What Austin Bought And Sold In December 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

The days are long, but the years are short.

That’s certainly how 2025 felt to me.

Looking back, the beginning of 2025 feels like ages ago. It has been a year characterized by political headlines, tariffs, artificial intelligence, bubble debate, and a widening K-shaped economy.

Next year, I would expect the primary forces driving the economy and markets to be the AI infrastructure buildout, a continuation of jobless GDP growth, Fed rate cuts, and affordability concerns (especially as we close in on the midterm election).

Tariffs were the biggest story of the first half of the year, while AI and a potential AI bubble were the biggest stories of the second half of the year.

Tariffs were by far the biggest “white swan” event (a known risk or economic shock) of the first half of the year, and then in the waning months of the year, everybody just seemed to shrug and move on. As Trump pulled back on his so-called “Liberation Day” mega-tariffs and started making trade deals, the worst-case scenario faded into a moderately bad scenario.

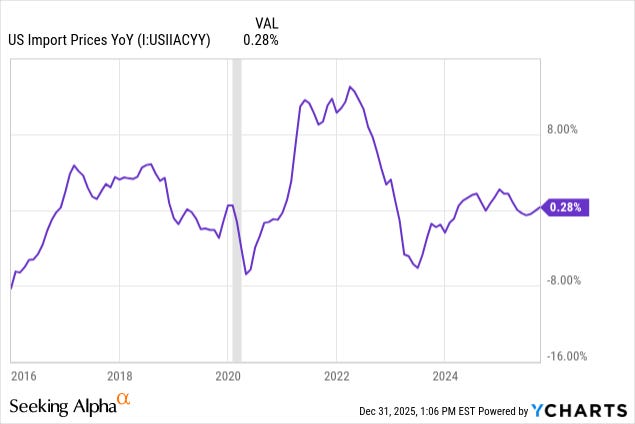

Import prices aren’t going down, which means foreigners are not, for the most part, shouldering the cost of the tariffs:

And the dream of high tariff barriers reshoring tons of manufacturing and leading to a resurgence in US manufacturing employment remains just a dream:

St. Louis Fed

After the post-COVID surge in employment of all kinds, including manufacturing, the US manufacturing sector has been steadily shedding jobs since late 2022.

That isn’t going to stop, because manufacturing just isn’t America’s competitive advantage on the world market anymore.

Our competitive advantage is primarily technology and innovation, not labor-intensive manufacturing.

As such, all tariffs will do is raise tax revenue by extracting it from American businesses and consumers, slightly dampening economic growth in the process.

In the second half of the year up to the present, the most widely discussed potential “white swan” event is an AI bubble and the associated overbuilding of AI infrastructure.

That debate remains ongoing, and I’m sure we at High Yield Landlord will have much more to say about it in 2026.

Also notable about 2025 (at least for REIT investors like us) was the depressing degree to which real estate stocks (VNQ) again underperformed the S&P 500 (SPY) and especially the red-hot AI-tech space (CHAT):

The older I get, the less inclined I am to make predictions. (If you’re right, nobody remembers or cares. If you’re wrong, and it’s in writing, some folks out there will find out and rub it in your face.)

But my sheepish and noncommittal prediction for 2026 would be that the total return performance of REITs and the S&P 500 will be a lot closer to each other than what we saw this year.

I know. Very bold bet, isn’t it?

If I had to guess, AI stocks like those in the CHAT ETF will outperform the S&P 500 again this year. That’s most likely, in my view. On the other hand, an unlikely but possible scenario is that we get hit with some “black swan” event (unforeseen shock) in 2026 that causes both the S&P 500 and REITs to fall. In that scenario, I’d envision REITs declining somewhat but outperforming the broader market, because they are a lot cheaper than the market and now have few fundamental headwinds.

That’s all just a guess.

My biggest prediction for 2026 is that all the bold predictions being made by analysts and strategists right now will be forgotten and worthless by the second quarter. By then, we’ll have something new to talk about. We always do.

Let’s get on to my top holdings at the end of 2025, and then the portfolio recycling I did in December, and then to a quarterly portfolio income update, and finally to my biggest realized gains and losses in 2025.

End-of-Year Top Holdings

My portfolio enters 2026 fairly concentrated into my highest conviction names, and I like it that way.