TRADE ALERT - Core Portfolio June 2025 (Capital Recycling)

Our 2025 realized gains are adding quickly.

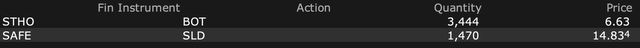

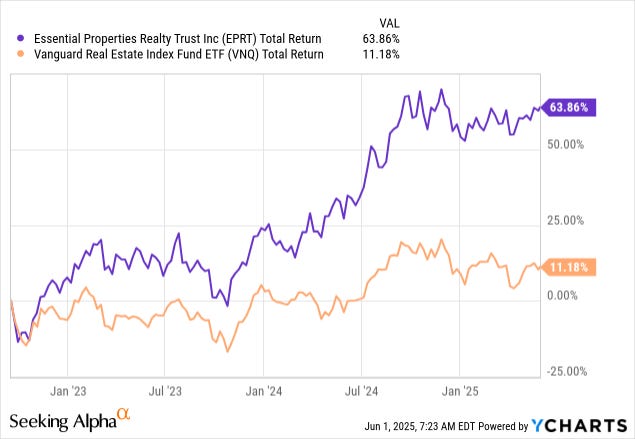

Just yesterday, we sold our position in Essential Properties Realty Trust (EPRT), booking a large realized gain:

This came after already booking gains on KlePierre (LI.PA), Modiv Industrial (MDV), Agree Realty (ADC), and Farmland Partners (FPI) earlier this year.

This led me to review our portfolio in search of a potential loser that we could sell to book a tax loss to mitigate the impact of these gains.

That's when I came across an analysis of Safehold (SAFE) vs. Star Holding (STHO), and it gave me the idea of selling our position in Safehold (SAFE) and redeploying the entire proceeds into Star Holding (STHO).

It allows us to book a large tax loss on Safehold, all while still keeping our exposure to it indirectly via Star Holding (STHO).

As a reminder, STAR was formed in 2023 as a spin-off from SAFE to manage the liquidation of certain legacy assets of the company that did not fit its ground lease portfolio anymore.

But in addition to these legacy assets, STAR was also seeded with 13.5 million shares of SAFE to give it enough scale, liquidity, income, and assets to manage its debt through the liquidation of the legacy assets.

And here is the interesting thing:

Today, the value of its stake in SAFE is $204 million, but STAR's entire market cap is less than half of that:

What this means is that by buying STAR, you get exposure to SAFE at a much lower valuation, and you then get the additional legacy assets on top of that for free.

Put differently, each dollar invested in STAR gives you more than two dollars worth of SAFE, plus some other assets. It is the cheapest it has ever been relative to SAFE since the spin-off.

If that were the story, then it would be a no-brainer to just own STAR instead of SAFE, but where it gets more complicated is that STAR also has quite a bit of debt.

Therefore, the questions to answer are the following:

How much are its other assets worth?

Are they enough to cover the debt?

How long will it take to liquidate the assets?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.