What Austin Bought And Sold In April 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

Time for another monthly portfolio review!

It feels like a lot has happened over the last month, although my portfolio has only shifted slightly around the edges.

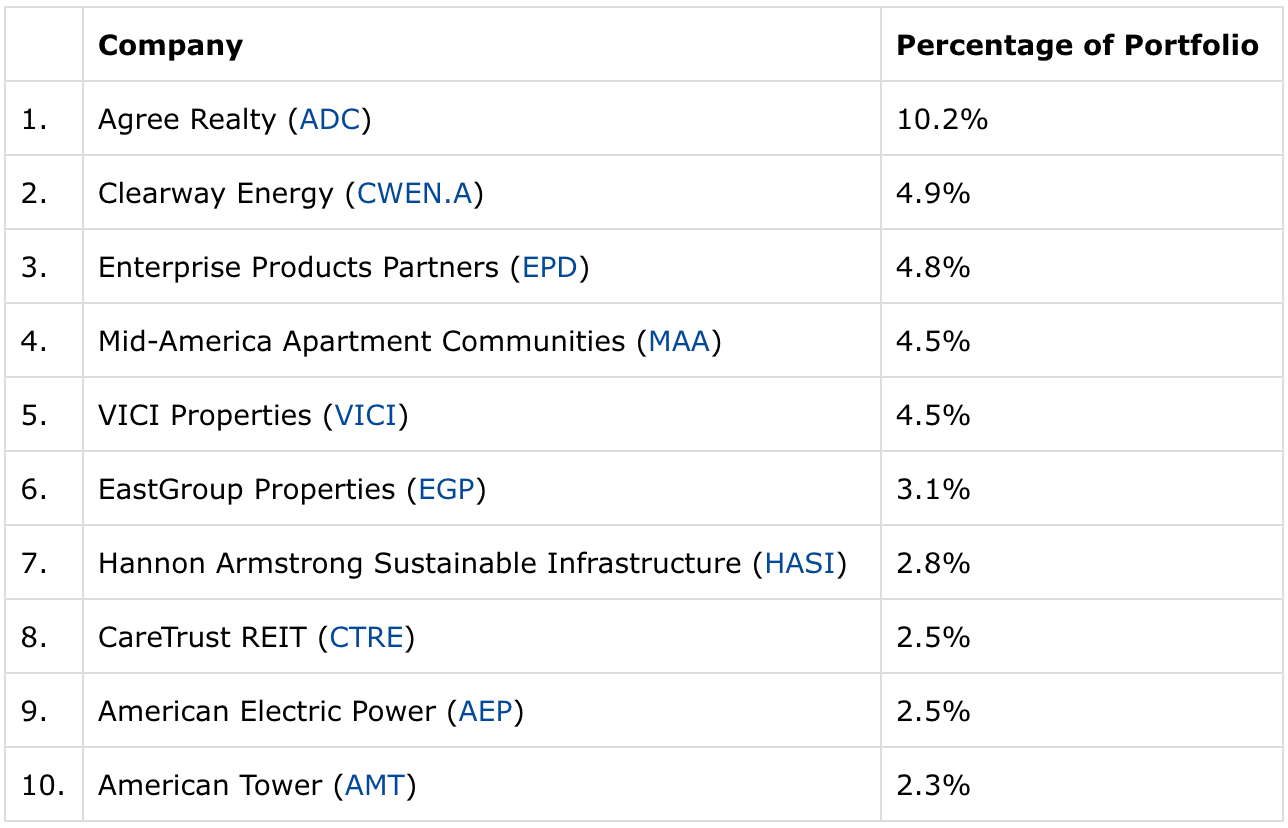

Top 10 Holdings

I came into a little bit of money early in the month of April around my birthday and quickly used that to beef up my positions in a few high-quality and conservative dividend growers like Agree Realty (ADC) and American Electric Power (AEP). Between some buying and appreciation over the course of the month, AEP has ascended into my top 10 while ADC has increased its share of my total portfolio value to slightly over 10%.

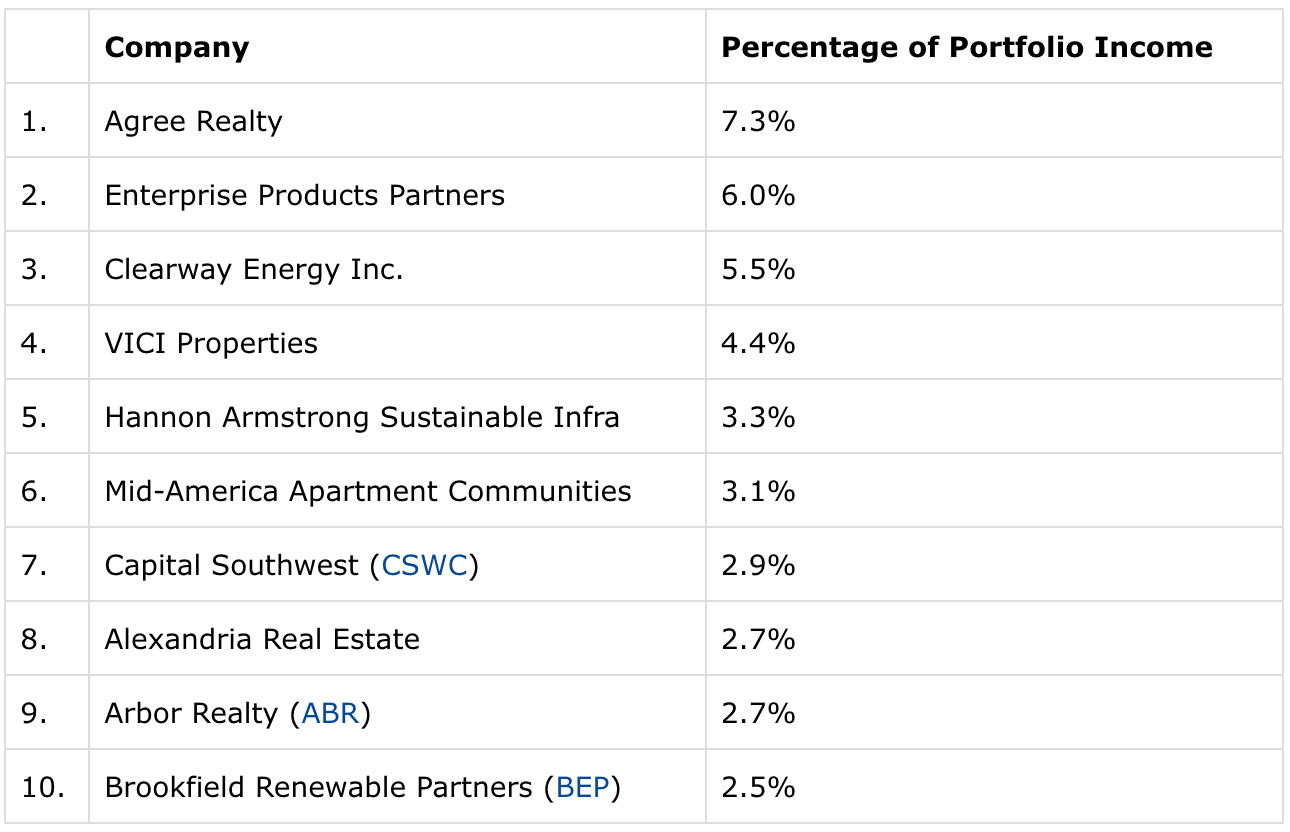

And just for fun, here are my top 10 holdings as a percentage of total annualized income:

My top 10 holdings by value account for 42.1% of my total portfolio, while my top 10 holdings by income represent 40.4% of my total portfolio income.

ADC stands out as the largest holding in both categories.

In principle, I don't have a problem with being this concentrated in my top holding, as long as I have sufficient conviction in the company.

If you're going to put a lot of eggs in one basket, you'd better choose a good basket and then watch that basket closely!

A significant part of my work history has been in real estate, and much of that was at a private net lease investment company with a very similar investment strategy as ADC. It's a highly defensive and recession-resistant investment strategy, and ADC's best-in-class cost of capital and disciplined acquisition underwriting give it a decent growth kicker.

It's basically the same growth model as Essential Properties Realty Trust (EPRT), but EPRT takes somewhat more risk on tenant credit and building types. (Although admittedly, that additional risk is mitigated by unit-level financials and master leases that ADC lacks.)

In my view, ADC makes the perfect portfolio anchor. It exhibits less fundamental downside and price volatility during recessions or market downturns, and it has the ability to consistently grow through almost any macro environment.

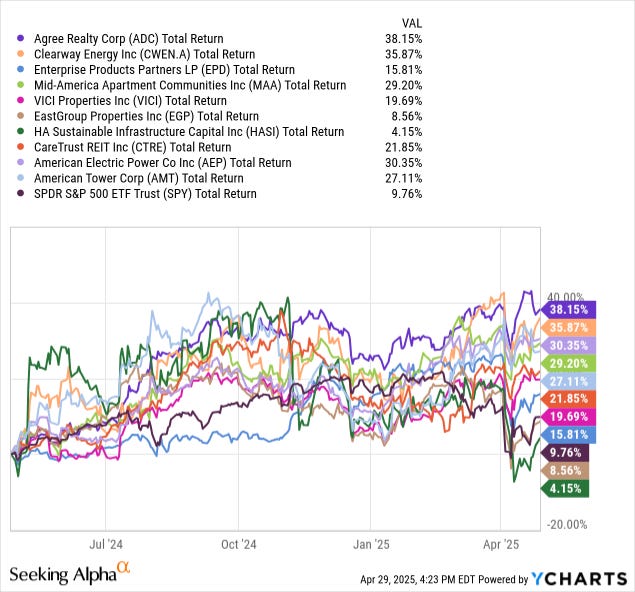

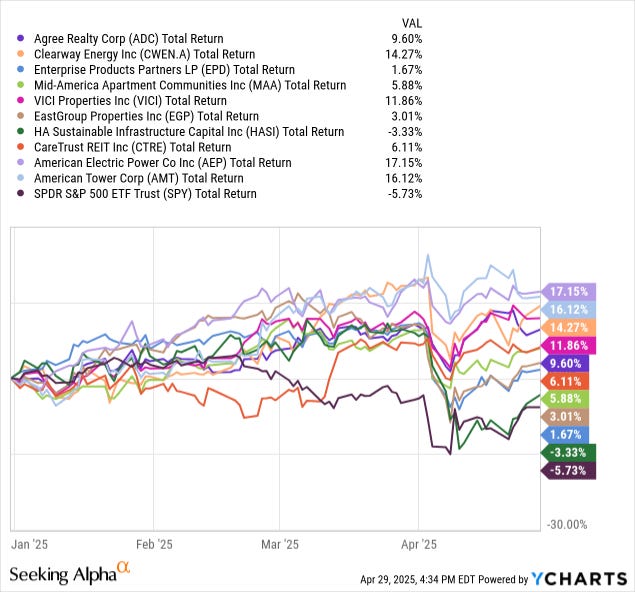

As the (admittedly busy) chart below shows, 8 of my top 10 holdings have beat the S&P 500 (SPY) over the last year, led by none other than ADC:

Only EastGroup Properties (EGP) and Hannon Armstrong Sustainable Infrastructure (HASI) have underperformed SPY over the last year, and not by that much.

Both are due to industry-wide negativity rather than stock-specific issues.

Year-to-date, I'm happy to say that all 10 of my top holdings have outperformed the market:

Regulated utility giant AEP, multi-national telecommunications REIT AMT, and and renewable energy owner/operator CWEN.A have led the pack in total returns so far this year.

What a refreshing break from the multi-year underperformance my portfolio experienced from 2022 to mid-2024.

And speaking of underperformance...

Fallen Angels

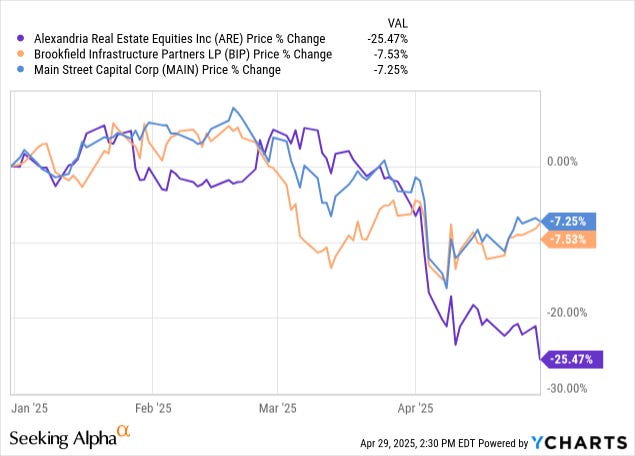

It's notable that in recent months, Alexandria Real Estate (ARE), Brookfield Infrastructure (BIP), and Main Street Capital (MAIN) have all slipped out of my top 10, not as a result of selling on my part but rather simply because their stock prices have dropped:

ARE has been particularly disappointing for me. I am down 38% from my average cost basis, and while I always acknowledge that I can't time the bottom and there's at least a 50/50 chance a stock will continue to drop after I've bought it, I have to admit I never foresaw this possibility.

It has spurred some thought about long-term vs. short-term investing.

I'm a long-term investor. That's what I aspire to be, and for the most part, that's what I think I am. I almost never think about what financial performance will be the next few quarters but rather the quality of the company's assets, balance sheet, and management team and whether that quality is enduring or temporary. But could it be that an excessive focus on the long term creates a selective blindness about the severity of short-term problems?

When it comes to ARE, I typically focus on the high-quality nature of the REIT's mega-campuses, balance sheet, and brand power. Those are undeniable. But perhaps this emphasis has blinded me somewhat to the magnitude of the short-term headwinds ARE faces from oversupply and disruptions to the biotech R&D industry.

Generally speaking, it seems to me that long-term considerations are good for determining what to buy, whereas short-term considerations are good for when to buy.

But sometimes short-term considerations can change the long-term ones. That's where fundamental analysis becomes nuanced and debatable.

For now, I continue to hold ARE. Selling now at a dirt cheap 7.8x FFO multiple would strike me as panic-driven capitulation. The dividend does not appear to be in danger at this time, so why sell at a 7.25% dividend yield?

At the same time, the short- and intermediate-term outlook continues to be cloudy, and there has been zero insider buying to illustrate management confidence.

Compare that to Healthpeak Properties (DOC) -- another healthcare REIT diversified across medical outpatient, life science, and retirement communities -- which recently saw a spate of insider buying totaling over $600,000.

The phrase "short-term pain, long-term gain" might apply to ARE here. But the question is whether the long-term gain (or growth) will outweigh the short-term pain, or if the reverse will be the case.

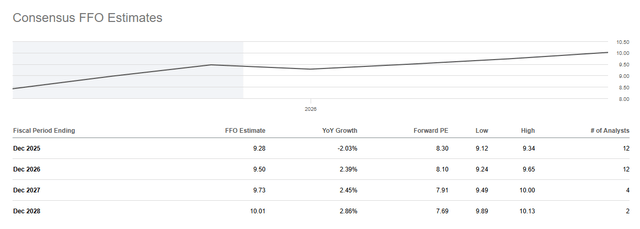

At a 7.8x FFO multiple, the market seems to be pricing ARE for negative growth, but the analyst consensus forecast calls for low-single-digit negative FFO per share this year followed by several years of low-single-digit growth.

If I can gain some confidence in this forecast, then I will become a buyer again.

If this forecast is accurate, then ARE has basically become a slow-growth giant like Verizon (VZ), which seems incapable of growth above the low-single-digits and perpetually trades at a high dividend yield -- and yet is pretty steady, reliable, and defensive.

So, if ARE has basically become like Verizon for the foreseeable future, then a 7.25% yield looks attractive.

On the other hand, the depth of ARE's selloff makes me think that there's something I'm not seeing or considering.