The Best Way To Invest In Estonian Real Estate

Important Note: This article is unusually long at 8,000 words because it first presents the macro-thesis for investing in Estonia. We recommend that you read the full article, but if you want to cut to the chase, you can skip the first section.

----------------------------------------------------------------------------------

Executive Summary

Real estate prices are today still about 3 times cheaper in Tallinn, Estonia as compared to Helsinki, Finland which is just across the Baltic Sea less than a 2-hour boat ride away. Helsinki is richer right now, but in the long run, we expect salaries to converge much closer to one another – leading the Estonian real estate market to strongly outperform.

The Estonian economy is today in an excellent spot to continue generating above-average GDP growth and catch up to their Scandinavian peers over the coming decades. Estonia currently ranks among the very best in the world in term of:

Economic freedom: 2nd in the EU

Ease of doing business: 12th worldwide

Entrepreneurship: 1st in Europe in terms of startups per capita and 1st in the world in terms of Unicorns per capita

Technology: 1st in digitalization in the world

Education: 1st in Pisa test in Europe and 7th out of 70 countries in English proficiency

Corruption: 21st out of 180 countries

Tax competitiveness: 1st in the OECDE

Solvency: 1st in the EU in terms of debt relative to GDP

Once a member of the Soviet Union, Estonia has now become a member of the NATO, EU, Eurozone, and OECD with an excellent business environment and pro-business government that strongly promotes entrepreneurship and a free market economy. Tallinn, the capital of Estonia, has today the most start-ups per capita in whole Europe, even more than London, with massive companies like Skype and Transferwise emerging from this tiny country.

In just about 30 years, Tallinn has become a huge hub for anything tech-oriented and is commonly called the “Silicon Valley of Northern Europe”.

With a motivated, well-educated, and entrepreneurial workforce and stable governments with pro-growth economic policies, Estonia is set to catch up to other more socialistic, less entrepreneurial, and much more indebted nations of Europe with lower levels of education and even higher corruption. As this occurs, we expect the Estonian market, and Tallinn in particular, to greatly outperform most other European markets with greater income growth and asset price appreciation.

Do we know where prices will be in one year? No. But we do know that a lot of money can be made in the Estonian property market over the next 10-20 years as prices converge closer to other more developed European countries.

The best way to gain exposure to this alpha-rich property market appears to be through Tallinna Sadam, a publicly-listed company that provides exposure to an infrastructure business as well as prime sites of Tallinn that will later be developed into apartment communities and commercial real estate.

In this report, we first take at the Estonian property market, then we discuss how to invest, and finally, we dig deeper into what makes Tallinna Sadam (TSM1T) an attractive investment.

Table of Content:

1 - Why Invest in Estonia?

1.1 - Strong Economic Growth Prospects

1.2 - Greater Appreciation Potential

1.3 - Higher Initial Cap rates

1.4 - More Favorable Taxation

1.5 - Lower Relative Risk

1.6 - Catalyst for "Forced" Appreciation

1.7 - Bottom Line

2 - How to Invest in Estonia?

2.1 - Direct investment

2.2 - Private Limited Partnership

2.3 - Publicly-Traded REIT

2.4 - Publicly-Traded Company With Significant Real Estate Exposure

3 - Tallinna Sadam

3.1 - Essential Infrastructure Business

3.2 - The Real Estate

3.3 - Valuation and Upside Potential

3.4 - Dividend Focused Management Team

3.5 - Risks Factors

4 - Closing Note

1- Why Invest in Estonia?

Real estate investors generally look for five things when investing in a new market:

Growth potential

Appreciation prospects

Initial cap rate

Taxation

Risks

In each case, Estonia scores much better than average.

Below we look at these factors in greater detail.

1.1 - Strong Economic Growth Prospects

Estonia is today one of the only remaining pro-business / pro-growth countries in the European Union with strong entrepreneurial incentives such as a 20% flat tax rate on personal income, and a 0% corporate tax rate on retained earnings. The country is so accommodating to businesses that it has become the nation with the most startups per capita in Europe. Moreover, because of its specialization in anything Tech-oriented, Estonia now has the most unicorns (Tech companies valued at over $1 billion) per capita in the world and Tallinn has gained the reputation of being the European version of the “Silicon Valley”.

Entrepreneurs from all around the world are moving to this tiny country to create businesses in what is one of the least bureaucratic, and most tax-friendly EU nations. I know this topic very well because I am one of them. As a young Finnish entrepreneur with a location-independent business (Investment Research), my options for a residency were limitless. And like many others, I quickly came to the conclusion that Tallinn, Estonia was the best destination to create my company and quickly relocated to the country. Living here, I have met numerous other Foreign entrepreneurs who just like me, came to Estonia to do business in a friendly environment while staying within the EU and Euro-zone. As a growing hub for start-ups ranging from small one-person shops to Skype-like giants, Estonia has tremendous growth ahead of it coming from the private sector.

Simple economics would tell you that such an environment is more productive to growth than the more socialistic EU countries like France, Germany, or even Finland.

Yet, the pro-growth economic policies and the large start-up seen are just a part of the story. Estonia is set to enjoy rapid economic growth and catch up to other nations because:

1. Low starting point: as a general rule, generating economic growth is much easier for an emerging country than a developed one. Estonia’s GDP per capita remains today at a more than 2x lower level than Finland, its close neighbor from the North. Natural convergence between the two economies is expected to lead to a higher growth rate in Estonia over the coming decades.

2. The right infrastructure: as Estonia regained its independence in the 90s, it massively invested in modernizing its infrastructure and most importantly, it emphasizes developing a state-of-the-art digital infrastructure. For this reason, the country is often referred to as “e-estonia” and it is today one of the only countries in the world where people can vote online and have access to the internet written in their constitutional rights. The country has been named ‘the most advanced digital society in the world’ by Wired, and the advantages of this are especially valuable to startups that can take care of everything online and even sign contracts digitally. The government estimates that its efficient digital infrastructure saves it up to 2% of its GDP annually.

3. The right people: Estonian people enjoy today the best education in the EU according to Pisa rankings, they speak some of the best English in the world and they are very tech-savvy. Moreover, people are exceptionally entrepreneurial and motivated to catch up to the standards of living enjoyed by the other Scandinavian countries. It positions Estonia for a bright future with large participation in tomorrow’s industries including technology, digitalization, and artificial intelligence. Estonia is also one of the least corrupt countries in the world according to the World Bank.

4. No debt burden: while most EU nations have accumulated massive amounts of debt over the last decades, Estonia has taken the opposite approach of taking as little as possible and only spending what it can afford to not harm its long-term financial well-being. Taking on debt allows you to spend what you do not have in the immediate term and boosts growth, but it also takes away from your future as the debt has to eventually be paid back. Estonia is today the least indebted nation in the EU with only 9% debt to GDP in comparison to an average of 86% within the EU:

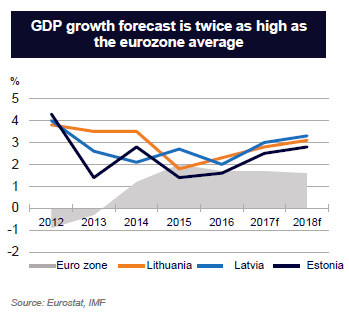

When you combine all the above factors together, you get a recipe for rapid and sustainable growth and this is why we expect Estonia to catch up to Finland and other developed nations over the coming decades:

How long will that take? We have no precise answer to that, but estimates range from 20 to 40 years.

If Estonia's economic growth per capita from now on was 3 % per year, and the Finnish economy went on to grow at the same tempo as it showed over the past 20 years, which is ~1.7% per year, then Estonia would reach Finland's standard of living in approximately 30 years, according to Kaspar Oja, an economist at the Bank of Estonia.

Whether it takes 20, 30, 40, or even 50 years, for Estonia to fully catch up we do not really know. But most importantly, it is catching up, which means that Estonia is set to become one of the richest countries on earth in the coming decades.

And that's not it!

In 2011, Estonia's then prime minister, Andrus Ansip, set the goal for Estonia to become one of the Top 5 richest nations in Europe, putting it right next to Liechtenstein, Luxembourg, Andorra, and Switzerland.

What do all these countries have in common?

They are all tiny European countries that used to be poor up until they started attracting rich people and business owners through attractive tax schemes. The main difference is that Estonia lost 40 years due to the Soviet time, but it is quickly catching up and setting itself to become another "Luxembourg of the North".

Quite frankly, already now it makes much more sense to move to Estonia than to Switzerland, Lichtenstein, or Luxembourg if you are a rich individual from a Nordic country (proximity and culture) or a digital business owner (infrastructure and business climate).

Today, Estonia is still behind, but a few decades from now, Estonia could very well be perceived as the "Luxembourg of the North" where Nordic rich people and digital businesses come to set up their base.

If you could have bought prime real estate in Luxembourg ahead of it becoming one of the world's richest nations, would you have done it? That's the pitch for investing in Estonia in a nutshell.

1.2 - Greater Appreciation Potential

As people get richer, they can afford to pay higher rents and property prices.

Today, property prices remain at 3x lower levels in Tallinn than in Helsinki, the capital of Finland just 30 miles across the Baltic sea:

Prices have already appreciated a lot in Tallinn, but they remain very reasonable when you consider that they just recently got back to the previous highs experienced before the great financial crisis:

And yet, from every perspective, Estonia is today much better off than it was 10 years ago.

The standards of living have greatly improved and average salaries have almost doubled since then – and yet property prices are only slightly higher than back in 2007:

It shows you that the appreciation of the recent years is not a sign of an overheating market. It has just been the recovery of the 2008-2009 losses.

Now the market has reset, salaries are way higher, and the appreciation has continued even through the covid crisis.

1.3 - Higher Initial Cap Rates

In addition to the higher appreciation potential, investments in Tallinn enjoy higher initial yields due to a relative lack of demand for investment properties from international investors who are still not very familiar with the Baltics.

Properties in Tallinn commonly offer a yield premium of 200-300 basis points compared to Central and Scandinavian markets. Moreover, the rents are also much lower, which leaves room for substantial rent growth as the economies converge in the long run.

Commercial properties (office, industrial, retail) located in prime locations of Tallinn yield today close to 6-7%; with older assets in less desirable locations often yielding closer to 8%. For the capital city with a bright future, these yield levels are very attractive when compared to other European markets.

1.4 - More Favorable Taxation

On a tax-neutral basis, we expect Estonian real estate investment to outperform in the coming 10 years. This is simply the result of higher initial yield, stronger income growth, and faster appreciation.

Now when you account for the tax advantages that investors enjoy in Estonia, the outperformance potential becomes even more significant.

While investors commonly pay anywhere between 30-50% in taxes on their real estate income and capital gains in Central and Northern countries, investors in Estonia are able to compound their earnings at a 0% tax rate indefinitely into the future.

This is because Estonian limited companies do not pay any corporate tax until distributions occur. It means that investors can collect rents and enjoy property appreciation within their limited liability company without paying any taxes, potentially ever. If you wish to let your wealth compound tax-free for 10 years, you are able to do so, and it makes a huge difference in how much growth is generated over time. Consider the following illustration of capital compounding with and without taxation:

Then once you decide to distribute earnings to yourself from your company, you pay a flat 20% tax on dividend payments. In comparison, investors in Central and Northern European countries may lose up to half of their annual return in taxes, especially if they are part of the higher income brackets. The Estonian flat 20% tax combined with 0% tax on undistributed corporate earnings is a huge advantage in growing long-term wealth through real estate investing.

Therefore, even if we assumed that the Estonian property market was only equally attractive as other European markets, it would still have a significant edge on an after-tax basis.

1.5 - Lower Relative Risk

This part is more subjective as it largely depends on one’s view of the Baltics and perception of risk in general.

One major risk of property investments is overpaying for assets. Today’s cap rates are historically low in most European capital cities and prices have grown way above replacement cost. If and when interest rates were to someday normalize, markets trading at extremely low cap rates would be the most at risk.

As an example, Munich in Germany is famous for its 2-3% cap rates on class A properties. The negative interest rates are driving enormous demand for local property investments. What happens if someday, interest rates were to recover to just 2%? Cap rates would need to expand significantly, and properties that once traded at low cap rates would drop the most in value.

Moreover, when investing in a low cap rate market, you are much more dependent on generating returns through appreciation which is less certain than income. In Tallinn, investors can earn high yields with conservative leverage.

Estonia still suffers to this day from the stigma of being an ex-Soviet Union country, but the reality is that Estonia has become very similar to Finland in all respects. Estonia is a member of the EU, the Euro-zone, the OECD, and even NATO, which has it's Cyberdefense headquarter in Tallinn.

The high level of government debt across Europe will certainly become a major issue at some point in the future, but as the least indebted nation in Europe, Estonia will fare much better when the next debt crisis hits the fan.

Overall, we view Estonia as a fairly similar market as Finland, but with less aggressive property prices – potentially reducing the downside risk in the future.

1.6 - Additional Catalyst for “Forced” Property Appreciation

But there is still one last catalyst that is almost guaranteed to result in significant price appreciation and rental growth in the long run.

A tunnel could get built to connect Helsinki and Tallinn through a rail system.

Without the tunnel, we believe that Tallinn will do very well, but with a tunnel, the investment thesis is put on steroid.

It is estimated that it would allow passengers to travel from one city center to the other in as little as 6 minutes if they use the Hyperloop technology from Virgin.

If the tunnel ever gets built, we expect a significant demographic shift from Helsinki to Tallinn as people seek to take advantage of geographic arbitrage by living in the cheaper Tallinn and working in the richer Helsinki. According to the latest statistics, you would need around 2,465€ in Tallinn to maintain the same standard of life that you can have with nearly 4,000€ in Helsinki.

When you consider this large difference in cost of living, you would expect the demand for properties in Tallinn to expand as Finnish workers seek home in the more affordable yet very close and desirable city. The incentives for moving to Tallinn become even greater when you take into account the massive tax advantages that Estonian residents enjoy as compared to residents in Finland.

Helsinki is already having issues with undersupply of affordable housing – forcing locals to move out of the city center into suburbs surrounding Helsinki. We suspect that a growing portion of these suburb-living fins would prefer to live in the vibrant city center of Tallinn than the distant suburbs once the tunnel gets built.

How likely is it for the tunnel to get built?

The tunnel, if constructed, is estimated to cost upwards of €15 to €20 billion. The tunnel's length would depend upon the route taken; but the shortest distance would have a submarine length of 30 miles, making it the longest undersea tunnel in the world (both the Channel Tunnel and Seikan Tunnel, whilst longer, have less length undersea). So, this is a very sizable project that is contingent on not only being physically feasible but also financially fundable.

There are however strong signs on many fronts that the project is likely to get done because:

1. Economic benefits: first off, the benefits for Estonia and Finland are massive and estimated to far outweigh the cost of the project in the long run. Not only would it serve millions of passengers resulting in increased economic connectivity and huge time savings, but it would also allow for more efficient freight transportation.

2. Growing passenger traffic: More than eight million people a year traverse the Gulf of Finland and passenger traffic is projected to increase at a rapid pace, reaching up to 30 million by 2030. The new tunnel is therefore being built to serve the growing number of passengers between the two cities.

3. Connecting Finland to Central Europe: Geographically Finland resembles an island as it is divided from the mainland by the Baltic Sea and Russia. The tunnel would finally connect Finland to the European rail network for increased freight and passenger transportation efficiency.

4. Integrate Baltic states: If built, the tunnel would form the last leg of the Rail Baltica project, which is intended to integrate the Baltic States into the European Union, as opposed to the Russian economy.

5. Planning already pre-funded: The European Union has approved millions worth of funding for feasibility studies, and the government bodies of Finland and Estonia have already invested significant resources in planning the project along with various other interest groups.

The project is far from being agreed upon, but the early signs are very encouraging with favorable pre-feasibility studies and vast interest from both nations who are set to greatly benefit from the development of a tunnel.

"The tunnel is a longstanding dream which is now closer than ever before," said Estonian Minister of Economic Affairs and Infrastructure Kadri Simson.

"The Tallinn-Helsinki railway tunnel would be a remarkable step in improving relations between Finland and Europe," said Finnish Minister of Transport and Communications Anne Berner.16

How Long would it take?

Building a tunnel of this size could take a very long time even if it was started today. Estimates say that it could be completed by as early as 2025 and as late as 2040.

Now, this may seem like a very long and therefore not an immediate factor for investors to consider.

But that would ignore that the market is a forward-looking machine. If and when the project is officially announced, investors won’t wait until it is done to start investing. Rather they will start speculating in anticipation of it – leading to rapid appreciation already in the coming years.

1.7 - Bottom Line

Estonia has arguably been the largest success story of all emerging countries in the last 30 years.

What was once a member of the Soviet Union has become a very modern country that resembles its Northern neighbor Finland.

Its economy is on track to catch up to Finland and become one of the richest countries in Europe within the next 20-30 years.

Yet, property prices in Tallinn remain at 3x lower levels than in Helsinki and we expect property prices to converge in the long run as Estonian salaries continue to rise closer to those enjoyed in Finland.

Property yields are 200-300 basis point higher – allowing for much greater income generation in today’s low-interest-rate environment.

The tax benefits in Estonia are very valuable and allow for tax-free compounding of wealth.

Finally, the anticipated tunnel construction connecting Tallinn to Helsinki could result in even greater and faster appreciation in Tallinn.

When you combine high yield with high growth, you get an exceptionally high-performing investment, and this is the simple reason why we are so bullish on Estonia. We know that Helsinki is richer now, but in the long run, as salaries converge, prices will be a lot closer.

Do we know where prices will be in 6 months? No. But we feel very confident that property prices in prime locations of Tallinn will be significantly higher over the next 10 years.

2- How to Invest in Estonia?

You have four main options:

Buy properties directly yourself in the private market.

Invest in a privately managed limited partnership.

Buy common shares of a publicly-traded REIT.

Buy common shares of a publicly-traded company with significant real estate exposure.

2.1 - Direct investment

This first option is likely to be a bad idea for most of you. I have done it, but unless you live here and know the market, it probably isn't a good idea. You lack the expertise, won't be able to properly manage your investment, and will lack diversification.

2.2 - Private Limited Partnership

The second option of investing in a private fund is preferable as it will align you with local professionals. However, there are downsides here as well. Most importantly, your manager will charge you fees based on the volume of assets under management, which leads to conflicts of interest. You also won't have much control over your investment and lack liquidity.

2.3 - Publicly-Traded REIT

The third option is to invest in a REIT. Generally, we would tell you that this is the best alternative because it gives you real estate exposure with the added benefits of liquidity, diversification, and professional management. However, in Estonia, there are only two publicly-listed REITs (Baltic Horizon & EfTEN Real Estate Fund III) and they are not particularly attractive. They are externally managed just like private funds and suffer similar conflicts of interest. Moreover, they own diversified portfolios of mostly office and retail properties, which will struggle in the aftermath of this crisis, and yet, their share prices have already recovered most of the losses.

2.4 - Publicly-Traded Company With Significant Real Estate Exposure

This leaves us with the fourth option, which is to invest in the shares of a publicly-traded company with significant real estate exposure. To give you some examples, it could be an asset manager, an infrastructure company, utility, airport, port, or even a ferry business.

And in the case of Estonia, this is our favorite approach because we have been able to identify a company with significant real estate exposure that trades at a deeply discounted valuation. Moreover, unlike the local REITs, this company is internally-managed and shareholder-friendly.

We are here talking about Tallinna Sadam, which means Port of Tallinn in Estonian. Its ticker is TSM1T and it is traded on the Nasdaq in Estonia.

3 - Tallinna Sadam

Tallinna Sadam is a real estate investment opportunity disguised as a port and ferry company.

Right now, its real estate is not getting much attention because it is not generating any income, but it is highly valuable and will play a major role in the long-term prospects of the company.

Below we highlight all its main business units. Then we discuss its real estate in greater detail. And finally, we show why the company is mispriced and present the upside potential and main risk factors.

3.1 - Essential Infrastructure Business

Right now, Tallinna Sadam generates revenue from 4 main business units:

Its passenger ports: 38% of revenue

Its cargo ports: 31% of revenue

Its ferries: 24% of revenue

Its ice-breaker: 7% of revenue

Its ports generate about 70% of the revenue and its ferries/ice breakers generate the remaining 30%.

It calls itself a "landlord port" because it provides infrastructure - land, quays, sea approaches, and safe navigations in the port waters - in exchange for steady payments that fluctuate little from year-to-year (unless there is a pandemic of course!).

Moreover, its ferry business connects the two biggest Estonian islands (Saaremaa and Hiiumaa) to the mainland, and it is subsidized by the government.

As such, Tallinna Sadam is first and foremost an investment in essential Estonian infrastructure that supports traffic in the region. It enjoys a near-monopoly, it is absolutely needed, and that makes it a very defensive business with highly durable cash flow.

That's attractive on its own, but that's not all that you are buying.

Tallinna Sadam also owns a lot of valuable real estate, and that's what really spiked our interest in the company.

3.2 - The Real Estate

The port and ferry business will continue to generate steady cash flow for decades to come, but it is unlikely to enjoy rapid growth. It is a utility-like infrastructure business with sticky but slowly growing revenue.

The growth and upside is its real estate.

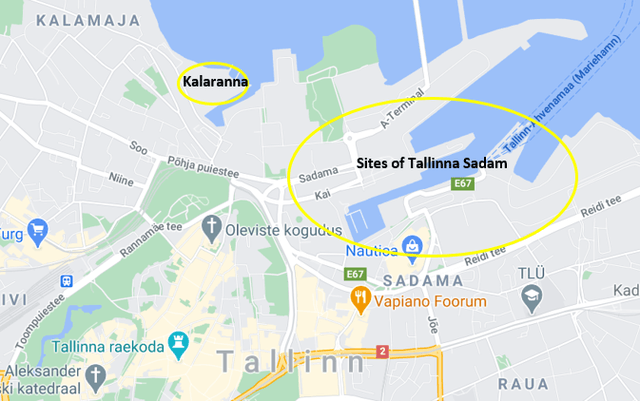

The company owns a lot of valuable lands that will be developed over the coming decade:

Let's start with its 3 industrial parks, which are strategically located next to its cargo ports. They are large in size and will eventually be developed into industrial real estate, which we all know is the hot property sector of the moment:

These industrial sites hold a lot of value, but it is unlikely to be unlocked via property development and disposition. From my discussions with the investor relations, it appears that their plan is to hold these sites for the long run and structure ground leases with tenants to earn rental income.

This strategy makes the most sense because it will allow them to monetize the land without having to make any significant investment themself.

Their capital is limited, and right now, they see much more potential in developing the 16 hectares of prime sea-front land that they own in Tallinn:

The company already has detailed plans for this development project.

It would include up to 240,000 square meters of build-up area, and possibly more by land reclamation.

This massive project will take all their financial resources and so that explains why they will stick to a ground lease strategy for the industrial park.

Here is how it will look like:

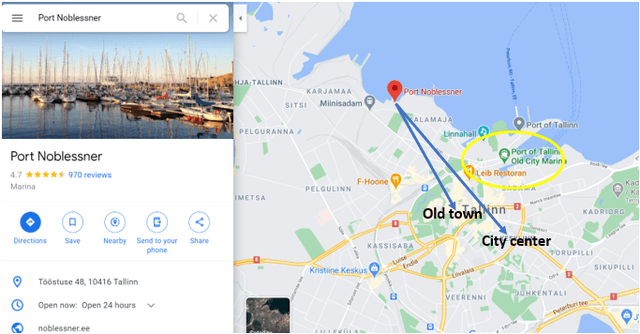

Importantly, this land is located just a short walk from the city center and old town of Tallinn.

In the picture below, you can see the old town on the left with the red roofs, the city center on the right with newer buildings, and the port in the north, which is directly connected to both of them:

It is hard to do better in terms of location. You are right on the sea, but just a short walk from the old town and city center.

These are the exact locations that go for the most money in Tallinn.

A few years ago, they developed apartments, restaurants, and shops at the Port of Noblessner, and its apartments sold for ~€3,500-5,000 per square meter, which was a new record for Tallinn. It is right on the sea, but if you look at a map, it is much further away from the city center and old town.

If Noblessner was able to set new records, we think that it is reasonable to expect the sites to do just as well, if not even better.

You need 20-30 min from Noblessner to walk to the old town/city center, but only 5-15min from these sites.

You also have access to better infrastructure. There will be a tram that will connect the port area to the city center and it will be free for the residents of Tallinn. However, there are only buses that go to Noblessner. There are also many more malls, restaurants, and jobs within walking distance.

Finally, if you are one of the many Finnish or Swedish expats who live in Tallinn (to save on taxes and enjoy a higher quality of living), then it is very convenient to be so close to the main port. With the Ferry, it takes you only ~2 hours to get to Helsinki, and so if you live a short walk from the port, it is even more convenient to go regularly to your home country to visit friends and family and be back in Tallinn by the evening.

You get my point: these are not just prime sites... They are arguably the best and most valuable undeveloped sites of Tallinn.

There are very few sites that enjoy proximity to both: the sea and the city center / old town in Tallinn.

It is not uncommon for apartments in similar locations to go for €10,000 to €15,000 per square meter in Helsinki, just 30 miles north across the Baltic sea.

If you buy into the idea that Estonia will catch up to Finland over the coming decades, then this is exactly where you want to invest: prime sites that are very short in supply due to their superior location.

We expect most real estate to do well in Tallinn, but these prime sites will do the best because we expect the spread between the highest quality real estate and the average quality real estate to grow over the coming decade.

That's what happened in Helsinki, and we expect the same to happen in Tallinn because they are very similar markets. Their population is not rising rapidly in a way that would lift the values of all locations. Instead, what's mostly driving prices higher is the increase in living standards and salaries enjoyed by the population. It increases their desire and ability to live in better locations, causing the spread in pricing to rise.

Spreads Will Rise and Prime Sites Will Outperform

Right now, you can buy new apartments for €2,000 - 3,000 per square meter in average locations, and €3,000 - €4,000 per square meter in prime locations of Tallinn.

So the spread is just ~€1,000 per square meter.

In Helsinki, the spread is much larger. You may pay €5,000 in an average location, but €15,000 in the best location.

As Estonians see their salaries rise and get richer, they will want out of the poorer suburbs like Mustamäe and Lasnamäe which are filled with old soviet style housing and move closer to the city center and sea to live in newer, better-located buildings.

That will cause the spread to rise and the best sites to outperform:

Moreover, as rich expats move to Tallinn, where do you think that they are moving? To old Soviet apartment buildings in Mustamäe or to modern sea-front buildings close to the city center?

They want to live right where Tallinna Sadam's sites are located and they are used to paying much higher prices for real estate.

In Europe, we are seeing a migration trend happen between Finland/Estonia as between California/Texas in the US. That will only grow the spread between prime and average sites even further.

With that in mind, I recently bought an apartment in what I believe to be the best site in the City: Kalaranna

As you can see, Kalaranna is in very close proximity to the sites owned by Tallinna Sadam. It speaks very highly for the value and future prospects of its real estate.

The plan is to develop it and sell it. How much value will that unlock? We look at this question in the section below.

3.3 - Valuation And Upside Potential

Based simply on normalized earnings per share, the company is priced at 12x EPS, which is very reasonable for a near-monopoly essential infrastructure business.

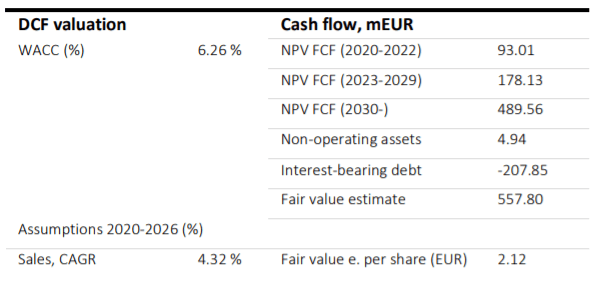

Endlight research, an Estonian investment research firm, did a discounted cash flow analysis of the business, and concluded that it is worth €2.12 per share (excluding the real estate):

That's ~20% higher than the current share price.

However, as we have shown previously, Tallinna Sadam owns a lot of highly valuable land that currently isn't producing any income. This is not included in the above DCF valuation, so you are essentially getting it for free.

What is it worth?

Here, luckily, we got the help of an independent appraisal of the development project from 1Partner Kinnisvara, a local specialist here in Tallinn.

They did a detailed analysis of the project and estimated the net profit at €0.92 per share. But it is important to note that this is based on a sale price of €3,333 per square meter for the apartments, which is conservative already in today's market.

If you recall, apartments in Noblessner sold for higher prices and that was a few years ago. The same developer who built Noblessner recently launched a new project right next to it, and prices are starting at €3,520 per square meter, and it is further away from the city center and old town.

So €3,333 per square is conservative already today, but then, you need to consider that most of these sites won't get build and sold before another ~10 years from now. Endlight Research estimates that it will take 3 years for the detailed plans to be approved, and construction won't start before 2025. From there on, the construction and sale period will last 10 years.

So the market value of this prime land could grow significantly by the time it is sold. The average square meter price has nearly doubled over the past 10 years and the difference relative to Helsinki remains significant.

Therefore, the near €1 of expected profit could turn out to be much larger in the future. It also completely ignores the value of the industrial parks that they own, adding further margin of safety to the estimate.

Put simply, we think that the port/ferry business is worth the current market cap, and you are essentially getting the real estate value on top of it for free.

It will lead to back-end loaded upside sometime in the next 10 years, and while you wait earn steady income from a defensive utility-like infrastructure business.

3.4 - Dividend Focused Management Team

The majority shareholder of Tallinna Sadam is the Ministry of Economic Affairs, and they want dividends. As a result, the company has the policy to distribute 70% of their profits in the form of dividends to shareholders:

As such, Tallinna Sadam is similar to a REIT. It has a clear policy to distribute most of its cash flow so that you get paid while you wait.

The covid crisis temporarily reduced the profit of the company because people could not travel and use its port. However, it is expected to bounce back in the coming years, and pay a €0.10 dividend in 2021 and a 10% higher dividend in 2022.

That would equate to a 5.6% yield in 2021 and a 6.2% yield in 2022.

Best of all, Estonia does not have a dividend withholding tax for most countries, including the US. This is because Estonia has a unique corporate tax system by which companies pay 0 corporate taxes on retained income, and pay a 20% corporate tax when dividends are distributed. So your withholding tax is essentially the corporate tax. There is no double taxation in Estonia, and it is one of the reasons why so many foreigners are moving here to set up businesses. You can learn more about Estonia's withholding taxes by clicking here.

3.5 - Risks Factors

There are several risks to consider before opening a position:

Risk #1: Real Estate Development

Building real estate is not the same as owning already-built properties.

Real estate development has the potential to earn great returns, likely €1-2 per-share profit in this case, but it also has many more risks.

Will they get the right permits? Will they get the right financing? Will they have the right know-how to complete a project of this scale? These are all risk factors to consider.

We think that they are likely to get the permits because the state owns most of Tallinna Sadam, and it is in the country's best interest to develop these sites. It will not only help the company, but also create a lot of jobs, economic activity, and make Estonia an even more attractive destination for expats and tourists.

We also think that they will be able to finance the project organically. The construction/selling process will likely happen gradually over a 10+ year period. When that time comes, they will likely reduce the dividend to a smaller rate to direct a larger portion of their cash flow toward the development project, which coupled with bank financing, and apartment pre-payments (typically 20% of the purchase price in Estonia) should be enough to get it done.

The skills needed to complete the project can be acquired by hiring the right people with the experience and/or partnering with another real estate development firm.

Risk #2: New Competition for the Passenger Port in Tallinn

In the long run, a second passenger port and/or a tunnel could get built. This could cause its passenger port in Tallinn to suffer.

However, there are counter-balancing factors to consider here.

First of all, the additional port and/or tunnel would not be built to replace the current port, but simply to add capacity to handle the expected growth.

Already today, more than 8 million people traverse the Gulf of Finland every year and passenger traffic is projected to reach up to 30 million by 2030. These estimates are put out by the people who are pushing for the tunnel to get built, so they are likely a bit optimistic, but it shows you that there will be enough traffic to support one more port and/or a tunnel.

Using the tunnel to get to Tallinn will be faster, but it will also be much more expensive. It is expected that a round-trip would be priced somewhere between €50-100 per person. In comparison, ferries commonly cost just €10-20 per person for a round trip. The ferries are able to offer these cheaper prices because you are then stuck for 2 hours on the boat and they make their money by selling you drinks, food, entertainment, and other things.

If you want to go faster, you can already today take a plane. There are around 300,000 air trips done per year between Tallinn and Helsinki. I would expect the airlines to suffer more from the tunnel than the ferries. The ferry is a cheaper solution and it will remain needed.

Moreover, if the tunnel gets built, it will make Tallinna Sadam's land much more valuable. Then Helsinki and Tallinn would essentially become one same city, and cause prices to converge even faster.

So overall, we are not too worried about this risk. The second port and/or tunnel likely won't happen before 10 or 20 years from now (if it even does), and by then, the passenger volume will have increased significantly.

Risk #3: Small Float and Poor Liquidity

Finally, this is a thinly traded security with a small €500 million market cap.

The state owns 2/3 of the shares and so the float is quite small.

It results in smaller liquidity which may make it difficult to enter or quit positions.

It may also result in greater volatility.

4- Closing Note

Estonia is one of our favorite real estate markets in the world.

We believe that it is slowly becoming the Luxembourg of Northern Europe, where rich Northern Europeans move to save on taxes and improve their quality of time, and young Entrepreneurs move to benefit from the most business-friendly environment in the European Union.

We think that Estonia will catch up to the living standards enjoyed in Finland, just 30 miles north, and potentially even surpass them in the long run.

As that happens, the real estate prices in prime locations of Tallinn will explode in value, just like we have already seen happen in other European cities.

Out of all publicly traded options, Tallinna Sadam appears to be the best opportunity to benefit from this thesis.

We like it because its main business generates steady utility-like cash flow that it uses to pay large dividends, and in the long run, the company has the potential to unlock significant value by developing its prime sites.

If you are a believer in Estonia's future, then this is a great story.

By the time they start building, the real estate will be worth materially more, and while you wait, you earn a good yield.

We give it a Buy rating with an average risk rating and small allocation.

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.