TRADE ALERT - Core & Retirement Portfolio December 2025 (ARE Investor Day Update)

Important Announcements:

Just a quick heads up:

We will share our exclusive interview with the CFO of HA Sustainable Infrastructure Capital (HASI) tomorrow. Stay tuned!

We expect to share our fourth Top Pick for 2026 next week.

I will host another live Webinar in a few weeks. Let me know if there are any specific topics that you would like me to cover.

--------------------------------------------------------

TRADE ALERT - Core & Retirement Portfolio December 2025 (ARE Investor Day Update)

Alexandria Real Estate just held its 2025 Investor Day and released a 150-slide presentation, providing a lot more details on its current headwinds and its path forward. It also announced the dividend cut that it telegraphed in its Q3 results and shared its guidance for 2026.

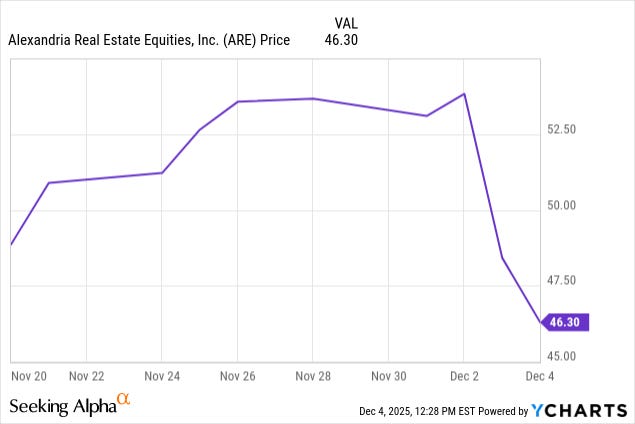

As a result of this, the stock gave up its recent gains and hit new lows that put its valuation at an even lower level than at the bottom of the Great Financial Crisis:

We are today making another small addition to our position with the purchase of 60 shares for our Core Portfolio (+13%) and another 40 shares for our Retirement Portfolio (+5%).

In what follows, I am going to share my takeaways from the Investor Day event and explain why I remain bullish on the long-term prospects of the company, even despite the growing near-term headwinds.

In case you are not familiar with the company, I recommend that you start by reading our recent update by clicking here. Much of it remains relevant today.

The Growing Near-Term Challenges

Alexandria has been our worst REIT investment of 2026.

In hindsight, we clearly bought in too early. Not all my investments are successful, and Alexandria is a good example of that.

So what went so wrong?

Alexandria provided a lot more details on this on its Investor Day.

In short, the policy chaos of the current administration has suppressed demand for life science space, which has compounded the oversupply issues that it was already facing.

The oversupply has been a known issue for a long time and has been a central element of our investment thesis. The pitch for Alexandria has been that it is unfairly beaten down due to temporary oversupply, which should only impact its results for a few years. As demand catches up to the supply, growth should accelerate, Alexandria’s market sentiment would improve, and its valuation multiple should recover, leading to significant upside.

But this obviously won’t work if there is no demand to fill the oversupply. Then you end up with growing vacancies and declining rents, which is exactly what is happening today.

On their conference call, the management repeatedly blamed the government for depressing the demand with a series of ill-advised policy decisions. To quote them, they said that “the government needs to get its act together”, is “in need of leadership”, and “the wrong people are in the wrong seats”. (By the way, this is coming from people who have historically strongly supported the Trump administration and celebrated his presidential victory.)

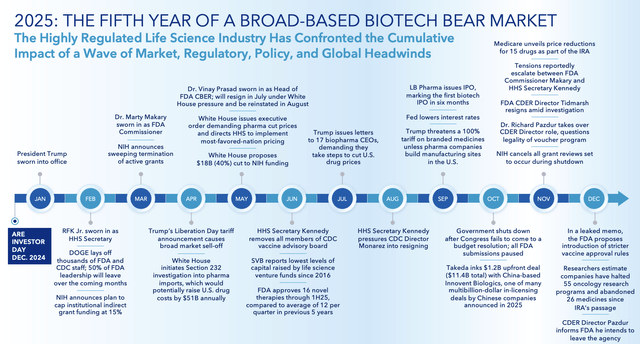

Here is a timeline of the policy chaos that they are referring to:

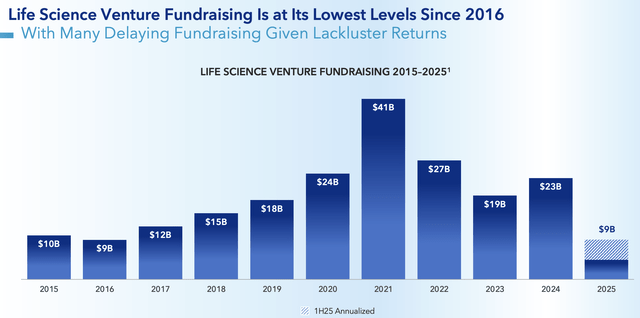

The combination of significantly cutting research budgets, threatening major tariffs on imported drugs, putting strict restrictions on pricing, imposing more regulations on advertising, and much more, has caused VC fundraising to drop to the lowest level in a decade:

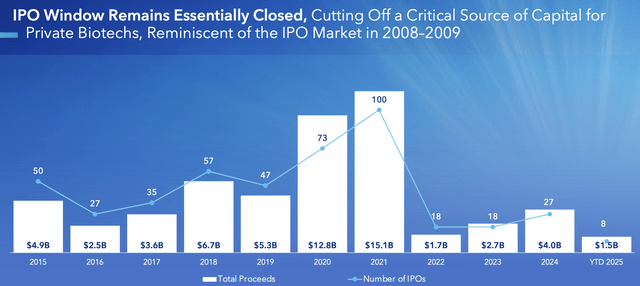

The IPO window has also effectively closed:

Things have gotten so bad that 50% of senior FDA leadership left the agency this year, and according to some surveys, up to 70% of US-based scientists would consider moving abroad. As a result of significant layoffs, the FDA also suffered 3x more delays in deadlines in Q3 vs. the six previous quarters.

When there is so much uncertainty, companies scale back new investments, and that’s happening right now in the life science sector.

If you cannot know if your government will impose major price controls, tariffs, or something else, you just cannot take the risk of investing large sums into research, as the potential payoff of a new discovery could be now a lot lower as a result of these policy changes.

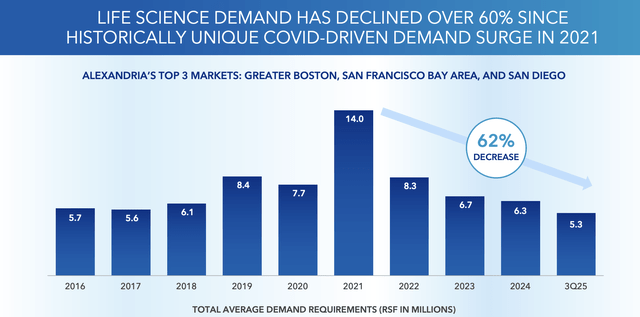

The result of this is that less money is pumped into R&D, and there is less demand for life-science space, right as it is already severely oversupplied:

So that’s what changed in 2025, and it caught most of us off guard.

In hindsight, we should have paid closer attention to the demand side, especially seeing all these policy changes, but like the rest of the market, we got used to this chaos and did not take it seriously enough.

This serves as a good reminder for us that government policies can have a major impact on the demand side of the life science property sector, and therefore, it should be closely monitored. I made a mistake here, but I will learn from it.

As a result of the cooling demand and the worsening oversupply, Alexandria is now turning into a longer story.

What we expected to be a 2-3 year play is now becoming a 4-5 year anticipated recovery, according to the management.

Their occupancy rate and rents are expected to face greater pressure than previously anticipated, which will lead to a dip in cash flow over the coming years.

In response to this, the management is doing two things:

First, it now announced its previously telegraphed dividend policy adjustment, cutting it by 45%. I am glad that they cut it as much as they did, as this really moves the needle and will allow them to retain enough cash flow to fund a good chunk of their development projects internally without having to increase leverage in an already challenging period.

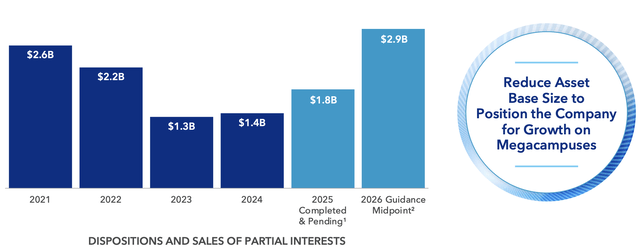

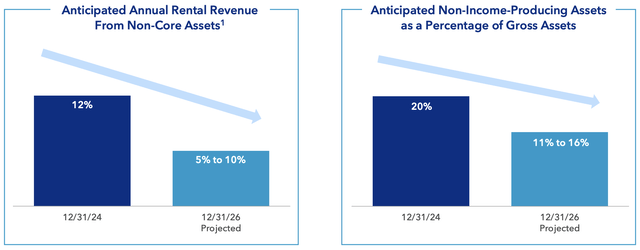

Second, it is doubling down on its portfolio repositioning, accelerating its non-core asset sales to refocus solely on its mega-campus communities and pay down debt. Next year, they expect to sell a record amount of assets, especially relative to their current portfolio size:

Most of these non-core asset sales will be dilutive to FFO per share, given that their cap rates are a lot higher than the interest rate of their debt.

On the positive side, these asset sales should allow the REIT to further strengthen their balance sheet, fund their development projects, and ultimately leave the REIT with a 90-95% megacampus-focused portfolio by the end of 2026.

So cash flow is dropping, but the quality of this cash flow is increasing, as its megacampus properties enjoy much greater barriers to entry and better long-term growth prospects.

All of this now explains why the cash flow is dropping so much in the near term. The combination of lower occupancy, lower rents on releasing, significant asset sales, and also lower anticipated realized gains from VC investments is all contributing to lower FFO per share.

Remember also that since most of Alexandria’s leases are triple net, its tenants typically cover all property expenses. This makes vacancies even more costly as Alexandria not only loses the income stream, but also becomes responsible for all the property expenses. It also results in greater capex, tenant improvements, and releasing costs, especially since tenants hold the cards in this oversupplied environment.

Taking all of this into account, the decision to cut the dividend starts to make a lot more sense to me. They could probably still maintain it as they themselves admit that they are doing this in an “abundance of caution”, but if you expect a multi-year period of challenging market conditions, it is the prudent thing to do. You don’t want to risk your long-term future just to fund some extra dividend payments, especially when that future could be immensely rewarding. More on this below: