TRADE ALERT - Core Portfolio March 2025

TRADE ALERT - Core Portfolio March 2025

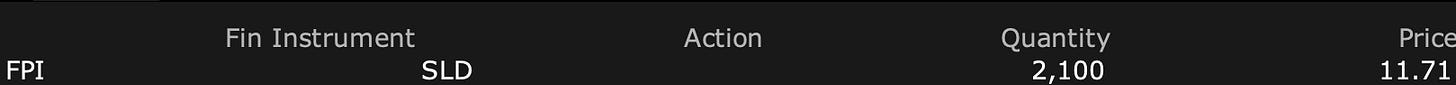

Today, we are selling our position in Farmland Partners (FPI). Not because we have become bearish but because our investment thesis has now mostly played and its discount to NAV has compressed even as that of some other REITs has expanded significantly.

The company recently paid a $1.15 special dividend and adjusted for that; the stock price would be nearly $13 right now. We previously estimated the company's NAV at $16, so there is still some upside. However, many other REITs trade at much steeper discounts, and therefore, we don't think that FPI is the best use of our capital anymore.

We are glad to note that this was a successful investment that far outperformed our REIT benchmarks (VNQ) and earned us a decent return even despite the 3-year-long REIT bear market.

We will continue to follow the company closely and will gladly return to it in the future if and when the discount to NAV expands again or if management makes significant progress in developing its asset management business. Our many exclusive interviews don't give us a sense of urgency right now, so we don't think we are missing out on much.

This sale unlocked nearly $25,000 and we expect to redeploy it into a new better investment opportunity.