become the REIT capital of Asia with 45 local REITs. We expect to add at least a few of them to our International Portfolio over the coming weeks so stay tuned for that.

The RETHINK conference was a great value for money given that it opened our eyes on two new investment opportunities and allowed us to build relationships with roughly 10 other REITs which we will continue to monitor going forward.

If we can answer any questions, please let us know. Have a great week end!

Good investing from your HYL Research Team,

Jussi Askola

Disclaimer: High Yield Landlord® ('HYL') is managed by Leonberg Capital - All rights are reserved. The newsletter is impersonal and does not provide individualized advice or recommendations for any specific subscriber or portfolio, as we do not have knowledge of the investor's individual circumstances. Subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation.