TRADE ALERT - Retirement Portfolio April 2024

I think that now is a good time to buy more preferred shares of REITs.

There are two simple reasons for this.

For one, a lot of them remain heavily discounted relative to their par value and offer up to 10% dividend yields and upside potential as interest rates are cut in the coming quarters.

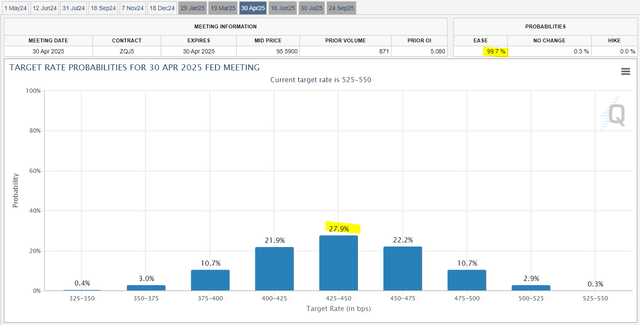

For two, as we pointed out in our most recent market update, we have now had 9 consecutive months of inflation below 2% ex-shelter, and this greatly increases the likelihood of interest rate cuts in the near term. According to the FedWatch Tool, there is a 99.7% chance of the Fed easing in the next year and the highest probability is 100 basis point lower interest rates:

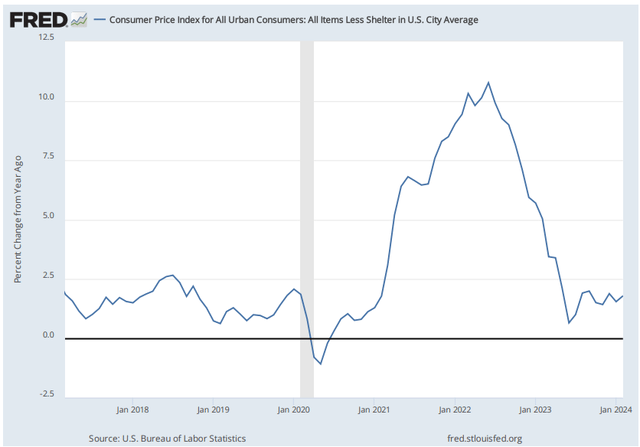

We of course cannot predict when and by how much interest rates will be cut, but it appears very likely that rates will go lower in the near term, and possibly by quite a lot. The sharp drop in the CPI suggests that we could be returning to the ultra-low inflation of the years preceding the pandemic, and if that is the case, then today's interest rates could rapidly become very restrictive, which is what the Fed is trying to avoid. We have all been focused on inflation in recent years, but the risk of deflation could soon resurface and the Fed needs to manage this as well:

Trading at low valuations, offering high yields, and with likely rate cuts in the near term, we think that discounted REIT preferred shares now offer particularly strong risk-to-reward outcomes.

For this reason, we just bought another