What Austin Bought And Sold In June 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

Lots to get to this month, so I won't waste time.

I'd like to talk a bit about whether an AI bubble is forming, wax philosophical about epistemic humility, and then finally get to my top 10 holdings and portfolio recycling in June.

Onward!

AI FOMO?

As I write this at the end of June, the US stock market is ebullient. The S&P 500 (SPY) sits right around its recently hit all-time high. Fear of missing out seems to be the primary emotion driving investors.

And yet, there's no telling how much higher the bull market can run.

To be clear, most of the greatest investors like Warren Buffett and Charlie Munger notoriously pay little to no attention to ambient noise like the momentum of the broad indices. They simply follow their bottom-up investment strategy year after year.

Fair enough.

But I do think there are some interesting points to observe about the current market environment.

As I have written in the past, there is some evidence to suggest that an AI bubble is in the process of forming. If so, it would not be like the Dot Com bubble that quickly inflated in the span of about two years. Rather, it appears to me as though the current AI euphoria is the continuation of a long trend of US tech sector outperformance and multiple expansion.

Over the last few months, however, the speed and momentum with which certain AI-related stocks have rallied is incredible.

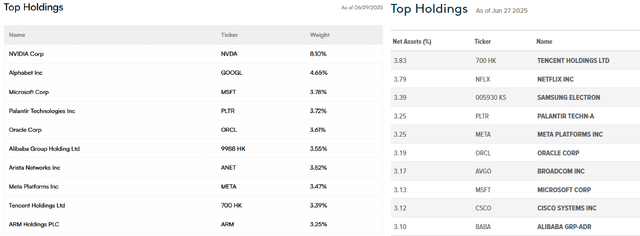

Here's a handful of AI-specific ETFs compared to the equal-weight S&P 500 (RSP):

Compared to the unweighted average stock, AI-related stocks have hugely outperformed, especially over the last few months.

As you can see, the two particular winners in the AI ETF space are Roundhill's Generative AI & Technology ETF (CHAT) and Global X's Artificial Intelligence & Technology ETF (AIQ).

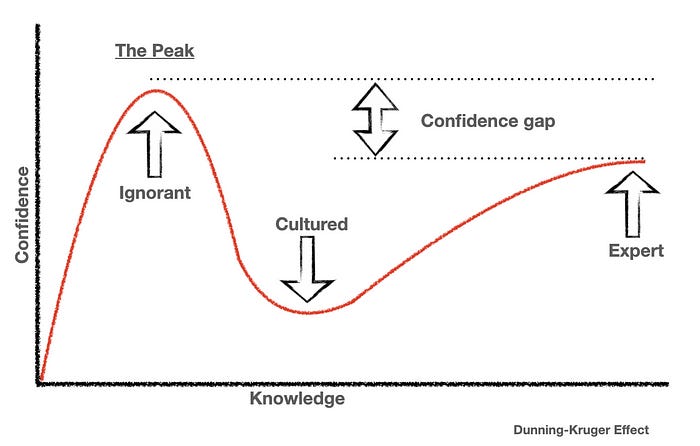

Below, on the left we see CHAT's top 10 holdings, and on the right we have AIQ's top 10 holdings:

CHAT's heavy weighting in Nvidia (NVDA) has played a huge role in its outperformance over the last several years, but both ETFs' stock selection methodologies have clearly worked very well in recent years.

NVDA now trades at about 50x TTM earnings and ~37x expected 2025 earnings.

What's interesting to consider in the midst of this outperformance is the heavy insider selling at NVDA. CNBC recently reported over $1 billion in open-market share sales from insiders over the last year. About half of those occurred over the last month.

You can find similarly heavy insider selling from the likes of Microsoft (MSFT), Tesla (TSLA), Alphabet (GOOG, GOOGL), and Oracle (ORCL), among others.

Now, there's always net selling at big corporations like these that issue lots of stock as employee compensation. But I would think that if the growth potential of AI is as awesome as what's priced in, and if insiders know that growth potential, then there would be less selling.

A Brief Meditation On Epistemic Humility

Arguably the most common vice among investors is pride.

Investing is a sport that attracts the mentally athletic -- smart people. But those smart people usually know they're smart and tend to overestimate just how smart they are. From an intellectual standpoint, they acknowledge that most investors can't beat the market or even a certain benchmark over a long period of time. But their tacit belief is that they are the exception.

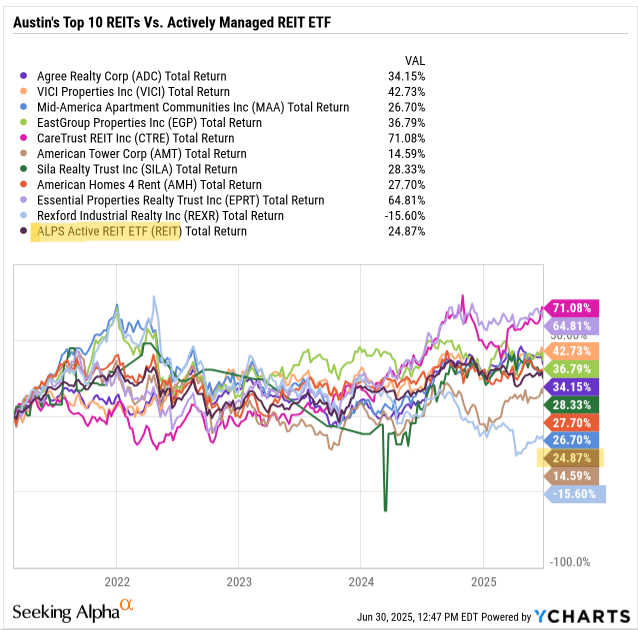

In investing, just as in any other field, the Dunning Kruger Effect holds true. This is the phenomenon wherein a person who just begins to gain knowledge on a subject quickly becomes overconfident in their level of knowledge.

These largely ignorant yet overconfident individuals inevitably experience something that shakes their confidence. In an investor's case, this usually takes the form of an investment thesis that proves painfully wrong.

That makes investing more like science than philosophy. Hypotheses are falsifiable. That is, whenever you form an investment thesis, the market will eventually prove you right or wrong.

Enough mistakes combined with a sufficient degree of honesty leads a person's self-confidence to drop sharply as their knowledge continues to increase. This is the point at which many upstart investors give up, concluding that investing isn't for them.

But, for those that persist, as knowledge and experience grow, one's confidence naturally builds as well. Investment theses start to become intuitive while also becoming more measured, more tentative, more probabilistic. After the proverbial 10,000 hours have been put in, one eventually gains expertise. But even in that expertise, one's confidence never returns to those early days of hubris.

If you ask experts in almost any field, you will generally find that proficiency instilled in them a strong sense of epistemic humility.

(Epistemology is the sub-field of philosophy that studies how we know what we think we know. Epistemic humility is the virtue of acknowledging the limits of one's knowledge.)

When it comes to investing, I think epistemic humility leads to a few inevitable, if perhaps unsatisfying, conclusions:

Most investors lack expertise in most if not all sectors, industries, and business models.

Most investors who are experts in something are only experts in one thing.

Stock-pickers should concentrate all or most of their individual stock picks in their area of expertise.

For diversification and exposure to everything outside of one's area of expertise, one should rely on passive ETFs or skilled active managers.

In last month's update on Austin's portfolio, I explained my idea of a hub-and-spoke investment model, where the hub represents diversified ETFs and the spokes represent high-conviction stocks within my sphere of proficiency.

When it comes to non-real estate stocks, my performance record is admittedly mixed.

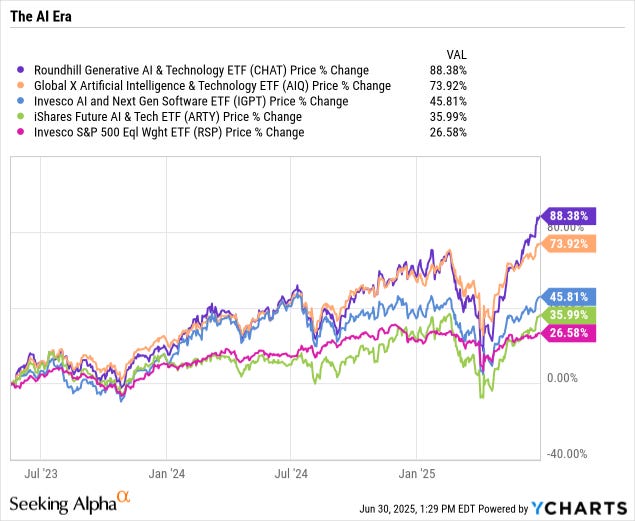

But within the real estate sector, I've done much better. For example, since the inception of the ALPS Actively Managed REIT ETF (REIT) four and a half years ago, my current 10 largest REIT holdings have outperformed the active manager.

The weighted average total returns of my top 10 largest REIT holdings has been 35.4% since February 2021, compared to 24.9% for the ALPS actively managed REIT ETF.

Notably, this excludes Alexandria Real Estate (ARE), which is now outside my largest 10 REITs, which has been a stinker in my portfolio and would drag down my portfolio's performance. On the other hand, it also excludes smaller REIT holdings like InvenTrust Properties (IVT) and American Healthcare REIT (AHR) that have been winners for me so far.

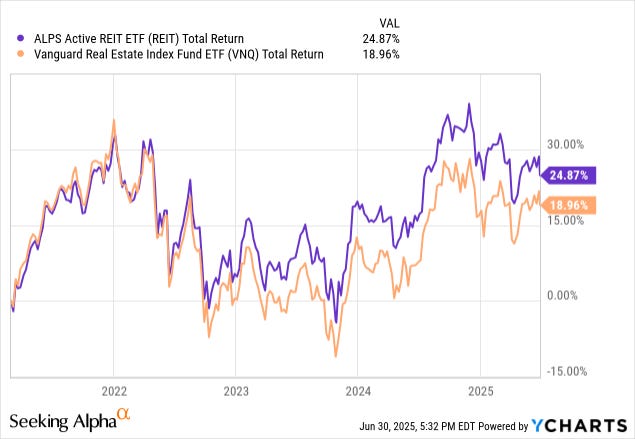

And mind you, during that time, the actively managed REIT ETF outperformed the broad-based and passive Vanguard Real Estate ETF (VNQ), which we might consider a benchmark proxy:

I'm blessed to have enjoyed good performance over the last few years, but I don't want to fool myself.

I'd place myself somewhere between "Cultured" and "Expert" in the Dunning Kruger chart above. I know my limits. I know that even within the real estate sector, there are plenty of unknowns and complexities. The landscape is evolving, and predicting which individual names or sub-sectors that will outperform going forward is not clear even to the experts.

"All I know is that I know nothing," to quote Socrates.

We operate in the realm of probabilities, not certainties.

Even within my sphere of proficiency, I must acknowledge my limitations, my fallibility, and the relatively meager exceptional investment ideas I can find.

One source of value from a community like High Yield Landlord is a regular reminder that due diligence is paramount and makes the difference between a smart investment and a dumb one. Smart investments are not always successful, but they're always deeply informed, well-reasoned, and aware of the risks.

It is an act of wisdom to admit the limits of one's knowledge, and in investing, that admission is perhaps the most profitable insight of all.