TRADE ALERT - Retirement Portfolio February 2026 (New Investment)

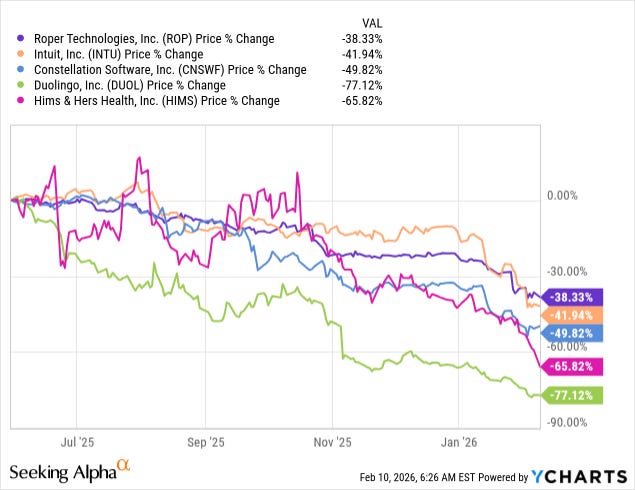

Yesterday, we reaffirmed our view that AI is likely to hurt most businesses and their stocks over the long run. You can read that article by clicking here.

SaaS businesses were the first domino to fall, but we expect a lot more value destruction over the coming years across most other sectors of the market:

But guess what won’t ever be disrupted?

Having a roof over your head.

This has made me realize that I want to have even greater exposure to residential real estate, especially in the context of our more conservative Retirement Portfolio.

It is arguably the safest long-term investment you can make because it fills our most basic need, and it is truly disruption-proof. How many investments can really say that?

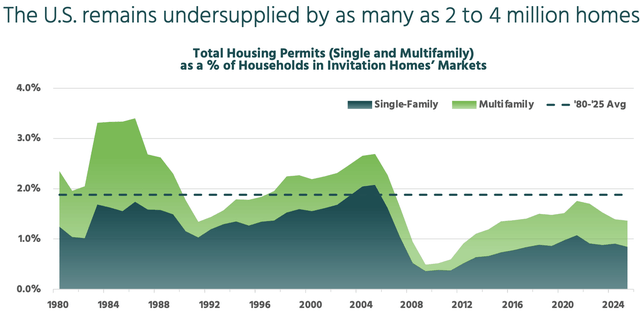

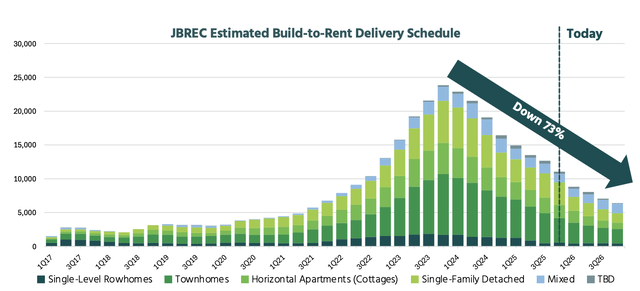

Moreover, the supply risk is now largely behind us. New deliveries are set to drop significantly in 2026 and even more so in 2027, likely leading to an acceleration in rent growth.

Despite that, valuations remain low for a lot of these REITs, and this is especially true for single-family rental REITs right now, as they recently sold off due to a social media post of President Trump calling for a ban on institutional investors buying single-family homes:

“For a very long time, buying and owning a home was considered the pinnacle of the American Dream. It was the reward for working hard, and doing the right thing, but now, because of the Record High Inflation caused by Joe Biden and the Democrats in Congress, that American Dream is increasingly out of reach for far too many people, especially younger Americans.

It is for that reason, and much more, that I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations.”

This caused the market to panic and sell single-family rental REITs (AMH; INVH). Here is how they have performed lately relative to our apartment REIT, Camden Property Trust (CPT), as an example:

Historically, single-family rental REITs have commonly traded at a premium relative to apartment REITs and offered lower dividend yields because they have enjoyed stronger rent growth and better capital recycling opportunities, selling individual homes to end users at very low cap rates to reinvest the proceeds at large spreads.

But this is no longer the case as the valuation spread has now disappeared.

I think that this is a buying opportunity.

Many investors were quick to overreact, thinking this potential ban would end these REITs’ businesses and force them to liquidate.

But that is not what President Trump is actually calling for.

If you read his statement closely, he is not talking about an ownership ban. He is simply calling for a ban on “buying more single-family homes”.

This wouldn’t have much of an impact on these REITs, as they haven’t been doing that on a large scale, and don’t even have the cost of capital for it anyway.

Their growth has largely come from developing new built-to-rent communities, reinvesting in value-add initiatives, providing financing to home builders, and growing third-party management platforms, earning fee income.

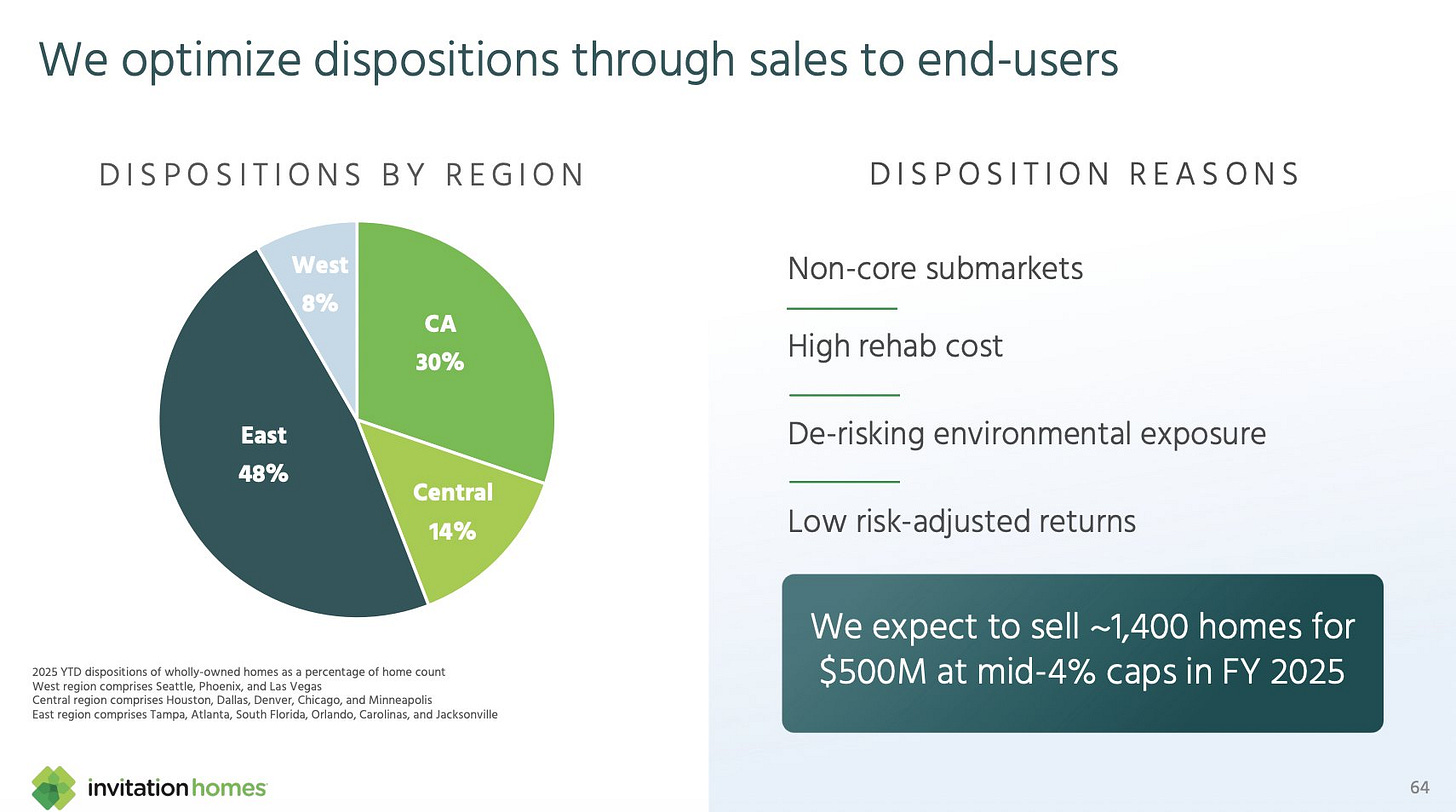

Not from buying individual homes in the open market. On the contrary, they have been selling quite a lot of homes in the open market to raise capital at a low cost to then reinvest the proceeds into higher-yielding opportunities:

So I am not too concerned by this.

It is much more preferable for a single-family rental REIT to develop a new built-to-rent community that’s optimized for renting with durable materials and lots of homes within a close proximity from one another for efficient management at a 6%+ cap rate, than acquiring older individual homes that are not optimized for renting and harder to manage at a likely lower cap rate than that.

Besides, I think that the primary reason for buying these REITs is not their external growth prospects, as they are trading at a steep discount to their net asset value.

The main reason is rather their long-term internal growth prospects, coupled with the upside potential of them repricing at closer to the fair market value of their properties.

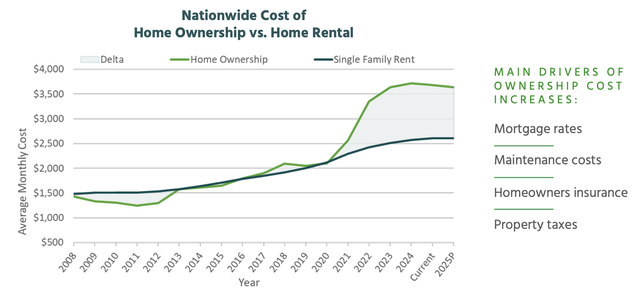

The single-family home market has been undersupplied for years, and renting is today exceptionally cheap relative to owning, which bodes well for the next decade:

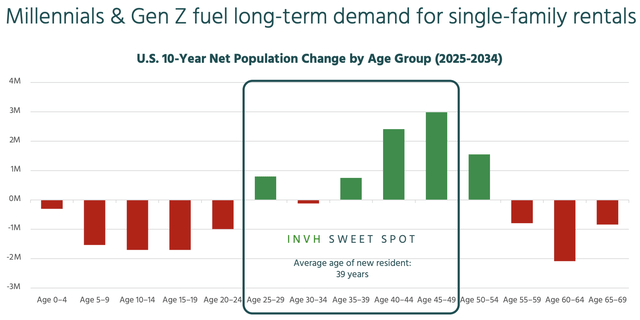

They should also enjoy a strong demographic tailwind over the coming decade, which is anticipated to lead to rising demand for single-family homes, even as new deliveries will be limited due to the high construction cost and interest rates:

But which single-family rental REIT is the most attractive today: Invitation Homes (INVH) or American Homes 4 Rent (AMH)?