TRADE ALERT - Core Portfolio December 2025

Quick Reminder:

I am excited to announce that we will be hosting our second live Q&A webinar, exclusively for subscribers of High Yield Landlord.

This is your opportunity to connect directly, ask questions, and dive deeper into REITs, real estate, and anything else we cover in the newsletter.

Event Details

Format: Live Zoom Q&A

Date & time: Sunday 12/21/2025 at 1PM EST

Spots available: Only 300 — first come, first served

How It Works

You will be able to ask questions live in the Zoom chat during the session

If you prefer, you can also leave your questions in the comment section below in advance — I will try to answer as many as possible

If you cannot attend live, I will post a recording afterward for all subscribers

Reserve Your Spot

Due to limitations in our Zoom plan, we can only accommodate 300 participants for the live session.

If you would like to attend live, please reserve your spot as soon as possible — click here to register.

Looking forward to seeing many of you there!

--------------------------------------------------------

TRADE ALERT - Core Portfolio December 2025

President Trump just signed an executive order initiating the process to reschedule cannabis as a less dangerous, Schedule III drug, and as a result of this, our cannabis REIT, NewLake Capital Partners (NLCP) is now surging in value.

The reason why it is surging so much is that this rescheduling will greatly improve the credit quality of its tenants.

As a Schedule I drug, in line with heroin and LSD, cannabis companies were heavily punished by the IRS. They couldn’t deduct business expenses such as payroll, marketing, rent, utilities, etc., and as a result, they were commonly paying effective tax rates of 60-80%.

This made it incredibly difficult even for the largest and most sophisticated operators to remain profitable.

But this rescheduling to a Schedule III drug would allow these companies to deduct all these expenses, which would lead to an immediate drop in taxes and a massive surge in profitability. It would lead to greater free cash flow generation, stronger balance sheets, and easier access to capital as well.

Not only that, but I think that this will pave the way for other favorable regulatory changes. As an example, President Trump has shown support for the SAFER Banking Act, which would provide easier banking access to cannabis companies. He has also shown support for the STATES Act, which would decriminalize cannabis and allow States to decide.

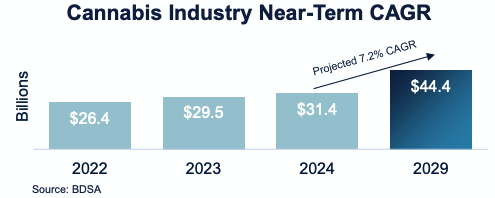

So this was the first catalyst, but likely not the last one. This is a rapidly growing sector with 88% of US adults support for at least medical use, and this is now increasingly being reflected at the policy level:

It is a major milestone for NLCP, as it would greatly reduce its tenant risk going forward, which is the main reason why it is so cheaply valued.

Even following the recent surge, the stock is still trading at just 6.5x FFO, an estimated 38% discount to NAV, and a 12% dividend yield, safely covered with an 82% payout ratio, which is at the low end of their 80-90% targeted range. This low valuation is especially intriguing when you consider that the REIT is net cash positive (more cash than debt).