Top Pick #1: VICI Properties

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

Top Pick #1: VICI Properties

Back in 2021, Christopher Volk, former CEO of STORE Capital (STOR), wrote one of the best articles I have ever read on net lease investing. It is entitled STORE Capital: 'A Class Of Our Own' and it explains what sets STORE apart from other net lease REITs.

I agree that STORE is a special REIT and it used to be one of our largest positions at High Yield Landlord up until it got bought out by private equity.

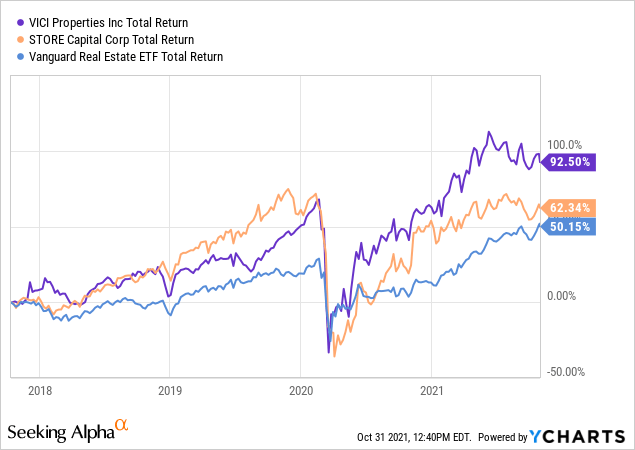

But another net lease REIT that's arguably even more special is VICI Properties (VICI). Just like STORE, it has a unique approach to net lease investing that has generated significant outperformance for its shareholders:

What is this unique approach?

Most net lease REITs like Realty Income (O) buy traditional net lease properties such as Dollar General convenience stores through the brokerage market and compete with a vast world of family offices, private equity funds, and high-net-worth individuals. There is a lot of capital chasing a limited number of deals and as a result, the bargaining power of these REITs is limited.

VICI, on the other hand, targets specialty net lease properties such as casinos and originates its own deals through relationships with casino operators that it has built over the years. Since there is a lack of buyers for these properties, VICI is in a stronger position to negotiate deals that not only result in higher returns but also mitigate risks.

This was well-reflected in its performance during the pandemic as it was the only net lease REIT that managed to maintain a 100% rent collection rate even as other net lease peers saw their collection rates drop to 60-80%. Moreover, it also managed to grow its dividend by 11% in 2020 and another 9% in 2021, which was by far the fastest growth rate of all net lease REITs.

As such, VICI is in a 'class of its own' as it has been able to generate superior returns with lower risk. In an efficient marketplace, such performance should be rewarded with a premium valuation, but VICI is actually priced at a discount relative to its riskier and slower-growing net lease peers.

Why is that?

We think that the market has failed to appreciate all the elements that set VICI apart from other net lease REITs.

Recently, I had the chance to meet with Danny Valoy, Vice President of Finance of VICI, and this meeting helped me gain an even better understanding of what the market is still missing.

In what follows, we will present 10 reasons why VICI is truly in a 'class of its own' and deserves to trade at a premium relative to other net lease REITs:

Reason #1: VICI's Properties Are Built To Last. The Average Net Lease Property Isn't.

As net lease investors, we tend to often focus more on the quality of the leases than the properties themselves. After all, the leases typically have 10+ years left on them, the rents are pre-set, and the tenant is responsible for most property expenses. As such, net lease properties generate bond-like income and the real estate element of the investment is often a secondary concern of investors.

That's all fine as long as your property is rented, but the real estate element becomes a lot more important once the lease runs out and the property sits vacant.

This is the biggest risk for most net lease properties because they are not built to last. A Dollar General net lease property is a very simple structure and it only costs about $300,000 to build. You would be lucky if it lasts for 20-30 years and after that, you typically tear it down and rebuild a new one.

As such, if you own traditional net lease properties, you know that you will almost certainly be hit with larger capex down the line. The tenant won't tear down and rebuild the property for you. Once it's time, negotiations will come into play and the tenant will hardball you into rebuilding a modern property or they won't resign the lease, leaving you with an empty old structure with little appeal. At the very least, they won't resign a triple net lease, but a 'double net' lease instead, leaving you responsible for the maintenance of the roof, structure, and parking lot. Alternatively, you could attempt to sell your net lease property before you get into this situation, but the market is not stupid and will almost certainly discount your property as it ages. So put simply, capex can only be ignored for so long when you invest in traditional net lease properties. Ultimately, net lease properties still age, and landlords need to deal with the deterioration of the structure.

Now compare that to the net lease casino properties owned by VICI.

Unlike the Dollar General properties, most high-quality casinos are built to last for a much longer time, and potentially forever as long as they are taken care of. The Caesars Palace, VICI's most prized possession, was built in the 60s and it is today more viable than ever. It is built like a fortress and can last forever.

Similarly, the Venetian, which represents ~10% of VICI's rental revenue, is built like the 'pyramids of Egypt' to quote the CEO of VICI. Just to give you a sense of the money invested in these constructions: consider that the lobby of the Venetian features 25-foot-high columns made of solid Botticino marble, imported from Italy. Now compare that to your average net lease property that's typically built as cheaply and efficiently as possible.

Therefore, VICI is much less likely to suffer large capex bills down the line. Its properties were built to last, and so from the sheer physical attributes of its properties, VICI is in a class of its own when compared to other net lease REITs. It boosts its long-term return potential and reduces risks because it won't need to rebuild properties, renegotiate leases with tenants, and/or sell properties at discounts as they age in a similar fashion as other net lease REITs may need to.

Reason #2: VICI's Leases Force Its Tenants To Invest Substantial Amounts in Capex. The Average Net Lease Property Typically Doesn't.

According to most triple net leases, the tenant is responsible for all property expenses and also for the maintenance of the property.

However, the devil is always in the details. While VICI has true triple net leases, other net lease REITs will often own a combination of triple net and double net leases, putting them on the line for some property expenses.

VICI goes a step further and requires its tenants to reinvest a minimum each year into its properties according to the leases. Typically, this is 1-2% of the tenant's net revenue annually, which amounts to $10s of million every year. Moreover, since its tenants are in the hospitality business, they know very well that good property maintenance is key to their long-term success. Therefore, VICI can rest well knowing that its tenants are taking great care of its properties. All this capex is added value for VICI and it can be very significant. As an example, the Caesars Palace recently rebuilt its entrance to make it more appealing:

On the flip side, the triple net leases signed by Dollar General typically don't require it to invest a specific amount of capex into the properties. They have a lot more flexibility to decide how much they reinvest in the property, and this may hurt the landlord because they are unlikely to invest much in terms of capex if they know that they are unlikely to renew the lease. Moreover, since these are not hospitality assets, the tenant is also less incentivized to take great care of the asset. It just isn't as important to the business.

So to recap: the average net lease property is not just built cheaply, but it is also taken worse care of than your average net lease casino.

Reason #3: VICI's Properties Enjoy High Barrier to Entry. The Average Net Lease Property Doesn't.

As we assess the long-term sustainability of a net lease property, the biggest risk to consider is a vacancy.

Vacancy itself is a factor of many elements such as the physical attributes of the property, its location, and most importantly, its profitability.

If Dollar General is earning good profits at a specific location, it likely won't want to move away when it comes time to renew the lease.

But over a 10-15 year lease, a lot of things can change because there are few barriers to protect Dollar General's business at most of its locations. As an example, Dollar Tree may decide to build a new modern property across the street, stealing the business and hurting the profitability of Dollar General. Typically, net lease properties are not located in Class A, highly urban areas. The land is abundant for new constructions and the risk of new competitors entering the market of your tenant is significant.

That, plus the fact that the property is aging and has to compete with new modern facilities, greatly increases the risk of vacancy down the line. Releasing the property may then require significant capex and/or lower rental rates, hurting the long-term returns and value of the property.

In comparison, VICI's properties enjoy higher barrier to entry. That's because building a new casino requires licenses, permits, specialized expertise, and substantial amounts of land and capital. It is a lot harder to build a new casino on the strip of Las Vegas than building another Dollar General in a rural location and for this reason, VICI's net lease properties have a stronger moat and are likelier to grow their rental income and gain value over the long run.

Reason #4: VICI's Tenants Are Highly Dependent On Its Properties. The Average Net Lease Tenant Not So Much

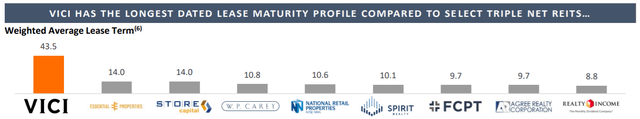

If you are the tenant of the Venetian and your business is doing well, you want to remain in control of the property for as long as you possibly can because you have no other alternatives. You cannot just build another Venetian on the strip. The Venetian is massive, it has a unique location and a lot of brand value. This explains why VICI has by far the longest average remaining lease term at 43 years, compared to just around 10 years for other net lease REITs:

If you are Dollar General and you are renting a net lease property, you are also dependent on that property, but to a much lesser extent because you likely have other alternatives.

The specific property has little brand value. The location is not so unique. And building a new property is quick and fairly inexpensive.

Because of that, leases are shorter as the tenant wants to keep its options open. At the end of the lease, Dollar General holds all the cards and can play hardball with the landlord to get a lower rental rate, capex invested in the building, or both. Otherwise, it may simply move across the street to a new facility, and it has done so many times in the past, leaving the landlord with an empty old property.

Reason #5: VICI's Properties Enjoy Great Inflation Protection. The Average Net Lease Property Doesn't.

Most net lease REITs have fixed rent bumps of 1-2% per year or 5-10% every 5 years. Moreover, because the tenant is responsible for most property expenses, the landlord is insulated from rising expenses. This offers some inflation protection, but it does not fully protect you because inflation could run higher than 1-2%, the property expenses are only covered by the tenant during the lease term, and at the lease expiration, you may need to heavily reinvest into the building or rebuild it completely (Remember that these constructions are not built to last).

VICI's casino net lease properties offer much better inflation protection because:

Not just fixed rent bumps: 97% of its rent roll has a CPI component to rent increases. For example, the Caesars lease, which represents 40% of the rent roll will escalate at the greater of 2% or the change in CPI (with no cap on the change in CPI), making it an inflation-protected revenue stream.

Less capex need: VICI's leases are true triple net leases, the lease terms are much longer, and the tenants are required to invest a fixed minimum into capex each year. As such, VICI is much better insulated from rising property expenses.

Lower vacancy risk: Because of what was mentioned previously, the risk of vacancy is lower, reducing the exposure to inflation even further as releasing the properties could lead to a lot of capex.

As such, VICI enjoys the best inflation protection from any net lease REITs, and it also enjoys the best deflation protection given that it has the longest leases and above-average fixed rent escalations.

VICI managed to negotiate these better lease terms because it is one of the only casino net lease investors of scale and it gives it stronger bargaining power with its tenants. Dollar General-type tenants, on the other hand, have many more options, and as a result, investors have less bargaining power.

Reason #6: VICI's Properties Have Significant Reinvestment Opportunities. The Average Net Lease Property Doesn't.

VICI owns iconic properties that present some growth opportunities via densification, redevelopment, and/or ground-up development.

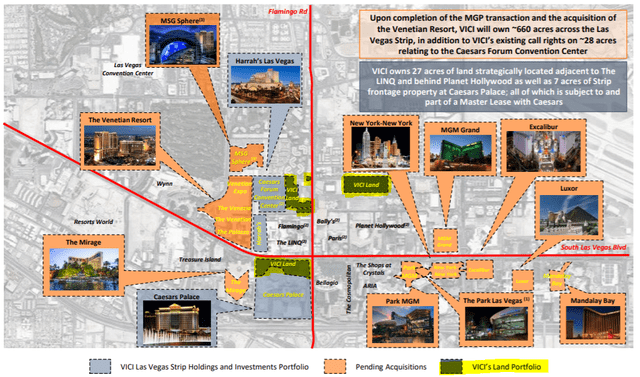

As an example, VICI owns several sites on the Las Vegas strip that are highly valuable but undeveloped as of now. These sites are part of the master lease with Caesars, and eventually, as they get developed, VICI will likely contribute capital in exchange for rising rental income.

VICI has actually set up a separate structure called VICI's Partner Property Group Fund to fund these "same-store" transactions in a way that's mutually beneficial.

In comparison, traditional net lease properties generally don't have such reinvestment opportunities to grow cash flow and create further value.

Reason #7: VICI's Properties Are Big-Ticket Investments That Move The Needle. The Average Net Lease Property is a Small-Ticket Investment That Does Not Move the Needle.

All net lease REITs attempt to grow faster by raising new equity and reinvesting it in additional properties, hopefully at a positive spread.

Historically, this has allowed most net lease REITs to grow at ~5% per year, despite only enjoying 1-2% annual rent hikes.

But VICI has done better than average and commonly grown at closer to ~8% per year thanks to its faster external growth.

There are several reasons for that, but an important one is that each new acquisition moves the needle because casinos are large-ticket investments. To give you an example, the Venetian was purchased for $4 billion. That's a single property!

In comparison, traditional net lease properties go for $2-5 million, which makes it more complicated to grow. It is just a lot easier to buy one asset at $4 billion than 1,000 assets at $4 million a piece.

Reason #8: VICI's Properties Are Located in Superior Locations. The Average Net Lease Property Is Located in An Average Location.

Net lease investors also tend to forget that location, location, and location are the three most important criteria of real estate investing.

They focus a lot more on the lease itself and the current yield and worry less about the long-term upside that's mainly a function of the location.

But if you are long-term oriented, the location should of course matter to you, and a lot of traditional net lease properties happen to be in secondary or tertiary markets where populations are stagnant or even declining. A Dollar General does not need a Class A city center location. Quite the opposite, it wants to be in a small town with little competition.

From this perspective, VICI is again leaps and bounds ahead of its net lease peers with nearly half of its revenue coming from the Las Vegas Strip, which is the most economically productive street in America, a true Class A location. Today, Las Vegas is booming with a lot of Californians moving there to get rid of the state income tax and lower their cost of living.

The remaining 50% is diverse, but again, its locations are typically above average as you simply don't build properties worth $100s of millions in poor locations. The superior locations lower risks and also improve VICI's long-term return potential.

Reason #9: VICI's Properties Are Bought at High Cap Rates and Discounts to Replacement Cost. The Average Net Lease Properties Are Bought at Lower Cap Rates and Premiums to Replacement Cost

Most net lease investors target properties that are occupied by large well-known companies such as 7/11, McDonald's, and Home Depot. As a result, there is a lot of capital chasing a limited number of assets, and not surprisingly, prices get bid up, cap rates are lower, and investors commonly pay large premiums relative to replacement cost.

This lowers future return potential and also increases risks because when the tenant decides to move out, the property may lose significant value as it reprices at a higher cap rate once released to another tenant. Moreover, paying a premium to replacement cost and receiving a low cap rate also reduce your protection against inflation.

This is a particularly big issue today for net lease investors as cap rates have compressed to near the lowest level ever, even as inflation has risen to levels we haven't seen in a long time. As such, the real yield of most net lease properties is today fairly low.

VICI, on the other hand, is still able to get materially higher cap rates and large discounts to the replacement cost of its assets because there simply isn't much competition for these deals. After all, how many investors can put $4 billion into a single property like the Venetian? It is not just about the money, you also need to have the specialized expertise, relationships, and significant scale to achieve sufficient diversification.

To give you an example, the Venetian and the MGM portfolios were acquired at around $0.6 million per room. In comparison, the new Resort World is estimated to have cost $1.2 million to build. That's a 50% discount to replacement cost. Perhaps these are not perfectly comparable but it shows you that VICI certainly isn't overpaying relative to construction cost:

Historically, VICI has gotten 6-7% cap rates on trophy casinos such as the Venetian, and closer to ~8% cap rates on regional casinos. Even better, VICI is today still just getting started with acquisitions in foreign markets and I suspect that they will get even higher cap rates given that foreign markets are even less competitive.

Reason #10: VICI Has Valuable Put/Call Options and Rights of First Refusals On Additional Properties of Its Tenants. The Average Net Lease REIT Doesn't Have That

VICI today holds several options on additional properties, which provides a clear pipeline for new acquisitions.

As an example, it has the right to call the Caesars Forum Convention Center, Harrah's Hoosier Park, and the Indiana Grand Racing & Casino at 7.7% cap rates.

It also has rights of first refusals on a number of trophy Las Vegas assets including the Flamingo, Bally's, Paris, and Planet Hollywood.

Other net lease REITs generally don't have such options and therefore, their pipeline is more uncertain and less predictable.

Summary Table

Bottom Line

There are many good reasons for VICI to trade at a premium to other net lease REITs, but today, it still trades at a discount because the market fails to appreciate all the things that set VICI apart.

In a previous email exchange, Ed Pitoniak, CEO of VICI explained to me that they are essentially bringing the triple net lease structure to Class A real estate:

"Conventional triple net lease real estate isn’t usually considered Class A real estate, especially if one defines Class A real estate as…

Significant in physical scale

Complex in its space design and programming

Of high quality in fit and finish

In prized locations

Class A office and Class A malls have those characteristics. Certain high-end residential properties can also have those characteristics.

Dollar Generals and 7-11s don’t. Our casino assets do have those characteristics, both in Las Vegas and across most all of our regional assets. So one can say about VICI that we’ve taken the Triple Net Lease structure, with its superior transparency and efficiency of economics, to gaming real estate. But one can also say VICI has taken the Triple Net Lease structure to Class A real estate, in casino form."

That's why VICI is in a class of its own and it is also why it deserves to trade at a premium valuation. But right now, VICI is priced at just 12x FFO compared to 13-15x FFO for most net lease REITs.

We think that the entire peer group is discounted, but VICI arguably offers the best value for your money given that it is priced at a lower multiple despite enjoying superior characteristics.

We estimate that its fair value at closer to 16x, which would unlock 33% upside from today's valuation.

But even ignoring that, VICI has a business that's set to deliver double-digit total returns. It yields nearly 6% and it is on track to grow by about 5-7% annually. Add those together and you get 11-13% average annual total returns even without any additional upside from multiple expansion.

Add some repricing upside, and you could realistically earn 15-20% average annual total returns over the coming 3-5 years.

That's the investment thesis for VICI in a nutshell.

It is likely to keep delivering above-average returns with below-average risk, and for this reason, it is an ideal portfolio anchor for most REIT investors.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.