TRADE ALERT - Core & International Portfolio September 2024

TRADE ALERT - Core & International Portfolio September 2024

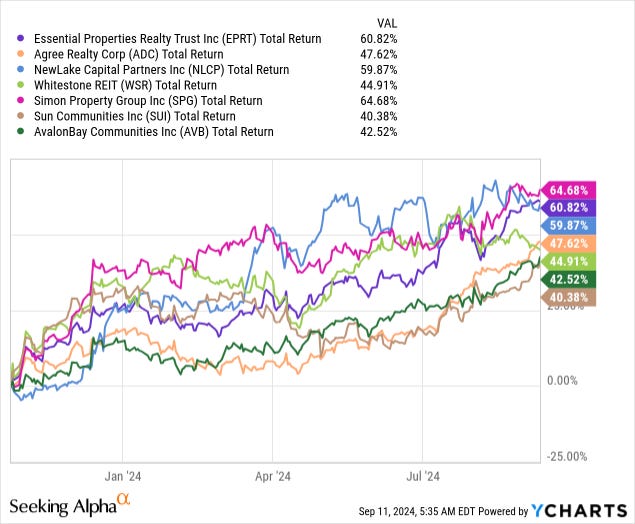

Lately, almost everything has been rising. Most of our holdings have strongly recovered and portfolio is now sitting at a new all-time high:

But there are some exceptions and today, we are adding more capital to two of our holdings that missed out on the recent rally.

I will keep this short because we have separate updates coming up for both of these companies in the coming weeks.

Firstly, I bought another 360 shares of RCI Hospitality (RICK), increasing our position size by 38%:

I had a phone call yesterday with the CEO of the company and I really liked what I heard. We will soon share our interview with members, but in short:

I think that they are likely to announce a few new club acquisitions in the coming months, which should boost their cash flow and help their market sentiment.

They will unveil a new 5-year plan later this year and according to my calculations, it seems that they expect to nearly double their FCF per share by 2029 and that's with conservative assumptions. This would price the company at just ~4x its 2029 FCF

Today, the shares are trading at a 15%+ FCF yield and they are aggressively buying back shares, which will create significant value for patient investors.

I think that the impatience of other investors has created an exceptional opportunity long-term oriented investors and I expect RICK to become a multibagger over the next 5 years.

Its business experienced some bumpiness due to the pandemic, but things are looking up from here and its valuations is ultra-low for such a rapidly growing company.

While you wait for our new interview with the CEO, you can read our previous one from a year ago by clicking here.

Secondly, I also bought: