What Austin Bought And Sold In January 2024

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

What Austin Bought And Sold In January 2024

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

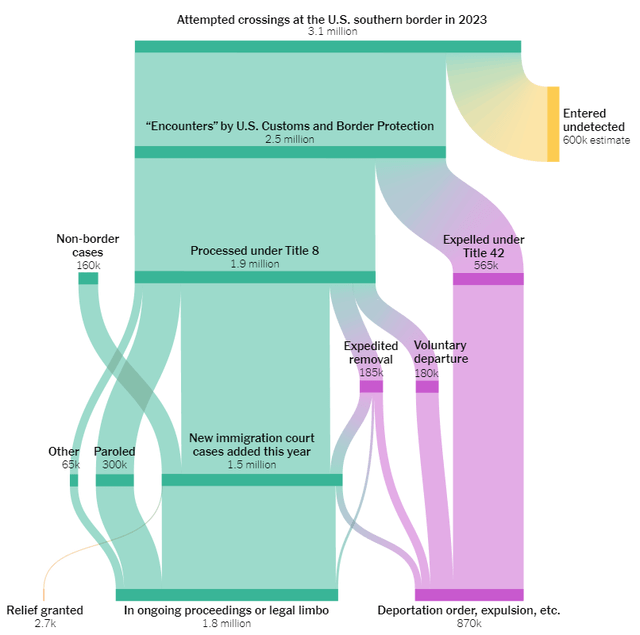

As I write this, the United States Senate is negotiating what would be the biggest immigration reform legislative package in decades.

I say "would be" because even if it did pass the Senate, it most likely would not pass in the more politically polarized House of Representatives.

It's another frustrating reminder of how Congress, especially the House, has become a political kabuki theater rather than a serious legislative body. Politicians on both sides would rather raise small-dollar donations by ranting on camera about the extremism of the other side than sit down together and hammer out a realistic compromise.

A realistic compromise may actually be on the verge of passing in the Senate, and large swathes of the House (on both sides) will undoubtedly lambaste it.

Experts all across the political spectrum describe the immigration system as broken and dysfunctional, but the reasons for these descriptors vary depending on one's preferences on the subject.

If you like immigration and perhaps want more of it, then you probably dislike our arduous and Kafkaesque legal immigration system that takes years, hundreds or thousands of dollars in fees, and the patience to work through reems of paperwork to legally enter the US.

If you dislike immigration and want less of it, then you probably dislike the porousness and permeability of the Southern border in the face of a significant surge in illegal border crossings in recent years.

I'm no expert in immigration, but a seemingly obvious and (to my mind) intelligent compromise would be to streamline the legal immigration process while strengthening border security.

Why can't this happen? Politics, I suppose.

The more pertinent question for investors is whether this matters to the US economy. I say it does.

An oversimplification that nevertheless approximates reality is that the economy is basically the combination of population and productivity.

That is, a growing population combined with rising labor productivity renders economic growth.

All people consume, and a large portion of the population works, so more people = more consumer demand and a larger labor force.

If you don't have population or labor force growth, then you have to rely solely on productivity growth to generate GDP growth. You might think that's not such a bad thing. As long as you still have productivity growth, you'll get GDP growth even with a stagnant population.

But that situation can't last forever, because a stagnant population eventually and invariably becomes an aging population, which translates into steadily declining consumer demand and ultimately weighs down the economy. You can't expect productivity to completely replace consumer demand in order to sustain GDP growth. Where's the incentive for businesses to invest in productivity enhancements if consumer demand is on the decline?

The ideal combination for economic growth is a growing population and rising productivity.

But the birth rate in the US as well as the rest of the developed world is plummeting. Blame it on delayed adolescence, hookup culture, the decline of religion, changing social expectations, whatever. Young people are just having fewer kids across most of the world.

If we want to keep growing our population, it will increasingly have to come from immigration.

Moreover, if we want to keep growing our labor force, there is increasing evidence that this growth will have to come from immigrants.

Consider this: the total nonfarm workforce in the US is up about 5 million people from its pre-pandemic peak.

And yet, there are about 2 million fewer native-born Americans in the workforce, and the native-born American workforce is 6 million people fewer than it would have been if the pre-COVID trend had continued.

Where did those native-born Americans go? Sadly, some of them died from COVID-19 or other causes. A lot more of them retired. There are about 4 million more retirees in the US today than immediately preceding the pandemic.

This growth in the retiree population is roughly in line with its pre-COVID trend.

So how is the total US nonfarm workforce up by 5 million workers since the pre-COVID peak?

About 2.5 million of that growth in the workforce came from foreign-born workers -- immigrants.

The rest, I believe, can be explained by multiple jobholders.

A permanent, structural labor shortage would not be a desirable outcome for the economy as a whole, even if it's good for certain workers.

That brings me back to my frustration with the dysfunctional US immigration system.

To my mind, it is a blessing that so many people around the world want to live in the United States. We must be doing something right! But rather than make it easier to work and assimilate here, our system instead incentivizes emigres to cross the border illegally, often turning to disreputable coyotes or cartels to help them do so. And once here illegally, employment is limited, and the motivation to learn English and assimilate is low.

That dampens economic growth. Economic research has demonstrated that when illegal immigrants are naturalized, they tend to both earn more and spend more money, thereby boosting economic activity.

Of course, second and third generations of immigrants who go through the public school system eventually assimilate, but life for first-generation illegal immigrants is not ideal -- outside their country of origin and unintegrated into their country of residence. This exacerbates the "otherness" of illegal immigrants that fuels nativism among a certain segment of the electorate in many developed nations.

Anyway, my point is that the optimally pro-growth (and pro-social cohesion) immigration system would be one that neither cuts off in-migration entirely nor allows rampant illegal immigration to continue.

Instead, it seems commonsense to me that the optimal immigration system would be one that:

Streamlines the immigration and asylum application process

Rewards jobholders

Attracts and retains highly educated and entrepreneurial people

Incentivizes integration in society

Secures the border, giving the nation a better understanding of who is entering the country while quickly turning away those who don't meet the requirements

Gives at least some illegal immigrants a path to naturalization

What's the takeaway for investors?

The directional change in corporate earnings (including for most types of REITs) is correlated with GDP, while the directional change in GDP is correlated with population growth and productivity. Holding productivity equal, population growth should result in GDP growth. And as the birth rate falls, population growth increasingly comes from immigration.

So maybe our broken immigration system is contributing to a long-term slowdown in GDP growth? Maybe. Then again, all else being equal, falling GDP growth correlates with falling interest rates. So maybe in a perverse way our broken immigration system is beneficial to REITs?

Candidly, I don't know. I'm well outside my wheelhouse at this point, but hopefully this discussion has spurred some thought while shedding more light than heat.

Top Ten Holdings

My top ten holdings haven't changed in the last few months. After some tax harvesting in November and December, the "Cashflow Compounders Club" portfolio is where I want it. There's a nice blend of "rowers" (steady compounders) and "sails" (high-yielding income plays), with the top ten holdings made up entirely of rowers.

Between the regular, reliable dividend growth of rowers like these and the high income of my strategic "sail" picks, I believe my portfolio is well positioned to achieve my goal of continuous sequential (quarter-over-quarter) dividend growth.

In my last update, I discussed how my Q4 2023 dividend income ended up falling slightly from the prior quarter. It's too soon to know whether Q1 2024 will be slightly lower still, but having honed and doubled down on the strategy I articulated in "The Galley Ship Portfolio," I believe my portfolio is where it needs to be to maximize both current income and income growth going forward.

Portfolio Recycling

I have become more cautious about selling appreciated positions recently, mainly as a result of regret from selling Vista Corp (VST). The independent power producer and Texas retail utility provider enjoys strong cash generation with which it has been aggressively repurchasing shares and increasing its dividend.

I sold at around $31, and since then it has soared another ~35% to $41.50 and change.

I often wake up in a cold sweat at night, and my wife tells me I was screaming something about "Vista Corp" in my sleep.

Okay, that's an exaggeration, but seriously, why did I sell?

The fundamental reason is that I looked at VST's sub-3% yield and viewed it as a low cost of capital with which to reinvest in higher yielding stocks.

Paradoxically, I don't regret buying those other stocks, but I do regret selling VST. I wish I still owned it, and now I'm feeling major FOMO. It's not that I could have sold it for more, it's that VST remained a strong, reliable compounder at the time that I sold it -- and remains so today. My investment thesis remained intact, but I succumbed to the temptation to do something clever in order to wring out a little more income from my portfolio.

That said, I did sell a few holdings in January, which I'll discuss a bit below.

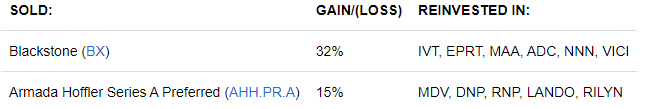

I decided to sell BX, despite it being a solid long-term compounder, because my real estate exposure is obviously very high. Like most of my REIT holdings, BX is sensitive to interest rates. Arguably, BX is far more sensitive to interest rates than most of my REIT holdings because (1) changes in rates affects fundraising, (2) changes in rates affects the market value of BX's private real estate which in turn affects stated IRRs, and (3) BX's real estate is more heavily leveraged at the asset level than my REITs.

This goes a long way in explaining BX's higher beta (volatility relative to the market) than REITs.

All else being equal, I'm a low-beta guy. That's not about investing theory. It's personal preference.

So, if I'm going to have this much exposure to real estate anyway, I figure I'd rather do it more directly by owning REITs with lower leverage, risk, and betas than BX.

Plus, when I sold at around $120, it felt like a decent time to do so. At that price, BX traded at a forward dividend yield of about 3.5%, which means that I increased my current income from the reinvestments.

Will I regret selling if BX's stock price continues to go up?

Some lizard-brain part of me probably would. But I think my logic is more sound from this sale than it was in selling VST.

As for selling AHH's preferred stock, that one is simple.

In January, AHH.PR.A went over $24, giving it further upside to par of only about 4% and a yield of about 7%. But I had other options to invest at higher yields and more upside, most notably Modiv Industrial (MDV), while only modestly increasing risk.

New Positions

I opened three new positions this week. For the first two, Jussi and I published our research in High Yield Landlord recently, so rather than repeat myself, I'll let those articles speak for themselves.

Modiv Industrial (MDV)

In my last public article on MDV in February 2023, I rated it a "Hold" mainly because of its cost of capital disadvantage. (One man's "deep value and high upside" is another man's "impaired cost of capital.") But since then, MDV's faster-than-anticipated evolution into a nearly pure-play industrial net lease REIT has impressed me.

If I had bought back in February 2023, I'd be up 28% and enjoying a total return of 39%. *Sigh* The good news is that I expect much more upside ahead for MDV.

At an AFFO multiple of 11.4x, MDV is valued slightly lower than Broadstone Net Lease's (BNL) 11.6x multiple, which strikes me as unfair because MDV's pure-play industrial focus deserves a higher valuation than BNL's high diversification. I think MDV could easily attain Plymouth Industrial's (PLYM) valuation multiple of 12.2x, but I think a fair value of 13x would be even more appropriate, giving MDV upside of closer to 15%.

Vesta Real Estate Corporation (VTMX)

My thoughts on VTMX are summed up in this International Portfolio Trade Alert, so see that for more.

DNP Select Income Fund (DNP)

DNP is another utility-focused CEF with strong management led by longtime (32 years) senior portfolio manager Connie Luecke. During her tenure, DNP has not cut its monthly distribution once.

The fund is about 85% equity and 15% bonds. On the equity side, DNP is 65% utilities, 20% or so midstream energy, and 15% communications. The fund is about 30% leveraged with most of that leverage being floating rate. That goes a long way in explaining the sharp drop in NAV since 2022.

The poor performance of utility stocks doesn't help either.

But if interest rates reverse course and go lower this year (and if utility stocks rebound), DNP should enjoy a strong resurgence while keeping its monthly distribution intact.

Insiders certainly seem to be bullish, as over the last few years they've bought 18,557 shares of DNP on the open market, currently worth about $166,000. Granted, that's not much compared to a $3.25 billion market cap, but it exhibits more insider optimism than can be found in most other CEFs.

I bought a small position at a yield-on-cost of 9%, mostly from the proceeds of selling AHH.PR.A.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola & Austin Rogers

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.