What Austin Bought And Sold In November 2025

Important Announcements:

Just a quick heads up:

We will share our fourth Top Pick for 2026 on Friday. Stay tuned!

We expect to interview the management of HASI very soon. Let us know if you have any questions for them.

I will host another live Webinar in a few weeks. Let me know if there are any specific topics that you would like me to cover.

--------------------------------------------------------

What Austin Bought And Sold In November 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

As Thanksgiving passes into the rearview mirror here in the US, I want to express how grateful I am to the High Yield Landlord community.

Jussi has created and facilitated a special platform for active REIT investors like us to discuss ideas, share real-time news updates on companies we follow, and celebrate/commiserate together. It’s a pleasure to play a small role in making it happen.

I’m also thankful for the recent rebound in many REITs and dividend payers, probably driven by the slump in interest rates, that has given my portfolio a lift.

My buy list has narrowed down to only a handful of names.

After executing a nice swing trade in Iron Mountain (IRM) earlier this year, I recently bought back into the document storage/data center REIT on its dip. The REIT delivered strong Q3 results and hiked its dividend by another 10%, but the market seems to be concerned about the level of capital spending it has committed to in the coming years. The Gotham City short report compounded these worries by alleging that IRM is inflating its EBITDA and is thus more leveraged than its reported metrics imply.

While this is a concern, most of IRM’s development projects are pre-leased, largely by major hyperscalers. While there is a risk of data center overbuilding down the road, IRM’s emphasis on working with the biggest corporate cloud players hedges this risk somewhat. The core records management segment, which is highly stable if slow-growing, also provides stability amid AI bubble fears.

Another REIT on my buy list is Public Storage (PSA), the second largest self-storage owner/operator in the US with (arguably) the strongest balance sheet in its industry. I like PSA for its scale, efficiency, low leverage, A credit rating, and conservative dividend policy that has resulted in 44 straight years without a cut.

But there is a solid case to be made for choosing CubeSmart (CUBE) over PSA right now, because CUBE sports a higher yield of ~5.5% (compared to PSA’s ~4.4%) and boasts some high-quality portfolio metrics such as locations in generally more population dense areas. Which you favor depends primarily on your ojectives and risk profile.

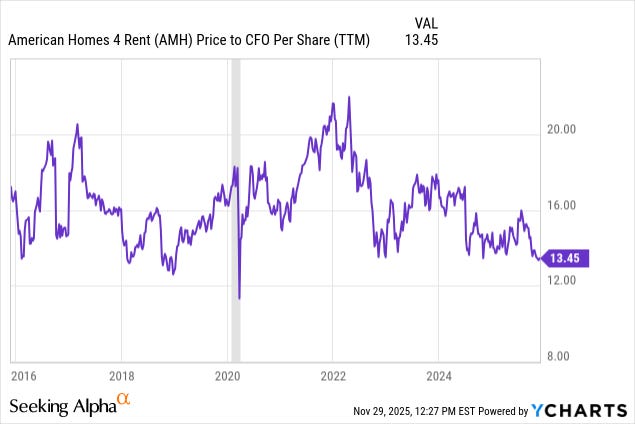

I’m also eyeing American Homes 4 Rent (AMH) as a holding to potentially add to right now, as its valuation is around its lowest level from the past decade.

AMH owns one of the largest portfolios of single-family rentals in the country, concentrated primarily in the Sunbelt and Midwest regions, and it also has an active development platform that delivers ~2,000 new built-to-rent homes per year.

With job growth and net immigration low right now, demand for SFRs is growing slower than it usually does. But I believe both the labor market and net immigration should rebound eventually, and that in turn should provide tailwinds to AMH once again.

Top 10 Holdings

I’m quite satisfied with my top 10 holdings on the whole.

My largest holding of Agree Realty (ADC) is over 9% of my total portfolio, which I don’t mind. I believe the high-quality net lease retail REIT makes the perfect anchor for a dividend growth portfolio, as it is both highly defensive and capable of steady growth in virtually any economic environment.