TRADE ALERT - Core Portfolio May 2025

Subscriber Meet Up in NYC

Before diving into today’s article, I wanted to let you know that I’m currently in New York City and planning to organize a casual meetup this week for any subscribers who would like to connect in person.

If you’re interested in joining, feel free to email me at jaskola@leonbergcapital.com, and I’ll follow up with the time and location.

Also, my apologies to those of you who hoped to meet me in other cities during my U.S. trip. My plans shifted more than expected, and I didn’t get the chance to respond to everyone. I truly appreciate your interest and hope to meet you on a future visit!

-------------------------------------------------------

TRADE ALERT - Core Portfolio May 2025

Summary:

We think that Safehold (SAFE) could be the ultimate winner of the AI revolution because it is one of the purest, leveraged ways to bet on an AI-driven future of deflation, lower rates, and real asset scarcity.

We recommend that you start by first reading our recent article on how we expect the AI revolution to impact real estate. Click here to read it

We bought another 300 shares, increasing our position size by about 25%.

-------------------------------------------------------

Artificial Intelligence (AI) is not just another innovation — it is the biggest breakthrough of the century.

Historically, major technological leaps like the Industrial Revolution, electricity, and the internet transformed economies because they allowed humans to do more by leveraging better tools. However, these innovations were ultimately constrained by human intelligence and decision-making speed.

AI removes that ceiling.

For the first time in history, we are building tools that are smarter and faster than humans at key tasks: reasoning, optimizing, diagnosing, strategizing, and executing. AI is essentially like electricity, the internet, and industrialization — compressed into a 10–20 year period.

Everything will change.

How AI Will Reshape the Economy (Recap)

In a previous article, we explained the second-order effects of AI on businesses and the broader economy:

Deflationary pressure: AI dramatically lowers costs, breaks barriers to entry, increases competition, and destroys pricing power.

Lower interest rates: Deflation and economic disruption caused by the revolution will force central banks to push rates back to lower levels.

Capital rotation: Investors will seek safety in scarce, tangible, yield-producing assets.

In particular, real assets that cannot be replicated — like land, infrastructure, and key real estate — will become even more valuable.

And Safehold (SAFE) could be one of the biggest beneficiaries.

Why Safehold (SAFE) is Uniquely Positioned

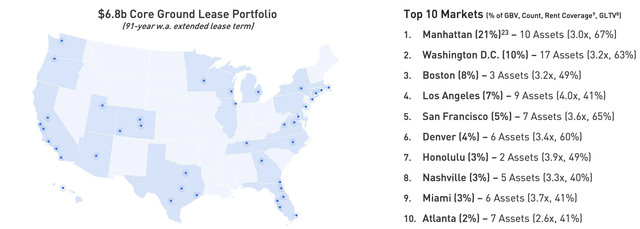

Safehold is the only publicly traded company focused on ground leases — long-term ownership of urban land under high-quality properties.

Here’s why SAFE stands out: