The Safest 10% Yielding REIT

Quick Note

Last week, I had the pleasure of teaching a class on REITs at the University of Michigan. I discussed key takeaways from my new book, The REIT Advantage, which is now available on Amazon. Foreword by the CEO of VICI Properties!

I am obviously biased in saying this, but I genuinely believe this is the best book on REIT investing available today. I have read all of them, and in my view, most focus far too much on theory and far too little on what actually matters in practice.

“I am honored to contribute this foreword and can highly recommend Askola as your guide to why and how to invest in REITs.”— Edward Pitoniak, CEO of VICI Properties

“Askola has produced one of the most insightful books on REIT investing in the last two decades. This is a must-read for potential REIT investors at every level.”— Joey Agree, CEO of Agree Realty Corporation

“Not since Ralph Block’s seminal work on REITs have I found a resource that is both this comprehensive and this succinct. This is an essential addition to every REIT and income investor’s library.”— Aaron Halfacre, CFA, CAIA, CEO of Modiv Industrial

For roughly twenty dollars, I do not think you can find a better investment in improving your understanding of REITs and real estate investing.

You can order your copy directly on Amazon by clicking here.

(Note that the above link is for Amazon US, but the book is also available on Amazon in other countries.)

The Safest 10% Yielding REIT

TRADE ALERT - Retirement Portfolio January 2026

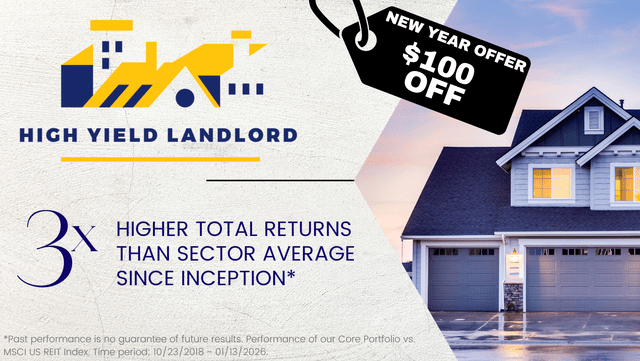

After President Trump signed an executive order initiating the process to reschedule cannabis as a less dangerous, Schedule III drug, we immediately bought more shares of Cannabis REIT NewLake Capital Partners (NLCP), predicting that its rally would likely continue as the market recognizes how positive this could be for its tenants.

So far, this has paid off as its stock has risen another 8% since then:

But oddly, NLCP’s close peer, Innovative Industrial Properties (IIPR) did not rise much at all. On the contrary, its Series A preferred stock (IIPR.PR.A) even dipped 7% since then.

As a result, it now trades at just $23, which is near its lowest share price ever. It now offers a 9.8% dividend yield and nearly 10% upside to par value.

We think that this is an exceptionally high yield for a company with so little leverage and strong dividend coverage.

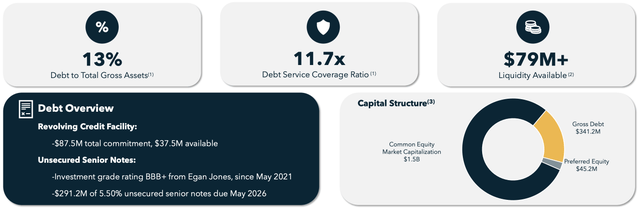

The company only has a 13% LTV:

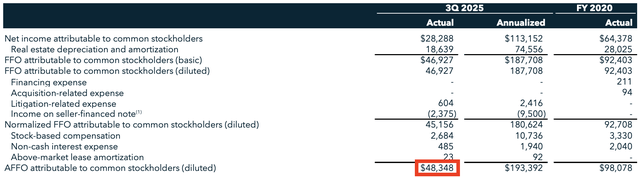

And its preferred dividend is nearly 50x covered by its AFFO:

Our member, Julian Lin, who runs the service Best of Breeds, recently shared an interesting table comparing the leverage and preferred dividend coverage of IIPR-A versus other high-yielding REIT preferred shares, and it clearly stands in a league of its own, despite offering a higher yield.

This is obviously because the cannabis property sector is perceived to be amongst the riskiest of all commercial real estate.

Tenants are on shaky legs, lease defaults are frequent, and future prospects are far more uncertain than those of other property sectors.

IIPR has itself had some major lease defaults, and this is likely why the stock is discounted. But as we noted in our recent article covering NLCP, conditions could now rapidly improve going forward, and even if they don’t, there is such significant margin of safety here that we feel very comfortable holding the preferred equity.

The REIT’s rents could literally be cut in half, and its preferred dividend coverage would still remain above-average and its leverage below-average.

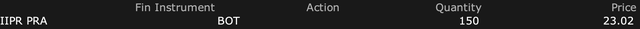

Therefore, we are today taking advantage of this recent dip to buy another 150 shares of the preferred shares, increasing our position size by 25%:

I would add that the Chairman and CFO of the company have recently bought a quarter million worth of the common stock in the open market:

This is, in my opinion, the safest near 10% yielder that you will find in the REIT sector.

What other REITs are we buying for 2026?

We’ve just released them, and for a limited time, you can join High Yield Landlord for $100 off, plus a 2-week free trial!

Offer ends soon! With the 30-day money-back guarantee, you have everything to gain and nothing to lose. Our approach has earned us 500+ five-star reviews from satisfied members who are already seeing the benefits.