What Austin Bought And Sold In July 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

Artificial intelligence is in the driver's seat.

Softer- or stronger-than-expected economic data, hotter- or cooler-than-expected inflation data, tariffs, trade deals, a catatonic housing market, presidential jawboning of Powell, a weakening paycheck-to-paycheck consumer... all of it seems to be, in the words of Shakespeare, "sound and fury signifying nothing."

Overwhelmingly, the biggest driver of stock price appreciation today are the earnings (or expected earnings) of AI-related companies.

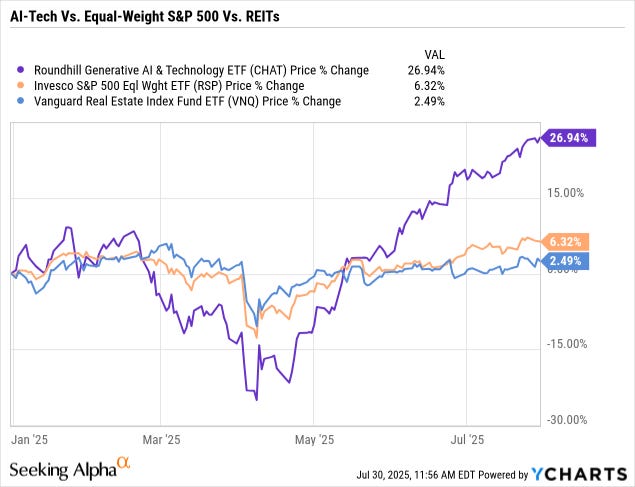

Compare, for example, the ~27% year-to-date gain of the Roundhill Generative AI & Technology ETF (CHAT) against a ~6% gain in the Equal Weight S&P 500 (RSP) and a ~2.5% gain from the real estate sector (VNQ):

Axios recently attested that excluding the technology and communication services sectors, S&P 500 earnings are down 3% this year. So tariffs, economic uncertainty, and low housing turnover are taking their toll... just not with the biggest and most influential stocks in the market.

Certainly, some parts of the stock market are highly exposed to a hit from tariffs. Automakers like Ford (F), General Motors (GM), and Stellantis (STLA) are reporting huge, billion dollar or more hits from tariff costs.

Most economic research, such as this recent report from the Yale Budget Lab, suggests that consumers will eventually bear the majority of the burden of these new tariffs. The Yale Budget Lab estimates that the average US household will eventually pay an extra $2,400 a year because of them.

But there's a lot of uncertainty in that word "eventually."

In the near-term, it looks like importers will be paying the majority of the tariffs, while consumers and foreign exporters foot only a minority of the bill.

That means margin contraction now, and a steady trickle of price hikes over the next few years (as long as the economy stays out of recession) that serve to rebuild margins but also put upward pressure on inflation metrics.

Where does that leave the directionality of interest rates and, relatedly, REITs?

My guess is that, despite tariffs being a one-time step-up in costs, the gradual roll-out of consumer price increases will make it look like higher inflation, which will further extend the Fed Funds Rate pause and keep long-term interest rates rangebound -- at least until May 15th, 2026, when Trump can install a more compliant Fed chairman.

If the above paragraph is valid, then I don't expect much compression in interest rates until next Spring or Summer, and that will likely prevent REITs from rallying significantly until then.

If tariffs get passed through to consumer prices sooner than expected, then I'd expect REITs to dip. If tariffs get absorbed by importing businesses for longer than expected, REITs might do a little better than I expect.

But in the long run (i.e. the next 2-3 years), I still foresee the underlying secular disinflationary trend to continue. That should bring nominal GDP growth down to an average range of 3.5% to 4%, which in turn should bring the 10-year Treasury yield down to that range as well.

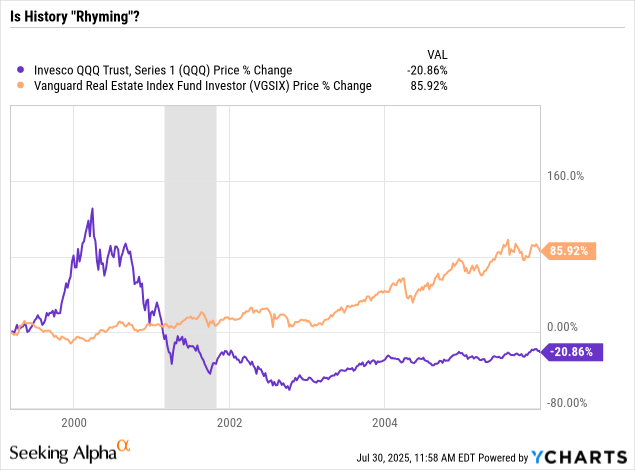

If this scenario plays out more or less as described above, then there's good reason to believe that history could "rhyme" over the next several years as it relates to REITs' underperformance versus high-growth tech.

During the Dot Com bubble of the late 1990s and into the Spring of 2000, REITs massively underperformed. The collective attitude of investors seemed to be that REITs were just too boring to own. Why buy a stock offering total returns of maybe 8-12% per year when one can enjoy 20-30% per year (or more!) from high-growth tech stocks?

I think the collective attitude of investors is basically the same today. REITs are just so boring compared to sexy, cutting-edge tech stocks. FOMO is a strong force at play in the market.

But at the same time, today, like the late 1990s, REITs are dramatically cheaper than the broader market:

The valuation gap today is reminiscent of the late 90s period, when a revolutionary new technology was all the rage and interest rates remained stubbornly elevated.

Perhaps it is merely apophenia (the human tendency to see patterns amid randomness and unrelated data) tricking me into seeing a resemblance between the late 90s and today, but the similarities do seem obvious and striking to me.

Maybe I'm wrong and growthy tech will continue to dominate the market. But if I'm right, then REITs should be big winners over the next 2-3 years.