Top Pick #3: BSR REIT

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

Top Pick #3: BSR REIT

BSR REIT (HOM.U / OTCPK:BSRTF) is a REIT that owns a portfolio of apartment communities in the famous Texan Triangle of Dallas, Austin, and Houston:

Most apartment REITs are today heavily discounted and they all enjoy unique advantages.

I am bullish on most of them and we own quite a few.

But there are 7 reasons why I have decided to include BSR in this Top 10 Picks list instead of others:

Reason #1: A Safer Path to Creating Value

The big apartment REITs AvalonBay Communities (AVB) and Camden Property Trust (CPT) create a lot of value for shareholders by developing new properties. This is great because they are commonly able to develop new assets at a ~6% stabilized yield, but these properties are really worth closer to a ~4-5% cap rate if they decide to sell them on the market.

As such, they are creating a lot of value and they earn good spreads over their cost of capital. This is one of the main reasons we invest heavily in both, AVB and CPT. Their development arms give them a long-term competitive advantage.

BSR is now starting to build its development arm and it already has one project underway in Austin, Texas, but for the most part, it is still a traditional landlord with more limited capabilities.

Our analyst Austin recently pointed this out in an article and argued that it was a disadvantage to keep in mind. I agree with him. In the long run, this could become an issue because new acquisitions simply don't move the needle for BSR. Cap rates are too low right now relative to their cost of capital.

But here's why this does not really concern me today. BSR has an even better path to creating value for shareholders: Buybacks.

Their shares are today priced at an estimated 45% discount to NAV, and BSR can create a lot of value by simply buying back shares at these low valuations. Their latest NAV estimate is $20.50 per share, but their shares trade today at $11 so they essentially get to buy real estate at 55 cents on the dollar.

Here is what the CEO of the company told us in a recent conversation:

"Above else, our team prioritizes capital deployment into higher buckets of return. So long as the public markets remain behind our view of the street value of our communities, we will deploy available capital into the higher, risk free repurchase of our shares. As the market changes, we will quickly adapt as we have shown many times in the past."

Note that the CEO said "risk-free" here because he is comparing the buybacks to acquiring or developing new assets, which comparatively, are a lot riskier endeavors, and this is why I like these buybacks so much.

Today, development projects are becoming a lot riskier due to the current economic climate. Construction costs and interest rates have surged... and we are likely headed into a recession. The big apartment REITs are now starting to scale back development projects and the ones that they have ongoing will have less predictable results.

But BSR can simply sit back and buy back shares at a steep discount as they collect rent payments, creating value for shareholders.

Eventually, buybacks likely won't be as accretive anymore and BSR will have to adapt again, but until then, they can take the easy and safer route. If they had a big development arm, it could even be a disadvantage in today's environment as it could distract them away from buybacks.

Reason #2: One of the Likeliest Buyout Candidates

On the one hand, the big blue-chip REITs like AvalonBay are probably too big to attract buyout offers. On the other hand, many of the smaller REITs may suffer some misalignment of interest between shareholders and managers. As an example, NexPoint Residential (NXRT) is discounted, but it is also externally managed, and its manager surely would prefer to keep managing the REIT to earn fees.

BSR stands out here as a small REIT with a heavily discounted valuation and a shareholder-friendly management team. The insiders are collectively the largest owners of the company and so they stand to gain a lot more from a sale of the company than from their salaries. They own ~40% of the equity, representing $100s of millions worth of value.

Besides, they own the right asset mix to attract interest from a lot of potential players. Most of their assets are located in rapidly growing Texan markets and many players would gladly increase their exposure to these markets as it could help their market sentiment. To give you an example, AvalonBay's market sentiment has suffered because it is too heavily exposed to coastal markets, but it could at least partially resolve this issue by acquiring a company like BSR as it would rapidly diversify its portfolio.

Reason #3: Slightly Lower Valuation Combined with Insider Purchases & Buybacks

We estimate that BSR is slightly more heavily discounted than its peers, trading at a ~45% discount compared to a ~35% discount for most of its peers.

This, on its own, does not mean much. These NAV discounts are just estimates and we could be wrong.

But what gives us extra confidence in the discount is that insiders are actually taking advantage of these lower valuations.

They are doing both: buying back shares with the company's funds (of which they own ~40%), and then on top of that, they are still making significant purchases with their own personal cash.

This summer, I had an interesting conversation with the head of their investor relations about their buybacks and insider purchases and he told me the following:

"You have mentioned a lot in your articles about stock buybacks and how they are a good move for us. It’s not only the company that believes that. I just bought another $10,000 last week. I have personally purchased about $500,000 in BSR stock from 2018 to 2023 and haven’t sold any. These are not shares the company gave me as compensation, and they aren’t stock options either, they are simply open market stock purchases of BSRTF just like everyone else. I of course disclose my purchases to our CFO, and I am only allowed to buy in certain windows of time when we aren’t in a blackout. But it speaks to your point about how aligned management is with shareholders. Heck I am in “middle management” and I have ½ million dollars of my personal money riding on our success."

Most peers aren't doing as much. AVB saw many insider sales in 2021 and no purchases in 2022. CPT saw many sales even in 2022 and 2023 and no purchases. This does not mean much, but it still provides additional confidence that BSR is undervalued because the people who know the company best are putting their money on the line.

Reason #4: Texas Focus

BSR is mostly invested in Texas. This has pros and cons.

On the side of cons, property taxes are high in Texas and could rise further. Moreover, since it is a business-friendly state, it is relatively easy to start developing new assets, increasing the risk of oversupply.

But even then, I think that the Texas focus is a net positive.

I think that the long-term outlook is very positive as the trend of businesses and people moving to Texas will continue for a long time to come. The incentives are simply too significant. This is especially true if you can now work remotely in the post-covid world and travel a good portion of the year. You would then much rather set up your tax residency in Texas to avoid the high cost and taxes of California if you aren't there a good portion of the year anyway.

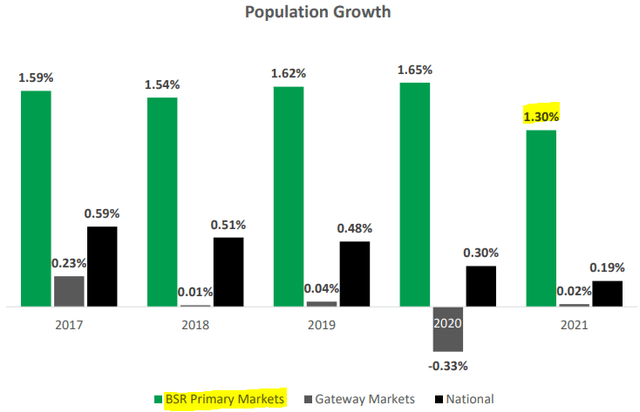

The differences in population growth between BSR's markets and those of other REITs are massive:

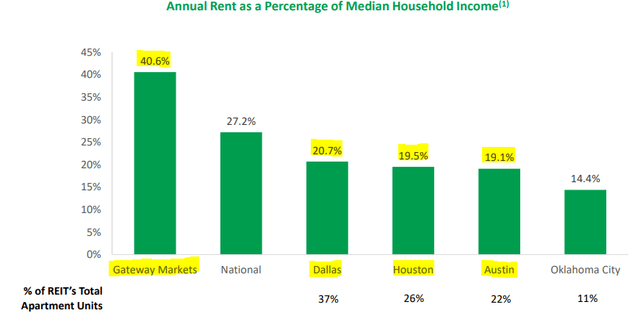

And besides, BSR's markets still offer very low rents when compared to its resident's incomes. It is today only around 20%, but it is closer to double in the markets of some of its peers. This should provide a tailwind for future outperformance as popular gateway markets may have maxed out most of their organic growth prospects, especially if the recent migration trends continue, but BSR still has a long way to go:

The near-term is of course a bit more uncertain, but even here, we have good reasons to remain bullish. Just recently, BSR gave an update to investors and noted that its rents had grown by 6% in the second quarter.

There are a lot of talks about rent growth turning negative in some markets, but this does not seem to affect BSR, likely because its rents are still a small fraction of residents' income, the demand is still increasing, and its rents are below market.

Here's what the CEO said on a recent conference call to investors when asked about near-term deliveries and the risk of overbuilding:

"I was hoping that somebody would sense that our comments are pretty bullish. Yes. So long-term trends to me and to our team are supply and demand driven, right?... And we see a built-up dam on new deliveries. Now that may impact us at the tail end of next year or moving into '24 or '25. But right now, we don't see any reason to not be extremely bullish about this portfolio and our markets. Let's talk about headwinds and tailwinds. I'm about the middle one, that's rising interest rates. Rising interest rates are certainly going to affect cap rates when you lose growth. We don't see growth looping going away anytime soon.

But here's what it affects more than us, single-family homeowners. So the average mortgage in the United States, the average 30-year fixed rate mortgage increase or rate was 7.08%. That's a 30-year rate, right? And what that means is more renters. The U.S. homeownership rate current near-term peak was in the second quarter of 2020, and it hit 67.9%... and it's potentially and permanently on its way down to 60% to 62%. What that means is more renters. What's impacted us with cap rates can be experienced on the lever to home ownership, right?...

I think those two big factors, we don't see a significant amount of supply net of absorption that would cause us to be anything but bullish about the future of BSR and specifically our three markets. If you want me to break it down to if you want me to break it down to percentage growth, I think 2023 is very healthy for us. I think we'll exceed expectations that this market has for us right now.

I think I'm more confident about '24 than I was a quarter ago. So plugging into the CoStar math, we've seen nothing but increases there on kind of a 3-year run rate of health in our sector and specifically in multifamily in the United States and the State of Texas. Percentage-wise, it's too soon to tell, but our viewpoint is it's better than everybody thinks it is today." [emphasis added]

Talk about being bullish! He said the word "bullish" three times in one answer. No wonder they are buying back shares and making insider purchases at these levels. They seem confident that they will continue to grow nicely for a while before oversupply starts affecting their fundamentals. I have not seen other apartment REIT management teams express the same level of conviction in their organic growth. It seems that the Texas exposure will remain a tailwind for the time being.

Reason #5: Class B vs. Class A

Just as importantly, investors should remember that BSR invests mainly in affordable, Class B communities, and this matters in today's economic environment.

Class B communities are affordable with rents at around $1,500 on average at BSR's communities. They are high-quality communities with good locations and amenities, but they are typically ~10 years old so tenants get a bit of a discount when compared to the latest, flashy Class A communities, which is what most of its peers own.

I think that this is an advantage as we potentially head into a recession. People will try to cut down their budget, leading to more demand for Class B relative to Class A:

This is why Class B communities are typically more defensive during downturns. Adding even more margin of safety: BSR's rents are today below market and the rent-to-income ratios in its markets are also a lot lower than average. Here's what the CEO said in our recent interview:

"Although we have achieved rapid rent growth over the last year, our rent as a percentage of household income remains highly affordable compared to the national average.

As explained on our last earnings call, it takes approximately 18 months to bring leases to market based on current turnover; therefore, our portfolio still has a runway to capitalize on the loss-to-lease." [emphasis added]

Therefore, we would expect BSR's properties to perform better than most of its peers in a future recession. We estimate that their rents are still 5-10% below market.

Reason #6: Future Catalyst to Force Value Creation

Today, BSR is primarily listed in Canada, despite owning properties mainly in Texas. Back when they became public, it made sense to list in Canada because it was cheaper and the company was small in size. There was also a lot of demand for such a vehicle in Canada back then.

But today, it seems that this actually hurts their market sentiment. Many US investors aren't buying BSR simply because it is primarily listed in Canada and many Canadian investors appear to have missed or underappreciated all the recent value creation, and as a result, BSR is now priced at the lowest valuations in its sector, despite having some of the strongest fundamentals.

I suspect that if BSR cannot fix its valuation over time, it will seek a listing in the US, and this could help it reach a higher valuation. It is a unique catalyst that only applies to BSR and I like that they have this in their back pocket because it is independent of their fundamentals.

Reason #7: Tax-advantaged Monthly Income

Lastly, this advantage may not apply to all investors, but it is good for me.

BSR's dividend payments are classified as "return of capital", at least for now, which allows investors to defer taxes.

This income is not taxed. Instead, the payments reduce your cost basis and so you will get taxed if and when you sell the stock at a profit someday.

This is beneficial for me because the classification as "return of capital" removes the impact of withholding taxes and the lowered cost basis does not directly impact me since I hold the shares in a tax-deferred account.

Moreover, the dividend is also paid monthly. I don't think that this is a major advantage, but it feels nice to receive monthly income. It gives you the real feeling of being a landlord.

Bottom Line

I am bullish on many apartment REITs, but BSR is our largest apartment REIT holding at this time.

In short, the pitch is that you get to buy an interest in a diversified portfolio of apartment communities in strong Texan markets at 55 cents on the dollar, and then you get the added benefits of professional management (that's well-aligned, cost-efficient, and well-incentivized), liquidity, limited liability, and tax-advantaged passive income.

The dividend yield may not seem high at 4.6%, but this is because they retain about 40% of the cash flow to buy back shares, creating value for shareholders. As such, the real "cash flow yield" is closer to 8%.

The NAV could drop a bit as cap rates expand, but since their NOI is rising rapidly and the management keeps buying back shares, I would not expect a significant impact.

Assuming that the NAV stabilizes at around $18 per share (10% lower than the current level), the shares would still have 60% upside to get there and while you wait, you collect steady monthly rent checks.

I really like the risk-to-reward.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.