Very Bad News For RCI Hospitality

The title is scary because the news is scary. RCI Hospitality (RICK) was just indicted in New York on state charges, in a case announced by Attorney General Letitia James, alleging the non-payment of certain sales taxes and the bribery of a state tax auditor.

Here is a short recap of the case:

What RCI did:

When customers bought a Dance Dollars (club-issued vouchers used to pay dancers for private dances), say $100 worth plus a $20–25 service fee, the club only booked and paid tax on the service fee portion.

The $100 face value that dancers later redeemed was treated as a pass-through to contractors, not as taxable revenue, similar to how a gift card functions as a medium of exchange rather than taxable income at the point of sale.

What New York argues:

Both the voucher face value and the service fee are taxable as part of the “admission to a place of amusement.”

By not collecting tax on the full amount, RCI failed to remit millions in required sales tax.

Bribery allegation:

Prosecutors say that RICK executives “smoothed things over” by giving one state auditor free meals, hotels, and entertainment at their clubs.

That allegedly helped reduce tax liabilities in audits.

This is very bad news, and there is no need to sugar-coat it. The bribery allegation is especially concerning, as that's a very serious crime.

But just how bad is it?

Here you can take two very different views. I will give you both, then share mine, and you can then decide what you make of it.

The optimistic view

Firstly, it is important to note that the dispute relates only to its club-issued voucher system for dances, not its much larger revenue streams like drinks, food, cover charges, or VIP packages.

Remember here also that the vast majority of dances are paid directly to the performers themselves in cash, who are private contractors, and only a small minority of them are paid with this voucher system to RICK. (RICK generally does not make much money on the dances. It simply charges a "house fee" to the performers who then keep the dance revenue for themselves.)

That explains why we are only talking about $8 million in missed tax payments over a 14-year window at three major NYC clubs. That's just about $0.5 million per year.

RICK earns about $1 million of free cash flow per week, so the alleged tax liability is not very significant. RICK argues that the allegations are baseless, and to be fair, it does seem ridiculously stupid to try to evade such little taxes, especially with this whole cover-up thing, when getting caught could destroy $100s of millions of value and potentially even land you in jail. We will get back to that later.

Secondly, you should note that we are talking only about New York state at this stage. RICK is large and diversified. It owns 56 clubs, and this case is only about 3 of them.

The first natural reaction when you hear such news is that if they are doing this in New York, they must be doing it elsewhere as well.

But not so fast.

Most state auditors aren't corrupt. It would take special talent to turn many different state auditors, especially with just free meals and some dances. A more likely explanation is that they had a special relationship with this specific auditor in New York, who became a friend of theirs, and they managed to get preferential treatment by showing him a good time.

Moreover, different states have different tax rules for this type of business. For example, Texas, which is RICK's biggest market by far, does not impose sales taxes on admissions to clubs. Instead, it has a separate tax that it collects on each customer at the door, so this couldn't be an issue there. Because each state’s tax law is different, a treatment that looks like fraud in New York may not even be an issue elsewhere.

Finally, RICK issued a rather strong statement about this. Here is what they said:

"RCI, the individuals involved, and the three clubs deny the allegations and will take all necessary action to defend themselves against these overreaching charges, while continuing to seek a just resolution.

We are clearly disappointed with the New York Attorney General’s decision to move forward with an indictment and look forward to addressing the allegations. We remind everybody that these indictments contain only allegations, which we believe are baseless.

As a publicly traded and audited company, RCI has a policy of paying all legitimate and non-contested taxes. All three New York City clubs remain open for business."

RICK will likely argue that this was a technical tax dispute rather than fraud. Their defense will be that Dance Dollars functioned like gift cards, a medium of exchange that should not trigger sales tax on the face value, only on the club’s service fee, which they did remit. Since dancers are independent contractors, RICK may claim the dancers themselves were responsible for reporting income and taxes on their share. On the bribery side, they will likely downplay the allegations, arguing that what prosecutors call “bribes” were routine business courtesies like meals and entertainment, not cash kickbacks, and that any audit settlements reflected legitimate negotiation over ambiguous tax rules.

I am not a lawyer, but AI can pass the bar exam these days and provide an informed perspective. I uploaded the full indictment to ChatGPT and asked for the most likely outcome. Here is what it said:

Company

The company will face significant financial penalties, including repayment of the disputed sales taxes, interest, and civil fines.

Total exposure could end up at 2–3× the alleged $8m shortfall, meaning $20–30m+ once penalties and legal fees are included.

RICK will almost certainly continue operating, as the disputed amount is small relative to the company's market value and profitability.

Executives

Because bribery is alleged, there is real criminal risk for individuals, particularly senior executives directly tied to the scheme.

Prison sentences are possible, but based on precedent in similar white-collar cases, they are more likely to be short, suspended, or replaced with probation, provided restitution is paid and plea deals are reached.

The “bribes” in question—meals and entertainment—are far less severe than outright cash payoffs, which lowers sentencing risk.

Why this is not existential

The case involves only a narrow slice of sales taxes tied to the “Dance Dollar” voucher system, not RCI’s much larger revenue streams from drinks, food, cover charges, or VIP packages.

The total amount at issue ($8m over 14 years) is modest compared with RCI’s overall tax contributions.

Other states where RCI operates have different tax regimes, so the New York case is unlikely to expand nationwide.

Bottom line

This looks like a costly but manageable legal overhang, not an existential threat to the company. Investors should expect reputational damage, heavier compliance oversight, and financial settlements, but not a collapse of operations.

This is still very bad, but not as bad as it initially seems when you first read the headlines.

This also means that the management is likely to remain in place for now. They are presumed innocent until proven guilty, and they claim that this is all baseless. Remember that despite the alleged "bribery", the actual tax implications are relatively small; it appears to be mostly regarding a tax technicality, and there were also no allegations of personal enrichment.

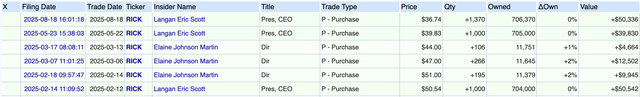

They were simply treating the taxation of their voucher system in a way that resulted in lower tax liability for RICK, the company. I would add that Eric Langan, the CEO, is one of the biggest shareholders; he did not sell any shares even as it reached nearly $100 per share, and has made regular insider purchases, with the latest one just last month, which strongly suggests that he believes in the company and was likely also surprised by the indictment.

Finally, if you are going to take the full optimist view here, this could turn into a major opportunity for them to aggressively buy back shares. The impact on the actual business could be negligible, but their stock now trades at just 5x normalized FCF.

RICK has regularly been a major buyer of their own stock, and with the stock trading this cheaply, they don't need to worry about acquiring new clubs, as they can just buy back the stock.

The pessimistic view

When there is smoke, there is fire...

The tax element is bad. But the real big deal here, in my opinion, is the bribery case. That is why this is a criminal, and not a civil case.

If proven guilty, they deserve major sanctions for that because it is a real crime. In that case, they could land in jail, potentially for a long time.

RICK could then lose its top management.

It could permanently hurt their reputation. At the very least, they are going to have a hard time closing new transactions until they resolve this case.

They will also need to keep more cash on hand to be ready for the potential fines and back taxes.

My view

I am in the middle.

I think that this is very bad news, and if proven guilty, I hope that there are real punishments, even if that comes at the cost of a lower share price. Honesty and integrity are more important than money.

But ultimately, I think that in the most likely scenario, the current assets of the company should not be permanently impaired in a material way.

They generate about $50 million of free cash flow per year, and the real estate alone (without counting the club operations business) has been estimated to be worth up to $400 million net of debt.

Yet, the market cap of the company is today just $250 million.

I give their management the benefit of the doubt and look forward to hearing their defense. It seems that they could have a legitimate case in arguing that this was a technical tax dispute rather than fraud, and that the bribery is an overreach, given that the disputed tax is fairly small in any case.

I still think that Eric Langan tried to do his best for shareholders, as RICK stock represents the majority of his net worth, even despite this spectacular blowup.

If RICK loses its top management, it will lead to great uncertainty in the near term. But it is also worth noting that RICK has not gotten much love for a while now, and a lot of the blame has been placed on the management for misallocating capital. Based on the latest market reaction, it appears that most investors now see this management team as a liability rather than an asset. If it were replaced, it could potentially lead to an even higher share price.

Club acquisitions are now removed from the equation, but that is not such a big deal, as they can focus on buybacks instead at these levels.

So again, this is very bad news and concerning.

But for these reasons, I will not panic sell. The actual assets are unchanged, and the likely impact from taxes and penalties is expected to be a minor percentage of the actual fair value.

At the same time, I will not rush to buy more before getting more information and waiting for the dust to settle a bit.

This serves as a great reminder of why it is so critical to diversify and not to get overexposed to a specific stock, even if you hold a high conviction.

Every stock has risks, and risk factors will play out at times.

I don't think that this is an existential risk for RICK, but it does justify a drop in our fair value estimate until we get more clarity. We increased our risk rating to "High" and lowered our Buy Under Price to $40.

The company's defense and buyback activity will determine whether we double down or not over the coming months. In the meantime, we will reach out to other major shareholders to try to get more information and will keep you updated if we find anything new.

Finally, please note that we have exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. We also own a position in FarmTogether. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other, and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

jussi i would severely trim Rick

this is gonna drag on

remember your lessons learned