TRADE ALERT - Core Portfolio February 2023 (New Investment Opportunity)

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

TRADE ALERT - Core Portfolio February 2023

We have had relatively few new investment ideas in recent months.

It is not that we aren't looking for new ideas, I can assure you that we are, but it has been hard to justify initiating a new position because most of our current holdings are already heavily discounted and the market volatility is presenting us compelling opportunities to increase the size of our current positions.

As an example, just the other day, Farmland Partners (FPI) dropped by 15% due to temporary headwinds, but the fair value of its farmland has actually grown, and as a result, it is now priced at a 35% discount to its net asset value.

We know FPI very well because we have owned it for a while and have gotten the chance to talk to the management and so it was an easy decision to buy more shares of the company. The same is true for other REITs that we own in our Portfolio. We know them the best and we think that it is hard to find better opportunities in today's market.

But with that said, we were just presented with a new opportunity to recycle some capital.

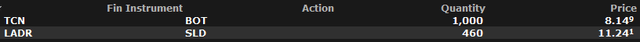

We are today selling our position in Ladder Capital (LADR) in order and reinvest the proceeds and then some into Tricon Residential (TCN).

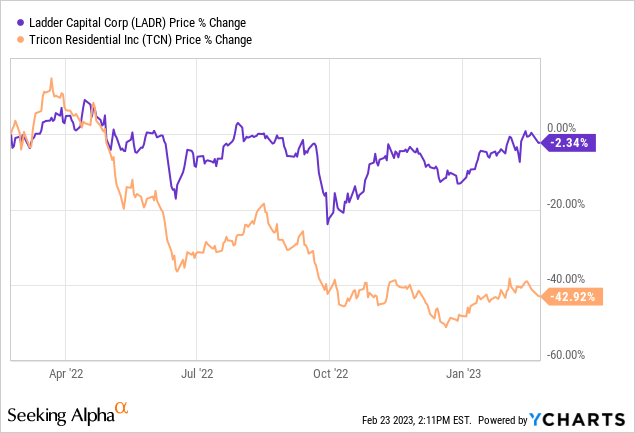

We have nothing really against LADR. We still give it a Buy rating and think that it is relatively attractive. But it has massively outperformed TCN and other REITs over the past year and as a result, its future risk-to-reward has become less compelling, relatively speaking:

Moreover, our thesis for LADR was focused on the monetization of its net lease portfolio, but this appears less likely now that interest rates have surged to much higher levels.

TCN, on the other hand, has seen its share price crash and as a result, its risk-to-reward has become compelling enough for us to initiate a small position.

Today, TCN's share price is down heavily, but LADR is flat and so we thought that now would be a good time to make the transition:

Below we explain why we like TCN. Please note that I expect to meet the management at the Citi Global Property Conference in two weeks and will then share our full investment thesis.

Tricon Residential (TCN)

TCN is one of just three companies that focus on single-family housing:

They all performed very well in 2020 and 2021 as home prices surged, but then they collapsed in 2022 as interest rates rose and investors began to fear that the housing market could crash:

This is a fair concern. Housing affordability has rarely been worse and very few transactions are happening today.

But as you probably know: the best time to invest is when everybody is fearful, and there are few other sectors that are impacted by greater fear than single-family housing at the moment.

As a result, these companies are now priced at exceptionally low valuations with steep discounts on their net asset values.

The values of their properties may decline in the near term, but the discounts are so large that this should be largely priced in.

We are particularly bullish on AMH and TCN, but I am the most interested in TCN because of its valuation and its asset management business.

Valuation

It is priced at the lowest valuation in its peer group with an estimated 40% discount to its net asset value, providing great margin of safety if property prices begin to decline and significant upside potential if and when interest rates return to lower levels.

TCN is a Canadian company (with a US listing) and so it needs to provide NAV estimates based on property appraisals, and the management believes that its current NAV estimate is conservative given that they have been able to sell properties at a 10%+ premium to it.

Moreover, we think that the values of these properties should be somewhat more resilient because 90% of them are located in strong sunbelt markets, and these are mainly affordable properties with a $1,700 monthly rent on average. The management also thinks that their current rents are about 20% below market.

Here is what the CEO said on a recent conference call:

"All of this to say that we have a lot of faith and a reported net asset value of $13.74 per share or CAD18.83 and believe the pullback in our stock is far over done."

This of course does not mean that its NAV won't decline at all, but it should limit the downside as its properties remain in high and growing demand and its rents keep growing at a rapid pace.

Asset Management Business

Unlike its peers, TCN is not just a traditional landlord.

It also has an asset management business that allows it to earn fee income by managing capital for others.

That's how the company owns $17.6 billion in assets, despite only having a $2.3 billion market cap.

This makes it less dependent on public capital markets because it does not need to raise new equity to buy additional properties. This wouldn't be possible at today's prices anyway.

Instead, it can raise capital in private markets from other investors to buy additional properties and it earns growing fee income as it grows its assets under management.

Before the recent surge in interest rates, they were targeting 15% annual FFO per share growth over the next 3 years. They then recently scaled back their growth plans because they don't think that it would be prudent to aggressively purchase new properties in today's uncertain environment.

But it shows you that they have access to ample private capital and could grow significantly in the coming years as the market eventually stabilizes. Even Blackstone's BREIT formed a $300 million partnership with TCN to acquire single-family properties and many other leading institutions are interested to work with Tricon. It speaks highly for their management.

In 2023, we think that the company's FFO per share will be more or less intact because its strong organic growth will go into higher interest expense. One downside of TCN today is that it has a lot of variable-rate debt, but this is priced into the stock, and it should serve as a significant catalyst if and when interest rates begin to decline.

TCN has not yet reported its full-year results for 2022 or issued guidance for 2023, but its close peer AMH just released strong results with 5-7% same-property revenue growth and a 22% dividend hike.

TCN's yield is relatively low at near-3%, but this is a growth story with the bulk of the returns expected to come from future upside as the company returns to rapid growth and its discount to NAV eventually closes down.

In short, you get to buy an interest in a diversified portfolio of professionally-managed sunbelt single-family homes at 60 cents on the dollar and then get to participate in the long-term growth of their asset management on top of it.

Stay tuned for our full investment thesis and our interview with the management team.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.