Uniti Group’s Hidden Upside Potential

Quick Note

Uniti Group (UNIT) has surged by over 50% in the last 4 months alone, and this has led many of you to ask us for an update.

Below, you will find our updated investment thesis going into 2026. In short, we remain bullish and expect more upside as the company disposes of non-core businesses and refocuses on its Fiber infrastructure division that benefits from the AI revolution. Legendary activist investment firm Elliott is the biggest shareholder, owning 25% of the equity, and will make sure that the management executes on this plan to unlock shareholder value.

Uniti Group’s Hidden Upside Potential

Uniti Group (UNIT) completed its merger with Windstream, which was previously its largest customer, in August 2025.

That merger transformed UNIT from a passive owner of fiber optic assets, which made it suitable for REIT status, to an owner/operator of fiber. This closed one door by spurring UNIT to deconvert from REIT status, but it also opened new doors by simplifying the business and making parts of it more attractive as a disposition target.

Today, the company owns and operates a ~$9 billion portfolio of about 217,000 route miles of fiber.

After the merger, however, management appears to be moving toward the sale of UNIT’s largest and most capital-intensive segment, which would allow the company to significantly deleverage and focus on its higher margin enterprise/wholesale/hyperscaler business.

Management is clearly more excited about this business, as it enjoys material exposure to the massive growth in AI infrastructure spending.

Let’s take a look at the post-merger UNIT’s three business segments, explore the potential sale of its fiber-to-the-home segment, examine how that would impact the balance sheet, and then discuss the exciting AI-related growth segment.

Three Business Segments

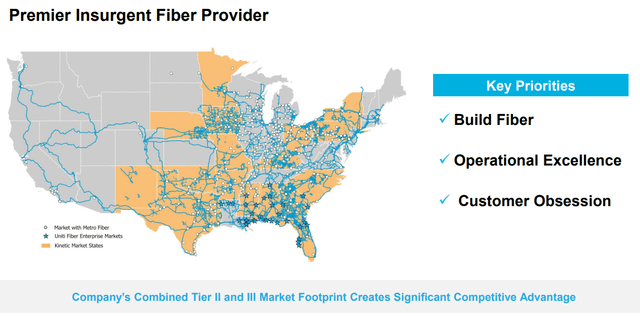

UNIT operates three business segments that can broadly be categorized as “residential,” “enterprise,” and “other services.”

Kinetic: A direct-to-consumer business made from the combination of Uniti and Windstream’s residential and small business fiber assets (built over existing copper lines), operating in suburban, exurban, and rural areas. This consumer-facing business provides Internet and home phone services.

Fiber Infrastructure: An enterprise/wholesale business leasing its fiber optic network to wireless carriers, government agencies, and hyperscalers (e.g. Alphabet and Amazon). Customers use UNIT’s fiber to support 5G networks and AI inference. This is a high-margin segment that generates stable, recurring cash flows.

Uniti Solutions: Various adjacent value-add services such as cloud management, traffic optimization, and digital security for customers who want a “one-stop-shop” solution. Often these customers are mid-sized enterprises that lack their own in-house IT/cybersecurity teams.

Management views Fiber Infrastructure as UNIT’s core, go-forward business line. Both Kinetic and Uniti Solutions are non-core segments that could be sold at some point in the future.

The difference between the two is that Kinetic’s capital-intensive characteristics make it a cash-burning segment, while the capital-light Solutions business generates meaningful free cash flow.

Potential Segment Dispositions

In the Kinetic segment, UNIT aims to surpass 3.5 million homes by the end of 2029, which compares to about 1.9 million homes currently. That will require UNIT to ramp up its fiber buildout from about 200,000 homes per year to about 400,000.

To accomplish this, UNIT is venturing out beyond its internal construction teams to use third-party contractors, a move that will inevitably increase buildout costs.

Between the need to use external contractors and inflationary cost increases, UNIT expects its fiber-to-the-home buildout costs to rise from its historical average of $600-650 to a range of $850-950 in 2026.

Kinetic also enjoys a competitive advantage in its geographic focus on Tier 2 and Tier 3 (suburban and rural) markets, where there is significantly less competition from other fiber providers.

According to CFO Paul Bullington in a recent conference interview, UNIT is intentionally “modular” or siloed in order to give themselves ample “strategic flexibility” for potential dispositions.

The Kinetic business seems the most likely segment to be sold, likely to a major wireless carrier or cable provider.

It’s difficult to say how much UNIT could fetch for Kinetic, but we would surmise somewhere around 15x EBITDA, or roughly $6 billion.

Compare that to UNIT’s current enterprise value of $11.4 billion, which gives it an EV-to-EBITDA multiple of 7.6x.

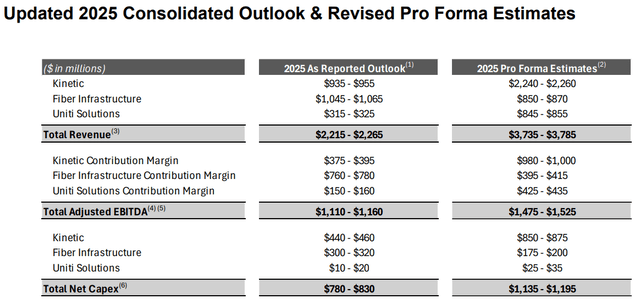

The Kinetic segment currently generates the most revenue and adjusted EBITDA but also comes with the most capex.

UNIT Q3 2025 Presentation

Using the pro forma estimates that reflect the merger with Windstream, UNIT’s Kinetic segment sports an adjusted EBITDA margin of 44%, while Fiber Infrastructure’s margin is 47%, and Uniti Solutions’ margin is about 50%.

Without the Kinetic segment, the rest of the business boasts an EBITDA margin in the high-40% territory and has considerably less capex requirements.

UNIT ex-Kinetic has about $510 million of pro forma EBITDA and $210 million of pro forma capex, giving it cash flow excluding interest of about $300.

Depending on the sale price of Kinetic, UNIT could significantly deleverage from such a sale, potentially bringing annual interest expense down to $150-200 million.

What if UNIT also sold its Solutions business, as management has discussed recently?

Bullington mentioned in the linked interview above that they would look to monetize its Solutions segment at an EBITDA multiple in the 3-5x range, which would be in the neighborhood of a $1.3-2.1 billion sale price.

Balance Sheet

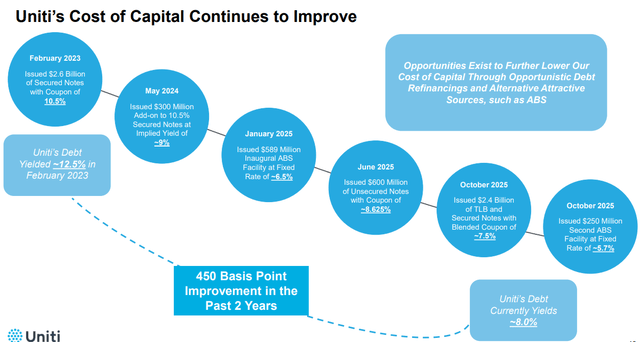

UNIT’s balance sheet has historically been weak and heavily leveraged, largely as a result of being a regional operator in a capital-intensive industry. Post-merger, UNIT’s credit rating has improved somewhat from CCC to B-.

Fortunately, management was able to refinance a significant amount of debt in 2025 to push out maturities and reduce UNIT’s cost of debt.

UNIT December 2025 Presentation

Notably, in October 2025, UNIT refinanced 10.5% senior secured notes due in 2028 with new loans at a rate of 7.5%, three full points of rate reduction.

Also, in January 2026, UNIT secured $960 million in asset-backed securities secured by its Kinetic fiber assets. This ABS loan matures in February 2031.

Most of UNIT’s debt now matures after 2030, with only ~$800 million (8.6% of total debt) maturing in 2027-2028.

In 2026, there are no major debt maturities to deal with, which gives management the ability to focus solely on strong operational execution and positioning the Kinetic unit for sale.

As of Q3 2025, UNIT has total debt of about $9.3 billion and cash of about $600 million, bringing net debt to $8.7 billion.

Current net debt to EBITDA sits at about 6.3x, but if we use pro forma adjusted EBITDA, then it falls to 5.8x. Management’s goal is to bring net debt to EBITDA down to 5.5x or below within the next few years.

Obviously, a sale of the Kinetic business at a favorable price point would go a long way in achieving these deleveraging plans, while simultaneously transforming UNIT into a far less capital-intensive business.

The AI-Related Growth Kicker

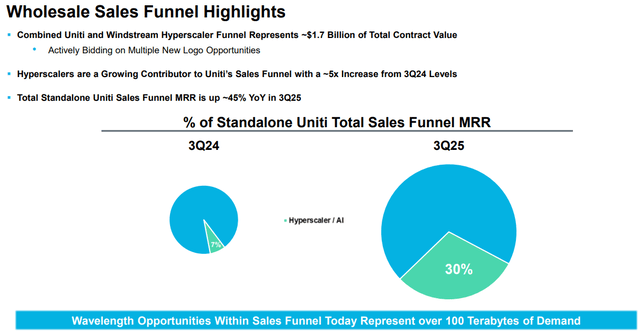

Management is clearly most excited about the AI-related opportunities within the Fiber Infrastructure segment, which have grown at a rapid pace over the last few years.

The company estimates that the fiber total addressable market for generative AI customers will increase 5x between 2025 and 2030.

Likewise, hyperscalers’ share of the total sales funnel within the Fiber Infrastructure segment has exploded from 7% in Q3 2024 to 30% in Q3 2025.

UNIT December Presentation

The growth potential in this space is enormous, and the economics of fiber deals with hyperscalers are very attractive.

To quote CFO Paul Bullington again:

I’ve been in the business for a while and seen a lot of the ups and downs, but I don’t think I’ve seen anything quite like this since maybe the iPhone kind of came in and really drove so much usage in demand for fiber, particularly Fiber to the Tower several years ago.

But that AI demand is showing up in a big way for us. And so we talked on our last earnings call about the size of the funnel for the kind of the hyperscaler demand set. We pegged it at, I think, $1.7 billion in total contract value. We expect that to continue to grow...

That funnel is largely made up of dark fiber deals that we would expect to be structured in an IRU format.

IRU stands for “indefeasible rights of use” and refers to contracts in which a customer pays a large upfront sum to lock in a long period of time (typically a decade+) of flexible fiber usage.

Here’s Pullington: “[I]t’s basically a prepaid lease and that cash comes in upfront and can offset a lot of the CapEx that you would potentially need to put in place in order to deliver the fiber.”

The time value of money dictates that income now is more valuable than the same income in the future. Certainly, for a capital-intensive business that is regularly raising capital to invest in capex, these lump sums of income are highly valuable.

The Opportunity

UNIT currently trades at an EV-to-EBITDA ratio of 7.6x using pro forma EBITDA estimates.

The enterprise value sits at $11.36 billion.

If we do a quick sum-of-the-parts valuation of the whole business, we find that UNIT is likely worth significantly more than this.

As we observed above, the Kinetic segment on its own could be worth about $6 billion. The Solutions segment is worth around $1.5-2 billion, bringing those two segments together to nearly $8 billion, and this is waiting to be monetized via future dispositions.

That would only leave $3-4 billion of value for the Fiber Infrastructure segment at the current share price, but if we assume a market value EBITDA multiple of 15-20x, it would be worth $6-8 billion.

That is why Elliott, the legendary activist investor, is so interested in UNIT. They are the largest shareholder, owning 25% of its equity, and they are likely to unlock this value by disposing of those non-core divisions and refocusing on the company on the fiber infrastructure, benefiting from the AI tailwind.

The upside could be significant.

The newfound growth opportunities from the AI infrastructure buildout make the Fiber Infrastructure segment a valuable growth business to hold onto indefinitely, and the market could then reprice it at a materially higher valuation.

Our confidence in UNIT has undoubtedly risen over the last six months, but for now, it remains a higher-risk investment whose upside is heavily dependent on successful dispositions that are by no means guaranteed.

We maintain our Strong Buy and our High Risk ratings.

Finally, please note that we have exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

We expect to share a Trade Alert with our paid members tomorrow, and by starting your free trial today, you will also gain access to it. You will also get immediate access to my entire REIT portfolio, our exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst’s Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. We also own a position in FarmTogether. High Yield Landlord® (’HYL’) is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other, and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.