Top 5 Picks For 2026 (No Paywall)

LAST CHANCE: Get $100 Off & 14-Day Free Trial

Your timing is perfect. We’ve just released our top investment picks for 2026, and for a limited time, you can join High Yield Landlord for $100 off, plus get a 14-day Free Trial!

We invest thousands of hours and over $100,000 annually researching the most profitable opportunities—all to bring you real estate strategies at a fraction of the cost.

Our approach has earned us over 500 five-star reviews from satisfied members already seeing results.

Offer ends soon—join now to claim this exclusive offer!

Below we share the first pick of our Top 5 list for free.

The rest is exclusive to our subscribers.

Top 5 Picks For 2026 - Pick #1

As the end of the year is approaching, many of you have been asking me to do a new series highlighting my Top 5 Picks for 2026.

I am personally not a fan of these series because I cannot predict how any REIT will perform over such a short time period, and even if I thought I could, I still would not want to invest based on such a short-term horizon. It encourages a short-term mindset, favoring companies with immediate catalysts and ignoring other long-term opportunities whose full potential may take more than a year to play out.

Moreover, it is impossible to pick 5 REITs that suit everyone, as the selection would depend heavily on your risk profile and objectives. As an example, Alexandria Real Estate (ARE) could be a Top 5 Pick for someone with a higher risk tolerance and long-term horizon following its recent crash. However, it certainly wouldn’t make the list of investors seeking stable income with lower volatility. This makes it very challenging to put together a list of Top Picks.

Finally, under no circumstance would I want to hold just 5 companies. Risk factors will eventually play out, leading to inevitable losses. For example, RCI Hospitality (RICK) crashed this year due to allegations of tax fraud. Very few people, if any, could have predicted this. Such risks exist for every company, and that is why diversification is so crucial. 5 companies just isn’t enough.

With all of that in mind, this new list will focus on what I view as the best risk-to-reward going into 2026, considering their near-term upside potential, and based on my own objectives and risk tolerance.

Before getting started, let’s still quickly review the results of our Top 5 Picks for 2025 series, which we posted a year ago.

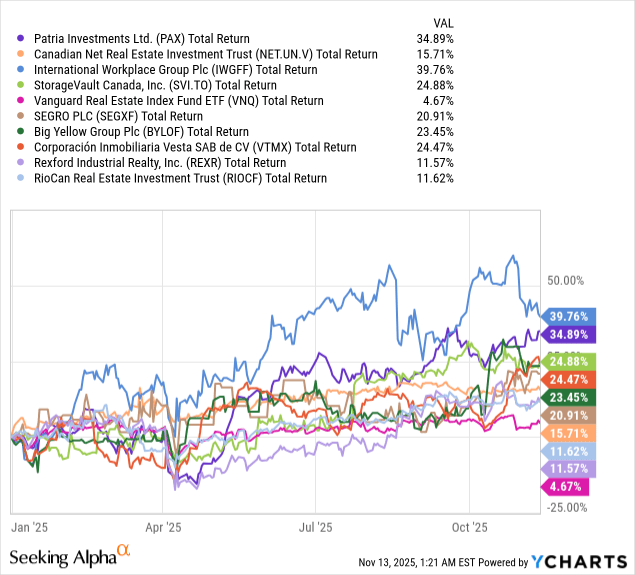

As a reminder, we initially shared 5 companies, and then added another 5 as “honorable mentions”. Here is the entire list, along with links to our investment theses:

Top 5 Picks For 2025 - Part 3: International Workplace Group

Top Picks For 2025 - Honorable Mention #2: Rexford Industrial Realty

All of them, except one, significantly outperformed the broader REIT market (VNQ). The one missing is, of course, RCI Hospitality (RICK), which crashed about 50% after it was announced that they were charged with tax fraud in New York State.

Ignoring RICK, nine out of ten of our picks earned market-beating returns, with the weakest performer (REXR) earning 2x higher returns and the strongest (IWG / OTCPK:IWGFF) earning about 10x higher returns than the VNQ ETF. Fortunately for us, that strongest performer happens to be our single-largest investment, representing 13% of our Core Portfolio.

While I remain very bullish on all of these companies, my selection would be very different going into 2026, especially following the recent market volatility.

Today, we share our first pick of the list, which is no other than BSR REIT (HOM.U:CA; OTCPK:BSRTF). Below, we share our latest thoughts on the company, taking its third-quarter results into account.

Top 5 Picks for 2026 - Part 1: BSR REIT

One of the apartment REITs we follow, Centerspace (CSR), announced this week that it is considering a sale of the company to unlock value for its shareholders. Analysts at RBC estimate a potential sale price between $85 and $98 per share, which compares very favorably to yesterday’s $65 close.

This continues the trend of private buyers stepping in to capitalize on the valuation gap in residential REITs.

Just over the past 18 months, we have had Elme, Aimco, AIR Communities, and Tricon go private or liquidate. (We used to own and profited from the AIR Communities and Tricon buyouts at High Yield Landlord.)

It shows that the management teams and boards of residential REITs are growing impatient after trading at steep discounts for the last 3 years, and increasingly many of them are now starting to take actions to force upside realization.

This begs the question of which REIT is next?

It is impossible to know for certain, but if I had to bet, I would pick BSR REIT (HOM.U:CA; OTCPK:BSRTF) as it has all the characteristics of an ideal buyout target:

It is the right size, owning about $1.4 billion worth of assets. That’s big enough to move the needle, but not too big for most major REITs and private equity players.

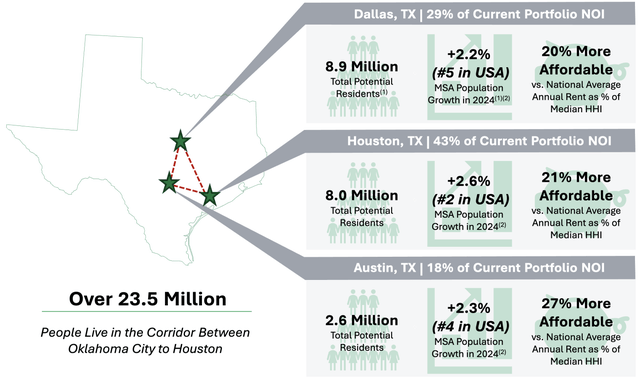

Its portfolio is very desirable, focusing on new modern affordable apartment communities in the Texas Triangle, which is enjoying rapid population and job growth, and attracting a lot of investors. Its properties’ average age is just about 10 years (vs. 25 years for CPT), one of the lowest in the entire REIT peer group, which should reduce capex requirements going forward, especially since these are suburban garden-style properties with pitched roofs. That’s exactly what lots of investors are looking for due to their simple management and lower capex burden.

The REIT presents significant value-add potential for a potential buyer. About 15% of the REIT’s portfolio by unit count is not yet stabilized. Moreover, its average rent and rent-to-income ratios are some of the lowest in its peer group at just $1,449 per month and ~20%, providing margin of safety and future upside potential as its markets keep on growing. BSR also still hasn’t maxed out all its potential in terms of offering additional services, just as bulk internet and valet trash, offering additional upside for a potential buyer. Finally, a larger, better-capitalized private buyer could create further value by reducing future interest expense, management cost, and removing all costs associated with being publicly listed, which are significant for such a small REIT. There is a lot of “meat on the bone,” so to speak.

It currently trades at the steepest discount to net asset value in its peer group. Its official NAV per share is $16.62, resulting in a 35% discount based on mid-5s cap rate. I think that this is a conservative estimate given that it’s based on today’s oversupply and higher interest rates. In the private market, similar communities transact in the high 4s and low 5s according to Camden Property Trust (CPT). They themselves recently sold a large portfolio of assets to AvalonBay at a 5% cap rate, and these were assets with lower upside potential. Given the relatively young age of the portfolio, lower capex burden, and growth-oriented market exposure, BSR’s portfolio deserves a lower cap rate than most peers. Therefore, the actual discount is likely even larger, especially considering that a large fraction of BSR’s portfolio is not even stabilized yet. Taking this into account, BSR’s implied cap rate is today in the low 7s or about 50 basis points higher than its larger peers, and 200 basis points higher than private markets.

Its management owns a lot of equity and has a long track record of acting in its shareholders’ best interest, steadily buying back shares at a discount to create lasting value. Moreover, just recently, they sold about a third of the portfolio to AvalonBay (AVB) in order to retire most of their Class B units, and signaled that this could open the door to a future M&A deal.

Why would a buyer target it now? We are at an important turning point. The REIT just announced its first positive blended rental increase in Q3, which suggests that the oversupply could be finally easing, and the management sees things improving further as we go into 2026, and expects particularly strong years in 2027 and 2028. On top of that, interest rates are gradually being cut, which should further increase the value of its communities. As such, the narrative will soon change very drastically. The reason why BSR and its peers have been discounted is the oversupply coupled with high rates. But as that shifts back to undersupply, solid rent growth, and declining interest rates, these REITs could rapidly reprice at materially higher valuations.

All of this makes BSR a prime target for a private buyer. You would never get close to a 7% cap rate on these assets in the private market, and especially not with the added benefits of diversification, economies of scale, liquidity, limited liability, and cost-efficient professional management.

But to be clear, we don’t rely on a buyout to earn attractive long-term returns. My point is simply that BSR is a great potential target for private equity, which makes it a great target for us as well.

A buyout could help accelerate upside realization, and from past conversations with the management, I sense that they would be open to offers. However, I also know that they would be unlikely to sell at a discount, knowing that the portfolio that they have put together enjoys very attractive long-term prospects.

Just consider how fast these markets are growing:

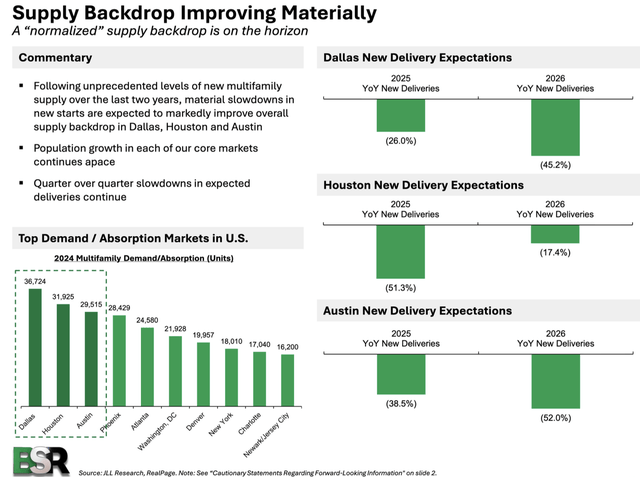

Dallas, Austin and Houston are the three fastest growing markets by unit absorption in the US, and this is happening even as new supply deliveries are dropping rapidly:

Therefore, the next three years should be far stronger than what we experienced recently, and as this becomes clear to the market, we expect significant upside as its NAV expands, even as the discount closes at the same time.

Prior to this bear market, BSR traded at a 10% premium to NAV and that’s really where it deserves to be to account for all the advantages of a publicly listed company vs. a private asset.

Assuming that BSR’s NAV appraisal cap rates compress to the low 5s even as its discount turns into a premium, it could see its share price rise by 50%+ from here. While you wait, you earn a near 5% dividend yield that’s paid monthly and typically classified as “return of capital” for better tax efficiency.

Closing Note

BSR’s larger and better capitalized peer, Camden Property Trust (CPT), is also very cheap and would make a great alternative for more conservative investors. Its discount to NAV is a bit smaller, but still very significant. Here is what their CEO said on their most recent earnings call:

“In the quarter, we bought back $50 million of our shares at a significant discount to consensus net asset value. If market conditions remain at current levels, we will continue to buy the stock, and we have $400 million remaining in our authorization... If you go back in history, leading up to the bubble and the tech crash in 2000, we bought 16% of the company back at that point....

Right now, with the current stock price today, it’s a 30% discount to consensus NAV. It’s a mid-6% cap rate. And the market today is a 4.5% to a 5% cap rate. So with simple math, that’s a 150 to 200 basis point positive spread to sell an asset and buy stock. And we’ve always said that we would allocate capital in this way if we had a significant discount, I think 30% is pretty significant.”

And importantly, its balance sheet is a lot stronger than that of BSR.

This makes it a tough choice.

BSR’s concentration on the Texas Triangle, coupled with its higher leverage and significant value-add potential, is likely to result in more upside. It is also a much likelier buyout target.

However, CPT offers much greater safety with its A-rated balance sheet, and even then, its valuation is also unusually low.

I think that both are great picks, depending on your risk tolerance. Since I am still relatively young, have a long time horizon, own a diversified asset base, and don’t fear occasional setbacks from risk factors playing out, I would favor BSR, but this may be different for you.

What are our other Top Picks for 2026?

We’ve just released them, and for a limited time, you can join High Yield Landlord for $100 off, plus get a 14-day free trial!

Offer ends soon! With the 14-day free trial, you have everything to gain and nothing to lose. Our approach has earned us 500+ five-star reviews from satisfied members who are already seeing the benefits.