Top 5 Picks For 2024 - Part 5

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

Top 5 Picks For 2024 - Part 5

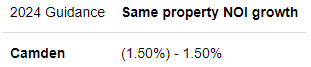

Blackstone (BX) recently announced that it would acquire Tricon Residential (TCN), one of our holdings, at a 30% premium to its latest share price:

Around the same time, The CEO of Blackstone (BX) attended the Davos World Economic Forum and made the following statement:

"So as we look forward to 2024, we think we're going to be a lot more active than we have been."

"We are, of course, not waiting for the all-clear sign and believe the best investments are made during times of uncertainty. We announced three major real estate transactions in the past few months, the $3.5 billion take-private of Tricon Residential...

Essentially, what he is saying is that the time to be greedy is when others are fearful, and this applies well to residential REITs.

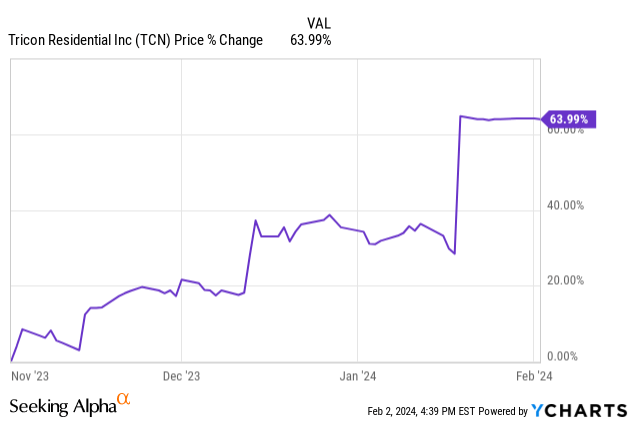

Right now, the rental market is overbuilt, particularly in sunbelt markets, and as a result, occupancy rates and rental rates are taking a hit. The poor same-property performance, coupled with the surge in interest rates, has led to a crash in the share prices of residential REITs, and pushed their valuations to historically low levels:

Most investors only care about the quarter results and right now, the near-term outlook is rather negative.

But astute investors like Blackstone are capitalizing on this opportunity they know that these challenging times won’t last for much longer.

This period of overbuilding will likely be followed by a period of undersupply because new supply growth has dropped significantly and home ownership has become unaffordable. Moreover, interest rates have already dropped substantially and will likely keep dropping further in the coming years.

This explains why opportunistic investors like Blackstone can afford to pay a 30% premium and still get a good deal.

But now that Tricon has been taken out, what’s the best residential REIT for 2024?

I believe that it is Camden Property Trust (CPT).

Below, I explain why I prefer Camden vs. Mid America (MAA), BSR REIT (HOM.U:CA), and AvalonBay (AVB) at this time:

Camden vs. Mid-America:

Camden is a diversified sunbelt apartment REIT just like Mid America (MAA), but it focuses more on affordable class B communities:

Their average monthly rent is materially lower than that of new development projects and as a result, they are not as heavily impacted by the oversupply.

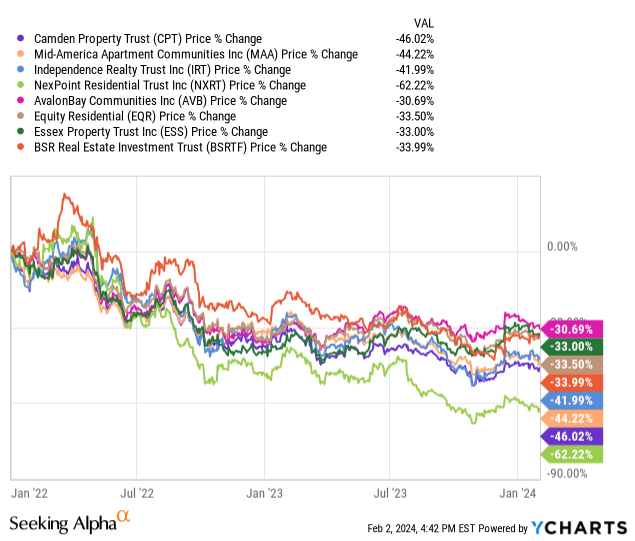

Camden just reported its Q4 results and issued guidance for 2024. The main takeaway is that its same property NOI is expected to remain stable despite the new supply:

MAA has not yet reported its Q4 results or issued guidance for 2024, but given that Camden performed better already in Q3, I expect its operational outperformance to continue.

Despite that, Camden is actually slightly cheaper than Mid-America. The difference is not material, but given that I expect Camden’s properties to perform better going forward, I believe that it should be the opposite. Apart from this one factor, both REITs are very similar large-cap A-rated blue chip sunbelt apartment REITs.

Camden vs. BSR REIT

I have previously highlighted BSR REIT (HOM.U:CA) as my Top Pick among apartment REITs and I am still mostly indifferent between the two, but if I had to pick one today, it would be CPT because their valuations have converged closer to another.

However, Camden is a safer REIT that deserves to trade at a higher valuation:

Portfolio: It owns a much larger and better-diversified portfolio across the sunbelts. BSR also focuses on Class B assets, which is great, but it is concentrated on a few Texan markets that will likely suffer more than the average of sunbelt markets.

Balance sheet: Camden is a large cap with a low 25% LTV, a long ~6-year average debt maturity, and an A- investment grade rating that gives it access to cheap capital, even today. Just recently, Camden raised a bunch of capital at a low ~5% interest rate, which is only 80 basis points higher than its current average interest rate. BSR, on the other hand, has more debt with a 40% LTV, much shorter debt maturities, and would need to pay higher interest rates on new debt since it doesn’t have an investment grade rating. As such, Camden is better protected from both, the oversupply and the rise in interest rates.

Management: Both REITs have good management teams, but Camden also takes the edge here because it has a much longer and better track record, a better reputation, and it can develop its own assets, creating a lot of value for shareholders.

Despite that, their valuations are today very similar:

Both are opportunistic, but the spread should be larger. An A-rated large-cap blue-chip with better assets, a stronger balance, and superior access to capital shouldn’t trade at such a small premium.

Therefore, I believe that Camden offers slightly better risk-to-reward at this time.

Note that BSR also has some unique advantages and you can read about those by clicking here. Small size, Texas concentration, higher leverage, and aggressive buybacks may lead to higher returns, but the overall risk-to-reward of Camden is currently better.

Camden vs. AvalonBay (AVB)

Coastal markets are today less impacted by oversupply, and as a result, the REIT market has priced coastal apartment REITs at slightly higher valuations.

That would make sense if all you cared about were near-term prospects.

But I think that the long-term prospects of high-quality assets in the right sunbelt markets remain superior and therefore, I would not pay a premium for coastal markets:

This is particularly true since the actual difference in near-term outlook is not significant. As we noted earlier, Camden is holding up surprisingly well, despite the more challenging conditions of its markets.

I like to own a mixture of both for the sake of diversification, but Camden is today slightly more attractive.

Closing Note:

Camden is the definition of a blue-chip REIT. Even in what’s expected to be one of the toughest markets in years, it still expects its cash flow to stay stable.

Despite that, it is today priced at a significant discount to its net asset value and remains one of the cheapest ways to invest in residential real estate. Its implied cap rate is near 7% but you would be happy to get a 5-5.5% cap in the private market, and that cap rate is likely going lower as rent growth reaccelerates and interest rates return to lower levels in the coming years.

We expect ~30-50% upside and while you wait, you earn a ~4% dividend yield and the REIT will grow the firm’s fair value by ~5% per year.

That’s a very compelling risk-to-reward coming from an A-rated blue chip.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.