TRADE ALERT - Retirement Portfolio December 2023

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

TRADE ALERT - Retirement Portfolio December 2023

Summary:

We have identified a new capital recycling opportunity.

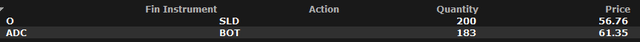

We are selling our position in Realty Income (O).

We are reinvesting the proceeds into its close peer, Agree Realty (ADC).

--------------------------------------------------------------------

Times of intense market volatility often lead to some interesting capital recycling opportunities that may allow you to upgrade the quality of your portfolio without sacrificing its future upside potential.

We think that we are today presented with such an opportunity in the net lease sector.

A few months ago, when Realty Income (O) announced that it would acquire Spirit Realty Capital (SRC) in an all-stock transaction, its share price dropped significantly in the following days.

We recognized that the market had overreacted and this led us to increase the size of our position by 50%.

But since then, its share price has strongly recovered and outperformed its close peer Agree Realty (ADC):

As a result, Realty Income's valuation is now comparable to that of Agree Realty (ADC) if you adjust for its higher leverage:

But Agree Realty is a far better net lease REIT. It owns safer assets, has a stronger balance sheet, and enjoys better growth prospects.

Here is a recap of all the differences:

And top it all off, there has recently been some negative news about Realty Income.

Firstly, its biggest tenant, Walgreens (WBA), got downgraded to "junk" status.

Realty Income is well-diversified so this is not a huge blow to the company. Walgreens only represents ~4% of its revenue. But it is still bad news as it lowers the value of Realty Income's properties (cap rates expand) and increases the risk of issues down the line. It also sends a clear signal about the headwinds facing pharmacies and it is a bit concerning that Realty Income's management didn't do anything about it. Today, pharmacies are their fourth biggest asset type, representing 6% of the portfolio.

Agree Realty, on the other hand, recognized this risk years ago and has been steadily selling Walgreens and other pharmacies to reduce their exposure. Today, their exposure to Walgreens is minimal and they have instead focused on increasing their exposure to safer net lease properties such as grocery stores.

I believe that this disparity between Realty Income and Agree Realty is largely the result of Realty Income's many portfolio acquisitions in recent years. It allowed them to keep growing at a good pace even as they got larger, but it also diluted the quality of their portfolio. They first acquired Vereit. They then bought a big portfolio from CIM Real Estate. And just recently, they acquired Spirit Realty Capital.

All these REITs have historically owned riskier properties, including a lot of pharmacies. These transactions were accretive to Realty Income's FFO, but they also increased its risks going forward.

Agree Realty is a much smaller REIT and this has allowed it to be much more selective, focusing on single-asset acquisitions rather than portfolio acquisitions. Here is a recent comment from Agree Realty's CEO about Realty Income's decision to buy Spirit Realty Capital:

And then the second bad news about Realty Income is that it just announced that it would form a JV with Digital Realty (DLR) to build two data centers.

It reaffirms my belief that Realty Income has become too big for its own good. There are not enough traditional net lease opportunities for it to keep the ball rolling so it must expand into new property sectors.

The REIT market has historically punished such behavior with a lower valuation multiple because investors typically prefer REITs to focus on one niche and become experts in it. You cannot compete with specialists if you are a "jack of all trades", and there is no added value in diversification within a REIT since investors can achieve that by owning a portfolio of REITs.

So Realty Income's continued expansion into new property sectors is essentially an admittance from the management that it is getting harder for them to grow because of their huge size.

Over time, the expansion into other property sectors coupled with a decelerating growth rate and more frequent tenant issues could lead to further compression in its FFO multiple relative to its peer group, and for this reason, I expect Realty Income to keep underperforming peers like Agree Realty going forward.

This would be different if Realty Income was priced at a discount that would compensate for these weaknesses, but there is no appropriate discount today.

ADC is essentially an improved version of Realty Income and it is priced at a similar valuation.

It has done far better over the long run and I see no reason why this outperformance would end anytime soon.

For this reason, we are today selling our position in Realty Income and consolidating this capital into Agree Realty (ADC), doubling the size of our position:

We see Agree Realty as an ideal anchor position in our Retirement Portfolio because it is likely to deliver above-average returns with below-average risk over the long run.

I would not expect any substantial upside from it, but its business is highly resilient and it should deliver ~12% annual total returns with limited downside risk and significant dividend income over the long run.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.