TRADE ALERT - Retirement Portfolio September 2025 (New Investment)

Ever since we sold our position in AvalonBay (AVB) for a large gain in late 2024, we have been looking for another apartment REIT to add to our Retirement Portfolio.

Currently, we only own Camden Property Trust (CPT) in it, and ideally, we would prefer to own another REIT to increase our exposure to this sector.

The opportunity has now finally come.

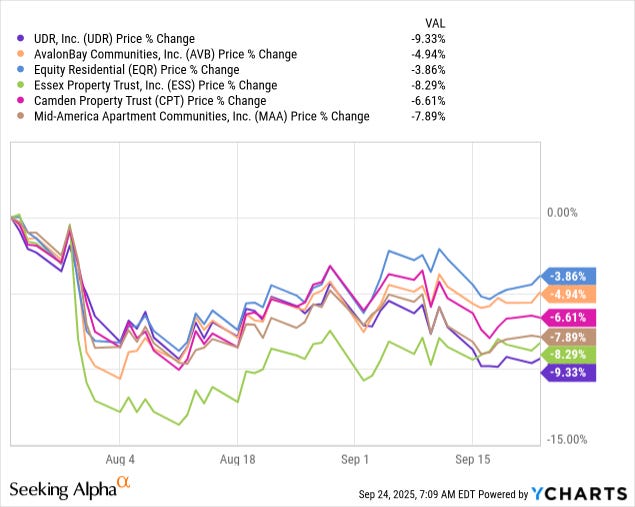

Following Q2 results, all apartment REITs sold off after they suggested that the acceleration in rent growth wouldn’t happen before 2026. Many investors were hoping for an acceleration already in the second half of the year, and this short delay was enough to cause their share prices to crash 5-10% across the board:

You will note here that UDR (UDR) sold off the most, which we find curious, as this REIT actually beat its Q2 expectations and even hiked its full-year guidance for both same-property NOI growth and its FFO per share.

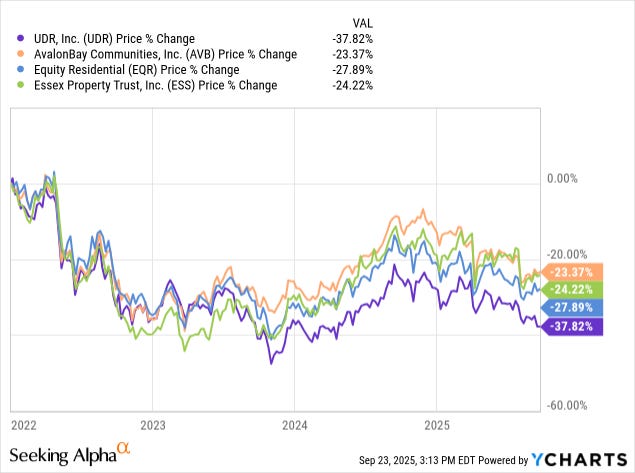

Following this latest sell-off, UDR is now the cheapest of the apartment REITs that focus primarily on coastal markets. It is down quite a bit more than its peers in this bear market:

We are today taking advantage of this latest sell-off to initiate a position in the company. We just bought 300 shares, which now represent 2.6% of our Retirement Portfolio: