TRADE ALERT - Retirement Portfolio December 2025 (New Investment)

Quick note:

I will be on a convoy to Ukraine the rest of this week, so I may be a bit slower than usual to answer comments and messages.

I will be back in the office on Monday to answer everyone. Thank you for your patience!

You can learn more about our efforts by clicking here.

---------------------------------------------------------------------------

TRADE ALERT - Retirement Portfolio December 2025 (New Investment)

Transaction: We bought 300 shares of VICI Properties (VICI) for our Retirement Portfolio

---------------------------------------------------------------------------

Earlier this year, we sold our position in VICI Properties (VICI) in order to fund our new investment in HA Sustainable Infrastructure Partners (HASI).

It was hard to let go of VICI back then because it is one of my favorite REITs of all time. Its CEO, Edward Pitoniak, even wrote the foreword of my new book, The REIT Advantage, which will come out soon.

But when VICI surged past $32 per share, even as HASI dropped to $26, we saw an opportunity to recycle capital from a lower-yielding, slower-growing company into a higher-yielding, faster-growing one.

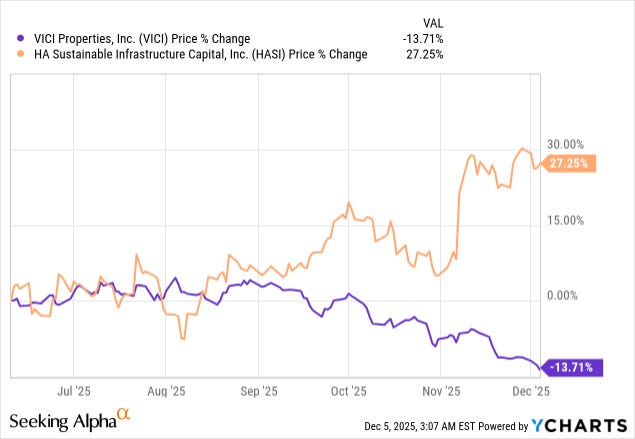

Since then, things have changed. VICI’s share price has dropped quite a bit, even as that of HASI has surged to new highs:

As a result, VICI is now once again offering a higher yield than HASI, and while it is growing more slowly, it is also more defensive in many respects.

I still would not sell HASI to reinvest in VICI as part of our Core Portfolio, which aims to maximize total returns. HASI is growing a lot faster, and I expect this to result in further outperformance over time. You can learn more about its growth outlook by reading our recent exclusive interview with their CFO by clicking here.

However, I think that VICI has now dropped enough to warrant a new position as part of our Retirement Portfolio, which aims to maximize safe income.

I think that VICI has become a much safer REIT than it was when we first invested in it back in 2019 as a result of its now much larger scale, better diversification, proven track record, and recently obtained investment-grade rating.

Despite that, it is now offered at near its highest dividend yield ever, excluding the flash crash of the pandemic:

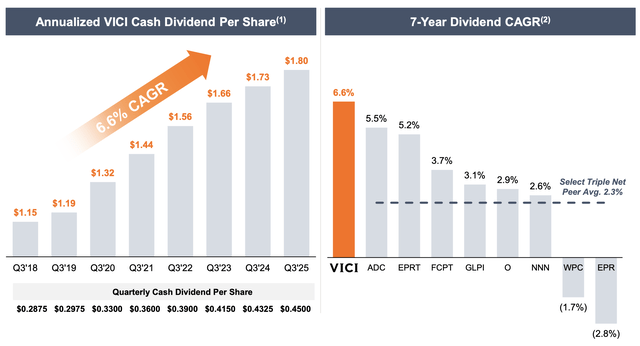

Its yield has risen so much, not just because its share price has dipped, even as the REIT kept growing its dividend at a rapid pace.

In fact, since its inception, it has grown it at the fastest rate in its peer group, beating even Agree Realty (ADC), Essential Properties Realty Trust (EPRT), and others:

And despite having historically managed to grow so much faster, it is today offering one of the highest yields in its peer group:

Interestingly, its dividend yield is now nearly on par with EPR Properties (EPR), which I consider to be a much riskier choice, given its primary focus on net lease movie theaters. Historically, the spread has been a lot greater than this:

So why is VICI suddenly so much cheaper?

There seem to be two reasons.