TRADE ALERT - International Portfolio October 2025

Last week, we initiated a new position in IRSA (IRS), Argentina’s largest listed real estate company, after its share price dropped sharply heading into the country’s midterm elections.

You can read our Trade Alert by clicking here.

Its recent sell-off had nothing to do with the company’s fundamentals. In fact, it had just recently announced a lot of very good news, including a 15% surge in its cash flow, successful land monetization deals, and a new bond issuance.

Instead, the sell-off reflected growing market fears that President Milei would lose political momentum, stall his reform agenda, and push the country into policy gridlock.

Those concerns drove a broad decline across Argentine equities.

The market was pricing in a loss, but instead, Milei won decisively. His party, La Libertad Avanza, almost tripled its seats, now controlling 101 in the Chamber of Deputies and about 20 in the Senate, compared to 37 and 6 before the mid-term elections.

This gives Milei far greater leverage to advance his ambitious fiscal and deregulatory reforms. It also marks the first time in decades that Argentina’s Congress has shifted decisively away from the Peronist establishment that long dominated national politics.

Now, we do not think that Milei is perfect or that he can work miracles. But we think it is very positive that the country overturned decades of left-leaning Peronist governance, which is ultimately what put Argentina in this economic mess.

Adding to the momentum, the U.S. administration has pledged a $20 billion financial package, with the possibility of expanding it to $40 billion through sovereign and private channels. This represents a major vote of confidence in Milei’s pro-market leadership and Argentina’s growing strategic alignment with Washington, which should help the country attract more foreign investments going forward.

This means that the pre-election fears have been proven wrong, and things are now even better than they were prior to the sell-off. Therefore, there is no reason to discount IRSA for fears of a poor election outcome anymore and it should rapidly return to its previous peak of $18 or even above it.

But because Argentina’s equity market is relatively inefficient, with limited liquidity and slower price discovery, it “only” surged 25% to $14.31 today, which is still far off from it traded prior to the election-driven sell-off. We are using this chance to buy a bit more of it, anticipating it to keep gradually recovering as the broader market catches up.

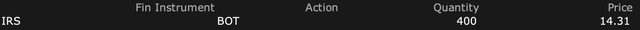

We just bought another 400 shares of the company, increasing our position size by 50%: