Student Housing At A Discount – 5.5% Yield And 40% Upside Potential

Student Housing at a Discount – 5.5% Yield and 40% Upside Potential

What is your idea of a perfect investment in today’s uncertain market?

You would want it to have a fortress balance sheet.

Plenty of liquidity to weather the coronavirus crisis.

Resilient fundamentals that can quickly recover.

A long history of outperformance in good and bad times.

And finally, a perfect track record of dividend payments.

Most often, companies of this caliber will trade at premium valuations and low dividend yields. However, after the recent market crash, a few blue-chip REITs are now priced at historic lows and offer exceptional opportunities.

American Campus Communities (ACC) is one of the best examples. ACC has all the characteristics of a blue-chip company and yet, it fell like a rock due to coronavirus fears. We started buying it in the low $20s when it yielded over 8%. It is up by 50% since then, but even now, the company remains discounted and offers an additional 40% of upside potential in the recovery. Note that many of our portfolio holdings offer greater upside potential, but they are also riskier than ACC.

We believe that it is close to a “perfect investment” in today’s environment and we expect to keep building a larger position. We explain why in this article.

The Only Pure-Play Student Housing REIT

ACC is the only REIT that focuses solely on student housing investments. These are similar to regular apartment communities, but they are leased to students only, often come with a meal plan, and are located in very close proximity to university campuses.

Why would you want to invest in student housing?

It has a moat: the proximity to a campus often gives existing properties a large competitive advantage against new supply.

Rent by the bed: the yields can be much greater than apartments because you rent by the bed and have more tenants.

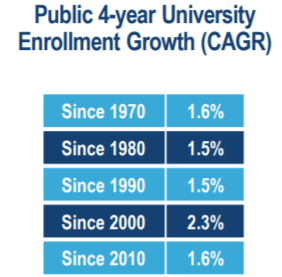

Predictable growth: the trend towards higher level education has a long way to go. Enrollment growth outpaces population growth.

Good credit: it is rare for students to not pay their lease, especially given that parents typically co-sign and/or make the payments.

Recession resilience: people attend universities whether we go through recessions or not.

Historically, ACC has achieved 15 consecutive years of same store NOI growth with a 3.8% annual average. Not even the great financial crisis could stop its growth as student housing proved to be even more resilient than regular apartments:

On the flip side, there are also some downsides to investing in student housing. Most importantly, its management is a huge hassle. The leases are shorter, the tenants are wild, wear and tear is a constant battle, and turnover is high.

For this reason, it makes a lot of sense to invest with ACC rather than to do it on your own. ACC was founded in 1993 and is today the largest owner of high-quality student housing in the United States. It has enormous scale as it owns 167 properties, representing 112,800 beds and a $10 billion enterprise value.

This massive scale comes with many advantages. Most importantly, it reduces risks through diversification. If you only owned one property, it would be quite risky because you would really on the performance of a single university. Here with ACC, you are very well diversified by location and university

Another benefit is that the management and leasing are very cost-efficient. Compared to its competitors, ACC enjoys many advantages:

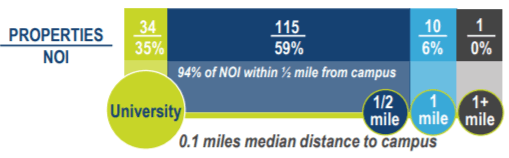

Finally, the portfolio is located at a median distance of only one-tenth of a mile from campuses. It gives it a durable moat against new competitors.

All in all, ACC has an irreplaceable portfolio of student housing with a lasting moat to continue generating steady NOI growth far into the future and irrespective of how well or poorly the economy is doing.

Long Term Growth Potential

ACC enjoys consistent 2-4% same store NOI growth. This is the result of owning the best properties right on the campuses of growing universities.

A university degree has generally a good return on investment, with a $23,000 salary differential between college graduates and high school graduates.

The average annual in-state tuition costs at the 61 public universities served by ACC is a manageable ~$11,000. After grant aid, the net tuition is less than $10,000 for most students, which surely isn’t cheap, but given the sizable salary differential, it is a worthwhile investment and therefore, we would expect enrollment to continue growing at around the same rate for years to come.

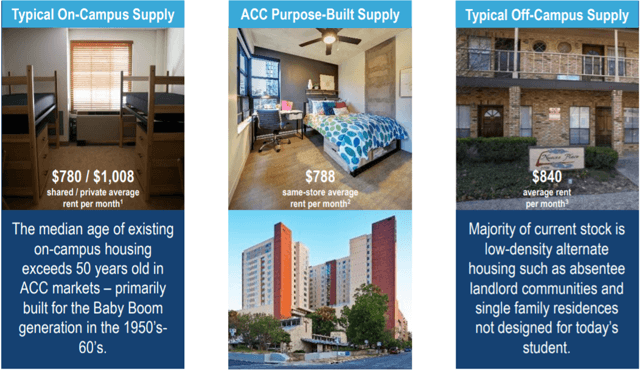

ACC is well-positioned to profit from this growth because it owns a better product at a better price point than its competitors. These are not luxury, expensive resort-style communities:

Importantly, ACC is not just a passive owner waiting for rents to grow.

It is also a largest developer of student housing. In fact, since its IPO, ACC has developed over $8 billion in properties and only acquired $5 billion. This ability to develop properties is very valuable because it results in higher returns from better properties.

ACC notes that acquisition cap rates for properties in close proximity to campuses are down to just 4 - 4.75%. However, by building themselves, they can get 6 - 7% cap rates. They earn more cash flow and it creates a lot of value to shareholders as these properties can be later sold at large gains to recycle capital into new projects.

As the long-time industry consolidator, ACC is the partner of choice for universities to modernize their existing housing stock. Right now, the majority of the student housing stock is old at a 50 year median age in ACC markets.

ACC provides a better purpose-built solutions for student housing with modern amenities, high density on campus, and better value for students:

Over time, this will provide a lot of avenues for long term growth as ACC continues to gradually modernize this industry with its better product at a better price.

All in all, ACC has the potential to grow FFO per share by 5-10% per year, reaching the higher end when they have good access to equity at a premium to NAV, and closer to the lower end when equity markets are shut.

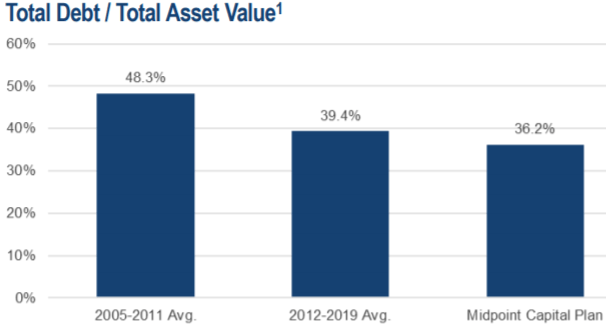

Fortress Balance Sheet

Another competitive advantage of ACC is its fortress balance sheet and BBB stable credit rating. Over the past decade, ACC has consistently deleveraged its balance sheet. Now it is down to just ~36% LTV, which is low for recession-proof student housing investments:

To consolidate a fragmented industry, you need a strong balance sheet and good access to capital. It also significantly lowers the risk in the near term because ACC has plenty of liquidity to cover any shortfall caused by the coronavirus crisis.

Finally, something unique to ACC, is that it is able raise equity capital through private joint ventures at low 4% rates by selling portions of stabilized assets. This is a big plus when their stock is too cheap to raise equity through the public market.

The Opportunity: Short Term Pain for Long Term Gain

Despite being a blue-chip company with:

High quality assets,

Resilient cash flow,

Long term growth,

And a fortress balance sheet…

… ACC is today priced at a 30% discount to NAV after seeing its share price crash in the wake of the coronavirus crisis.

Some university campuses are temporarily closed and have sent students back home to their families. This will probably lead to a disappointing results in 2020 due to unusually low occupancy rates.

However, ACC has a BBB stable credit rating and plenty of liquidity to weather any temporary drop in cash flow. Once the initial panic is over, we expect students to return to universities and ACC to quickly recover. Therefore, it appears very short-sighted to reprice an entire company at a large discount just because of a few quarters of disappointing results.

Clearly, ACC is not in danger of permanent capital destruction. And in the recession that comes after the initial crisis, student housing is positioned to thrive with better same store NOI resilience than any other property type:

Currently, the company is priced at a near 7% cash flow yield. Remember that private investors are buying joint ventures into these assets at ~4% cap rates. Leveraged, they are probably getting a 5-6% cash on cash. Yet, you are getting the opportunity to invest at an ~7% cash flow yield with the added benefit of liquidity, diversification, professional management.

This is because the shares are currently priced at a ~30% discount to NAV.

Historic Price-to-NAV shows that ACC is trading at a comparable valuation as in 2008-2009 when the company was much smaller and more heavily leveraged:

As the company reprices to its former highs, it has over 40% upside potential and we have high confidence in this recovery happening over the coming years. For a lower risk blue-chip, with a safe dividend, this is very attractive in our opinion.

The Dividend

Since its IPO in 2004, ACC has not missed a single dividend payment. It is one of the few REITs to not have cut its dividend even in 2008-2009:

Today, ACC is a much stronger company with larger scale and more liquidity than ever before. Therefore, we believe that a cut to the dividend is very unlikely. In fact, the company just announced that it maintains its dividend.

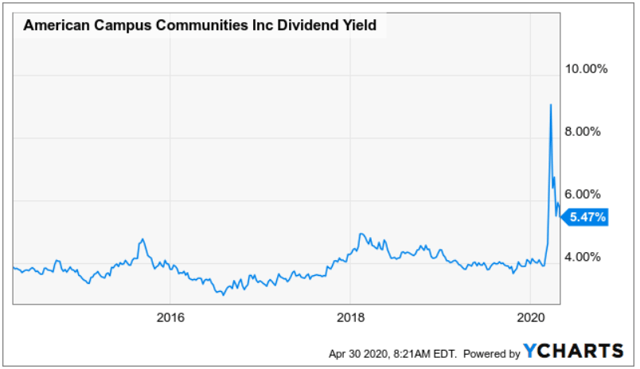

Commonly, ACC yields right around 3 to 4% because of its relative safety and long term growth potential. However, after the recent crash, its dividend yield has expanded to near 5.5%, a historically high level:

The 5.5% dividend yield is safely covered with a 76% payout ratio and it has been steadily rising over the past years. The safest dividend is the one that has been recently hiked. We expect the dividend to be maintained in 2020 and return to growth by 2022 at the latest.

A Director is Buying Heavily

Reinforcing our belief that ACC is undervalued: a director of the company bought $425,000 worth of shares in March:

The interesting thing is that he made this investment at a 20% higher price than the current share price. If he thought that it was cheap then, now it has even better margin of safety.

Risks

Bears think that the recent crisis may give a significant boost to e-learning, which could then lower the need for student housing. While it is possible, we believe that it is unlikely that we see such drastic changes in people's behavior.

Learning in a group with a professor, regular discussions, group projects, presentations, case studies, etc... are difficult to arrange through online classes.

And even more importantly, we doubt that this will be a popular option among most students who also go to college to socialize, make friends, experience life, grow to become adults, etc... That is a very big part of going to university, and it cannot be replaced with online classes.

Even if a portion of classes move online, students will still need to rent student housing as long as a portion of classes happen on the campus.

ACC owns the best located campus housing. So even if enrollment dropped a bit, it should be able to fill properties. The landlords with less well-located properties would take most of the hit.

Bottom Line

ACC has it all. High quality assets. Recession-proof cash flow. Fortress balance sheet. And strong management with perfect dividend track record.

It is a blue-chip company trading like junk. It will suffer a hit in the near term, but its long term prospects remain intact.

We also expect it to recover faster than most other companies because student housing is a recession-proof asset class.

With a 5.5% dividend yield and 40% upside potential, we are very bullish and expect to keep building a larger position in the coming weeks.

Good investing from your HYL Research Team,

Jussi Askola