What Active REIT Managers Bought And Sold In Q2 2025

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 7th, 2025. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

What Active REIT Managers Bought And Sold In Q2 2025

What did the REIT "smart money" do in the second quarter of this year?

In August, the 13F filings for all the major asset managers were released, including the active REIT managers that we follow. While we do not base our own investment decisions on what other REIT investors are doing, we do find it interesting to see how the "smart money" is allocating capital — what they're buying and selling — from quarter to quarter.

The biggest reason we don't base our own investment decisions on what active REIT portfolio managers are doing is a difference in holding period.

Here at High Yield Landlord, we formulate investment theses for each of our holdings, and we tend to hold those positions for a long time. We may not be Warren Buffett-style "buy-and-hold forever" investors, but our holding periods tend to be measured in years rather than quarters.

Not so in the active asset management industry, which is constantly trying to outperform benchmarks from quarter to quarter. As such, active managers are constantly trimming and buying, closing and opening positions in their portfolios in an attempt to outperform every single quarter.

Plus, depending on whether an asset manager has net inflows or net outflows of capital, they may be net buyers or net sellers of REIT shares in any given quarter.

As such, many factors besides long-term fundamentals play a role in active managers' buy and sell decisions.

Generally speaking, when an active manager is buying a REIT, it is a signal that they expect it to perform well over the next few quarters. When they're selling a REIT, it indicates the opposite — that they expect it to underperform in the next few quarters.

Another point to note is that, as we'll see below, the bigger the asset manager in terms of AUM (assets under management), the closer they hug the benchmark in their top holdings. You can see the top holdings of the market cap-weighted Vanguard Real Estate ETF (VNQ) here, and you will notice that the larger asset managers (Cohen & Steers, CenterSquare, and AEW Capital) only slightly diverge from the benchmark in their own top holdings.

Bigger asset managers tend to be conservative and aim for slight outperformance over their benchmark rather than take the risk of greatly diverging from the benchmark, either to the upside or the downside.

Career risk for asset managers makes significant divergence too risky.

Nevertheless, we still find it interesting to see what the REIT "smart money" is doing, because the real estate sector enjoys some of the biggest long-term outperformance of active managers over passive indexes.

We start with the only buy-and-hold REIT portfolio manager we know of.

Starwood Capital Management

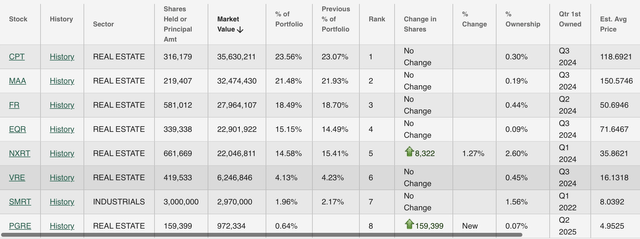

Billionaire real estate investor Barry Sternlicht's Starwood Capital primarily invests in commercial real estate on the debt side, especially via Starwood Property Trust (STWD), but the company also maintains a small and concentrated REIT portfolio.

As you can see, most holdings have been held for a year or more at this point, and there was basically no change in the portfolio from Q1 to Q2.

Starwood is bullish on multifamily REITs, especially in the Sunbelt, as well as First Industrial Realty (FR), which is a holding in High Yield Landlord's portfolio as well.

Sternlicht has argued that 2026-2027 should be very good years for multifamily and industrial real estate, as the supply headwinds of the last few years will turn into supply tailwinds (low new deliveries) over the next few years.

That aligns with our own theses for FR and Camden Property Trust (CPT).