TRADE ALERT - Core & Retirement & International Portfolio December 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on December 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

TRADE ALERT - Core & Retirement & International Portfolio December 2024

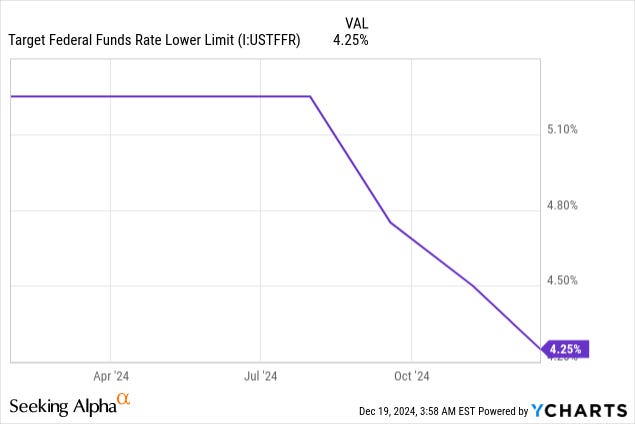

Yesterday, the Fed cut interest rates by another 25 basis points.

As a result, interest rates are now a full 100 basis point lower than they were at the start of this rate cutting cycle.

This may seem like good news... but here's how the market reacted:

Everything dropped by 3-5%. This includes the S&P500 (SPY), Tech stocks (QQQ), REITs (VNQ), utilities (XLU), Bitcoin (BTC-USD), etc. Some big tech companies like Tesla (TSLA) dropped by nearly 10% in a single day.

Why?

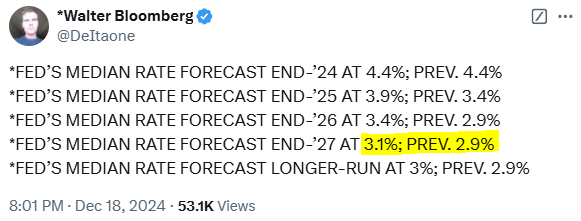

Well, the market is a forward looking machine and the Fed signaled that they would be more cautious about rate cuts in the near term.

Until recently, the market expected 4 rate cuts in 2025, but the Fed now signaled only 2 cuts for the next year.

The economy is still strong overall and there is growing uncertainty about near-term inflation as tariffs, deportations, and tax cuts could be inflationary.

The Fed recognizes this and wants to make sure that it isn't cutting rates too fast as this could lead to another wave of higher inflation.

"When path is uncertain, you go a little slower" Powell

But here's what I find interesting:

Powell still confirmed that the inflation story is still "broadly on track" and the long-term projections for interest rates have not changed much at all.

Our own research confirms this and we have a 'market update' coming up on this topic next week for members.

What this means is that while there is more uncertainty in the near-term, the long term trajectory for inflation and interest rates is unlikely to have changed.

Therefore, we view this dip as an early Christmas gift.

You now get to buy more shares at even lower valuations and any delay in further rate cuts will only prolong the period of undersupply and faster rent growth that will follow in the coming years.

In other words, this is another case of short-term pain for long-term gain. The market dip is the result of investor's excessive focus on short-term performance, but the long-term picture remains more or less the same.

Today, we are making one addition to each portfolio to take advantage of the dip. We intentionally focus on REITs that suffered a particularly big sell-off in recent weeks: