TRADE ALERT - Retirement Portfolio April 2025

TRADE ALERT - Retirement Portfolio April 2025

Today, we continue with our portfolio recycling program.

After its strong outperformance, we are selling half of our position in Agree Realty Corporation (ADC) to reinvest in better opportunities.

We have nothing bad to say about ADC. On the contrary, it is a fantastic REIT.

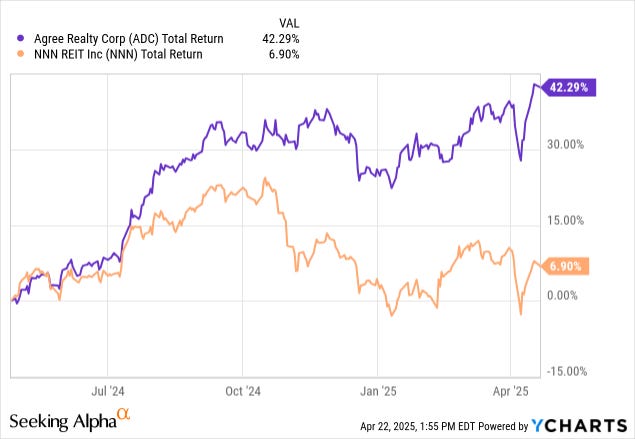

But it is hitting new all-time highs even as most other REITs, including some of its close peers, remain heavily discounted. As an example, ADC has surged by 40% over the past year, even as its close peer NNN REIT (NNN) remained flat:

ADC deserves to trade at a premium, and some of its outperformance is certainly warranted. However, the degree of outperformance has been excessive, and it now makes it less attractive, relative to other companies.

It trades at 18.7x FFO, which is right around its fair value, and it has limited upside left. Its dividend yield has also compressed to just 3.8%, which is not particularly attractive for our Retirement Portfolio, which aims to maximize safe income.

For this reason, we sold half of our position to unlock capital for other opportunities.

What are we buying with this capital?