Top 5 Picks For 2026 - Pick #1

Top 5 Picks For 2026 - Pick #1

As the end of the year is approaching, many of you have been asking me to do a new series highlighting my Top 5 Picks for 2026.

I am personally not a fan of these series because I cannot predict how any REIT will perform over such a short time period, and even if I thought I could, I still would not want to invest based on such a short-term horizon. It encourages a short-term mindset, favoring companies with immediate catalysts and ignoring other long-term opportunities whose full potential may take more than a year to play out.

Moreover, it is impossible to pick 5 REITs that suit everyone, as the selection would depend heavily on your risk profile and objectives. As an example, Alexandria Real Estate (ARE) could be a Top 5 Pick for someone with a higher risk tolerance and long-term horizon following its recent crash. However, it certainly wouldn’t make the list of investors seeking stable income with lower volatility. This makes it very challenging to put together a list of Top Picks.

Finally, under no circumstance would I want to hold just 5 companies. Risk factors will eventually play out, leading to inevitable losses. For example, RCI Hospitality (RICK) crashed this year due to allegations of tax fraud. Very few people, if any, could have predicted this. Such risks exist for every company, and that is why diversification is so crucial. 5 companies just isn’t enough.

With all of that in mind, this new list will focus on what I view as the best risk-to-reward going into 2026, considering their near-term upside potential, and based on my own objectives and risk tolerance.

Before getting started, let’s still quickly review the results of our Top 5 Picks for 2025 series, which we posted a year ago.

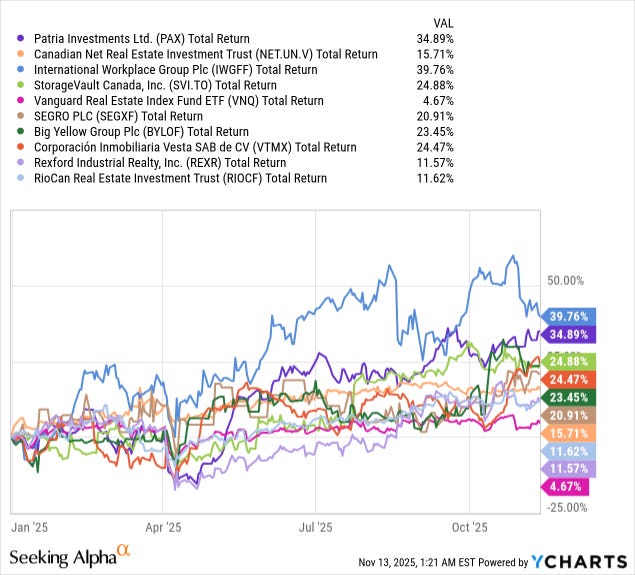

As a reminder, we initially shared 5 companies, and then added another 5 as “honorable mentions”. Here is the entire list, along with links to our investment theses:

Top 5 Picks For 2025 - Part 3: International Workplace Group

Top Picks For 2025 - Honorable Mention #2: Rexford Industrial Realty

All of them, except one, significantly outperformed the broader REIT market (VNQ). The one missing is, of course, RCI Hospitality (RICK), which crashed about 50% after it was announced that they were charged with tax fraud in New York State.

Ignoring RICK, nine out of ten of our picks earned market-beating returns, with the weakest performer (REXR) earning 2x higher returns and the strongest (IWG / IWGFF) earning about 10x higher returns than the VNQ ETF. Fortunately for us, that strongest performer happens to be our single-largest investment, representing 13% of our Core Portfolio.

While I remain very bullish on all of these companies, my selection would be very different going into 2026, especially following the recent market volatility.