The Market Is Crashing: What's Our Plan?

The Market Is Crashing: What's Our Plan?

The market is in a free fall right now. Almost everything is dropping heavily:

The S&P500...

Tech stocks...

Bitcoin...

Financials...

Consumer goods...

BDCs...

And REITs are not an exception. They are down 30% year-to-date and the sell-off really accelerated over the past few days:

The biggest REIT ETF (VNQ) is down 30%, despite mainly investing in mega-cap, investment grade-rated REITs, so you can imagine that the smaller and lesser known REITs must be doing even worse. Many of our members have pointed out on our chat that this is starting to remind them of early 2020 when everything crashed due to the pandemic...

What's happening?

The market appears to be panicking over the combination of:

Rapidly rising interest rates,

Persistently high inflation,

And a very likely recession.

Then it also surely doesn't help that Russia is threatening the world with a nuclear war and the pandemic is also still lingering around. Europe and Asia are already in a recession and it appears very likely that the US is headed in the same direction. The yield curve is clearly signaling this:

That's a lot for the market to digest and it explains why we are having a "risk-off" moment.

What do we make of it?

If you have been a member of High Yield Landlord for a while, you probably know already how we react to market volatility. We don't shy away from it. We embrace it because it serves us bargains, and the lower prices go, the more shares we will buy because ultimately, this is just another temporary setback that will result in substantial upside once REITs recover.

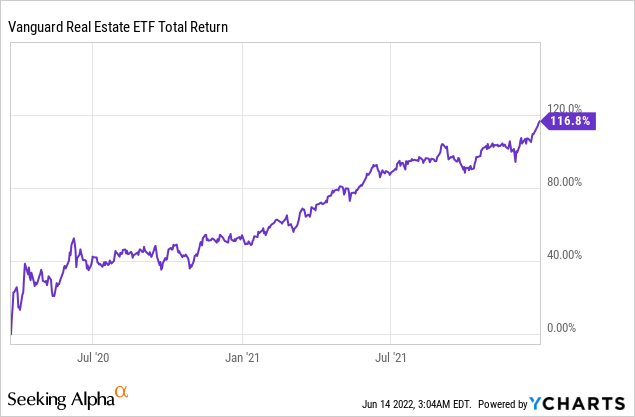

It is thanks to this simple philosophy that we earned huge returns in 2020 and 2021 as the market recovered, and today's sell-off is just another opportunity for us to profit in the coming years:

You may feel like today's uncertainty is unprecedented and that, therefore, this time must be different. But in reality, we have actually been through much worse and always made it to the other side. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; the resignation of a disgraced president; a global pandemic; and much greater inflation than today. Yet, the Dow rose from 66 to over 30,000.

So based on history, there is a 100% chance of an eventual recovery. Volatility comes and goes, but the REIT market has always eventually recovered from every single crisis in history:

And beyond that, REITs have always been exceptionally rewarding in the periods following sharp sell-offs.

REITs nearly tripled in the two years following the crash of the great financial crisis:

They also more than doubled in the year following the covid crash:

In that sense, I am actually glad that the market is crashing again. Seeing red colors never feels pleasant in the moment, but looking back, we have always made our largest gains coming out of bear markets.

The market is at its most inefficient when it is volatile and that's really when active investing is the most rewarding and also when a service like 'High Yield Landlord' should provide the most value.

Of course, we don't have a crystal ball and cannot know how the REIT market will perform in the short run, but historically, those who have had the courage to buy REITs when they were temporarily discounted have always been richly rewarded in the following years.

Here are 6 reasons why this time won't be different:

Reason #1: They are heavily discounted: We buy good real estate that's professionally managed at large discounts to their fair value. In some cases, we pay as little as 40 cents on the dollar for high-quality real estate that's diversified, liquid, and professionally managed (e.g. Vonovia). Historically, such massive discounts don't last for long as REITs typically trade at small premiums, which reflects the added value of liquidity, diversification, and professional management.

Reason #2: They own inflation-protected assets: We are not making any more land and good locations only grow in demand over time. Moreover, building materials and labor are only getting more expensive, which increases the replacement cost of existing properties. This makes real estate, and by extension REITs, some of the best inflation hedges in the world. Despite occasional crises, we will always need good real estate. It is absolutely essential to the survival and prosperity of the human race.

Reason #3: Their debt is being inflated away: While property values keep growing over time, the value of their debt is permanently inflated away in today's environment. Most REITs have financed their properties with fixed-rate long-term debt and therefore, the high inflation is a gift to them. When a REIT borrows $100, it still only needs to pay back $100 years later even as this $100 is now worth a lot less.

Reason #4: Limited impact from rising rates: Contrary to what you often hear, REITs have historically been strong performers during times of rising interest rates. That's because rising rates are typically the result of economic growth and/or inflation, both of which are very beneficial for REITs, and since REITs use fixed-rate long-dated debt, the negative impact of rate hikes is very limited. This time around, interest rates have surged very rapidly and it is causing investors to panic, but it should also be noted that REIT balance sheets are the strongest they have ever been, inflation is high, and valuations are heavily discounted.

Reason #5: Limited impact from the recession: Most REITs are relatively resilient to recessions because they generate income from multi-year leases. Moreover, having a roof over your head is a basic necessity that does not simply disappear in a recession. Sure you may not need quite as much real estate during a recession, but you will need an apartment to sleep in, a place to work, a grocery store to buy food, etc. Consumers and businesses typically don't completely rethink their real estate footprint just because the economy is taking a dip for a year or two. For this reason, REITs have historically outperformed most other sectors during recessions.

Reason #6: Private equity is buying REITs left and right: Right now, private equity players like Blackstone are flushed with cash and they are buying REITs left and right. Blackstone has already bought out $30 billion worth of REITs in 2022 and it recently noted in its conference call that they are looking for more buyout opportunities because they think that REITs are materially discounted relative to the underlying value of their real estate. Since making that statement, REITs have dropped another 10%.

It is easy to get distracted by the negative news and get emotional when volatility is high, but you really don't need to be a rocket scientist to understand that buying good real estate at a heavily discounted price will result in attractive returns in the long run. Sure, an occasional crisis may lead to worse results for a year or two, but the impact on the fair value of income-producing real estate should be limited because its value should be determined based on decades of expected future cash flow.

Yet, REITs commonly drop by 30, 40, or 50% at the first sign of uncertainty because most market participants are focused on short-term results and lack the discipline to hold for the long run.

Warren Buffett has famously said that "investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ." However, you need to have the discipline to hold when volatility is high and have the courage to step up and actually make purchases when opportunities are abundant.

Coincidentally or not, Buffett has been deploying a lot of his cash in 2022:

What is our accumulation strategy?

We have highlighted it in a few previous articles, so if you have been a member for a while, feel free to skip this section.

Legendary investor Howard Marks once noted that: "Because we do not believe in the predictive ability required to correctly time markets, we keep portfolios fully invested whenever attractively priced assets can be bought. Holding investments that decline in price is unpleasant, but missing out on returns because we failed to buy what we were hired to buy is inexcusable."

This is exactly what we are doing at High Yield Landlord.

We understand that "time in" the market matters a lot more than "timing" the market; and to buy low and sell high, you need to first buy when things are low. It may seem like common sense, but a lot of people are paralyzed by fear and never take action when prices are low due to the fear that prices may drop even lower.

We know that prices will eventually recover, but we must accept the limitation that we cannot know how low prices will drop, and when prices will recover.

That is why when we entered the pandemic, we set a simple plan to buy REITs in many phases with small weekly additions. This way, we are sure to profit in the long run and we don't risk running out of cash early into volatility. Here is a chart of what this accumulating strategy looks like:

You can follow a similar accumulation strategy and adapt it to your own cash availability. Personally, I'm using cash from four different sources to fund these investments.

Property Loans: I own a portfolio of loans and as new loans mature, I reinvest the proceeds into discounted REITs.

Dividends: I reinvest all the dividends.

Portfolio recycling: at times, we may sell a REIT that has reached its fair value target, and reinvest the proceeds in other REITs that are more heavily discounted.

Monthly Savings: Finally, I use my monthly savings to buy more REITs.

Consistency is key to our accumulation strategy.

Disciplined investing beats emotional investing in the long run.

Our plan is to make small but steady portfolio additions, week after week, and we will do so with great discipline and consistency - regardless of what the market throws at us - because we know that this will pay off handsomely in the long run.

With that in mind, we expect to make a number of small additions to our favorite holdings later this week and we are also currently finishing our due diligence on two new potential opportunities.

Closing Note:

At the worst point of the pandemic, REITs dropped by 43% in just a few weeks, and some individual REITs dropped a lot more than that. Yet, just one year later, REITs were already hitting new all-times as if nothing had happened.

If you cannot deal with this type of volatility, then you probably aren't meant to be an active investor and should stick to more passive means of investing.

However, if you have the patience and discipline to sit through times of volatility and buy more when the opportunity presents itself, then these times of volatility can truly make you rich.

Taking my REIT portfolio as an example: it generated nearly 20% average annual returns in the 5-year period ending in 2021. But these returns were largely the result of the actions that we took during the pandemic.

That's when the market was at its most inefficient and that's also when active management was the most rewarding.

For this reason, we get excited when the market is crashing due to uncertainty. You may not like to see red color in your brokerage account, but this is exactly what we need to boost our long-term performance.

Stay tuned for our coming Trade Alerts!

Good investing from your HYL Research Team,

Jussi Askola