Top Pick #8: Big Yellow Group

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

Top Pick #8: Big Yellow Group

What was the best performing real estate investment over the past 25 years in the US?

You may be surprised to hear that it was self-storage.

Even in the worst 5-year period, self-storage delivered 7% annual returns, showing that it outperforms not only during the good times but also during recessions:

Why has self-storage been such a strong investment?

There are two main reasons:

(1) First off, this is a sector in which the professional management of REITs has really made a big difference.

Still 20 years ago, the self-storage market was highly fragmented and most properties were owned by small unsophisticated investors. Then came REITs that began to use their scale to consolidate the market, improve the management, implement revenue optimization technologies, and use national advertising campaigns and better branding to grow rents.

Put simply, REITs were able to buy under-managed properties and improved operations to grow cash flow, and created a lot of value in the process.

(2) Moreover, self-storage is notoriously defensive during recessions. People need to store stuff whether the economy is booming or collapsing, and it may be even cheaper to downsize your residence or office to rent storage space for the extra stuff. For this reason, self-storage REITs were able to earn positive returns even in 2008 and 2009, which is when most other real estate investors were taking big losses.

High growth combined with recession resilience has led to 17.3% average annual returns with low volatility over the past 28 years.

If you had invested $100,000 in the US self-storage REITs, you would have turned it into $8,716,544 – a 87x without any additional contributions.

The compounding works very well at these rates of return!

Unfortunately, self-storage investments are not a well-kept secret anymore in the US. Everybody has witnessed these superior returns and not surprisingly, money has poured into this sector. Properties have been built all over the place and even smaller operators have caught up to the improvements in revenue optimization systems.

This does not mean that the self-storage prospects are now unattractive, but we would not expect the same rates of return to continue going forward. The market dynamics have changed, and the growth outlook has significantly deteriorated in the US.

But the European self-storage market is still very opportunistic we believe that it is set to reproduce these superior results over the coming decade or two.

The European Self-Storage Market

In many things, the European market is 10 to 20 years behind the US.

A great example of that would be the fast-food market. In the US, you can find countless options for fast food, ranging from burgers to subs, pizzas, Mexican food, sushi, etc…

In comparison, until fairly recently, we only had McDonald’s, Subway, and a few other major chains in Europe. Now, slowly other players are coming in and their success has been phenomenal so far. KFC, Taco Bell, Chipotle, Burger King,… are all in a rush to open locations all over Europe.

The same applies here to self-storage, but we are even more behind.

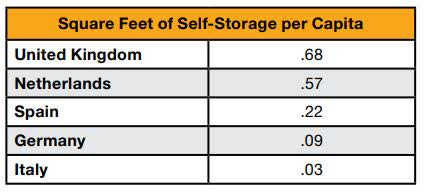

To give you an idea, there is today about 10 square feet of storage space per person in the US compared to less than 1 in Europe.

Having lived on both continents, I can tell you that the difference in supply is very noticeable. In the US, you can find a self-storage property at nearly every corner. However, you really have to look for them in Europe.

This is quite surprising when you consider that:

Living expenses in European capital cities are high and rising.

European cities are very dense and growing.

Europeans regularly relocate for work or studies, just like Americans.

Marriages and divorces are also very common here.

Older generations are also slowly passing away, leaving a lot of things behind to store.

The demand-driving factors are not identical to the US, but the differences do not justify such a massive disparity in storage space supply.

So, why is the supply so low relative to the US?

Self storage awareness is still very low. Most people still do not know about this solution and its key benefits.

However, this is changing rapidly.

Big Yellow notes that 75% of its clients are people who have never used storage before. They are learning about its benefits, and telling their friends, and so the pent-up demand is slowly coming to the surface.

The opportunity for investors is significant:

Buying European self-storage REITs today is similar to buying US self-storage REITs 25 years ago.

The market is still highly fragmented.

There are not many sophisticated investors.

The supply is almost non-existent.

The demand is on the rise.

And REITs have a lot of opportunities to consolidate, add value, and grow cash flow.

Knowing how well US REITs performed over the past 25 years, we believe now is a great time to invest in Europe, which is still in its early innings in terms of self-storage potential. Below we discuss our Top Pick to profit from this opportunity.

My Favorite European Self-Storage REIT: Big Yellow Group

Big Yellow Group (OTCPK:BYLOF) is one of the largest self-storage REITs in Europe. It recognized the European self-storage opportunity back in 1998 and it has ever since been a significant outperformer – earning 15.8% annual total returns on average:

In that sense, it already has a long track record of success and a proven model that works. Now it just has to replicate it over and over again.

Big Yellow has done a lot over the past 20 years, but it is really just scratching the surface in terms of what it could achieve in the long run.

Today, it operates ~110 self-storage properties and it also owns another 11 sites that are waiting to be developed.

It is famous for its yellow-colored properties which are highly visible:

It has established itself as the leading brand in the South of England and it is now expanding to cover the rest of Britain. In other words, it still has a lot of growth potential in the UK, and has not even stepped foot outside of the UK:

It has managed to grow cash flow and earnings per share by 15% per year over the past 15 years.

Will this double-digit growth continue?

We believe so.

Here is what sets it apart:

Superior Branding: It has done a great job at branding itself. According to surveys, it is by far the most recognized brand for self-storage in the UK and it could replicate this elsewhere in Europe. Today, 23% of surveyed people know the Big Yellow brand. In comparison, the second most recognized brand, Safestore, was only recognized by 4% of people.

Digital Presence: The Big Yellow brand is very recognizable because of the unique appearance of its properties, but it is not only that. Big Yellow is very active online with ad campaigns, sales funnels, SEO optimization, etc… It is behaving like a true consumer-oriented company and today over 90% of its clients come from digital platforms. Other real estate investors lack expertise in this area.

The Best Locations: Big Yellow got into the self storage business over 20 years ago. Therefore, it has a first-mover advantage and was able to pick the best locations before other competitors entered the market.

Big City Focus: It invests mostly in London and similar large cities with a very dense and growing population. As consumer awareness keeps growing in these markets, the demand growth potential is exponential. Moreover, these locations lack flexible business warehouse space, driving even more demand for its properties.

Occupancy Upside: Its existing portfolio has an ~84% occupancy rate. It has been steadily growing over the years, and they believe that they can reach 90-100% in the future. As they get closer to that range, they will also gain higher traction in raising rents.

Development Capabilities: It has unparalleled experience in building its own properties. It currently has 11 sites under development and will have many more to come in the long run. Building its own sites results in higher yields and greater cost efficiencies.

Strong Balance Sheet: Big Yellow maintains a fortress balance sheet with a low 18% LTV.

Track Record of Launching New Brands: Big Yellow has also proven that it is able to launch and operate new brands. In addition to Big Yellow properties, it also operates Armadillo Self-Storage, a lower-frills brand for smaller towns and cities. Its strategy is to buy smaller under-managed properties and then improve operations and add the brand to grow cash flow and value. Big Yellow has been successful at it, and therefore, we believe that it could replicate this elsewhere in Europe when it starts reaching the limits of the UK market.

They have grown the portfolio from 0 to 110 properties and achieved 16% annual total returns in the process for their shareholders. Yet, they are still early in the scaling of their business and have significant growth ahead of them.

Today, the business is well-positioned to execute its next phase of growth, which will aim at covering the rest of Britain and later expanding elsewhere in Europe.

A Wonderful Business at a Reasonable Valuation

Is this an exceptional bargain?

No, it isn’t.

Does it have significant immediate upside potential?

Not either.

Why buy it then?

This is a wonderful business at a reasonable price.

It was getting pricey in early 2022, but since then, its share price has crashed by 40%, and as a result, it is now priced at just 16x cash flow, which seems very reasonable for a lower-risk recession-resistant business with a long run-way of double-digit growth potential.

I am confident that paying this price will result in further outperformance over a multi-year time horizon:

Since 2004, cash flow has grown by 15% per year and the company is still at its infant stage in terms of what it could achieve in Europe. While you wait for the growth to compound your returns, the company pays you a 4.5% yield and this dividend is also growing at a double-digit rate.

How to Invest in Big Yellow Group

We invested in Big Yellow Group directly in the UK with the ticker BYG. You can also buy it in the US with the ticker BYLOF. Note however that the liquidity is much lower in the US and this is why we bought it directly in the UK.

What You Need to Know About Withholding Taxes

There are some tax implications when investing in International companies. Most importantly, a withholding tax may be deducted from the dividends paid by International companies.

This withholding tax is generally 20% for British companies, which may seem like a lot, but there are two things to remember here: Firstly, you get a tax credit in your home country to avoid double taxation. And secondly, this is mainly a capital appreciation/growth type investment, and the appreciation is not affected by withholding taxes. Even if there was no dividend, I would invest in Vonovia.

Note that the exact tax rate depends on your country of residency. Investors can find the withholding tax rates for each country on PwC's website. Click the below link to be redirected:

Dividend Withholding Tax Rates

You can use the search bar to change the country and review the different withholding tax rates:

When tax time comes, you will receive in your 1099 from your broker, the amount of foreign taxes withheld, and you use that figure for a credit on your taxes due. In case of doubt, we always recommend contacting your broker and/or a tax advisor. For a detailed overview of Foreign dividend withholding taxes, click here.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.