What Austin Bought And Sold In October 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

Not to be a kiss-a**, but I think Jussi absolutely nailed it in a recent Trade Alert when he said that AI-related tech is fueling all market gains right now.

Outside of AI-related tech, other parts of the market are doing mediocre at best and terrible at worst.

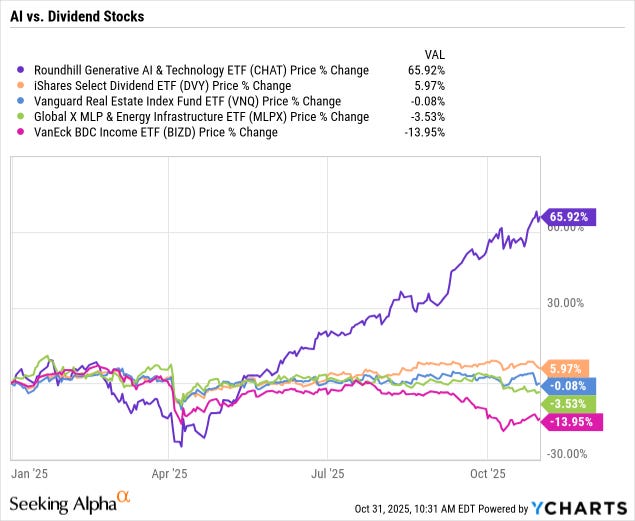

Just compare AI-related stocks (CHAT) to various types of dividend payers, from your standard high-dividend stocks (DVY) to real estate & REITs (VNQ) to midstream energy (MLPX) to business development companies (BIZD):

The market is painfully K-shaped right now -- and getting more K-shaped over time.

Over time, AI investment and capex is accounting for a larger and larger portion of economic growth. Aggregate consumption, non-AI investment, the housing market, and the labor market are all stagnant. The only significant source of growth to be found right now is in the AI space, and stock prices are reflecting that.

But as we warned in a recent Market Update, there is a major and underappreciated risk in giving in to FOMO and piling into AI-related tech right now. While there is no way to time the market or what stage of the investment cycle we are in, it does look likely that AI infrastructure could be in the midst of a bubble.

That is, there appears to be significant over-investment into infrastructure and overvaluation of the companies at the center of the AI ecosystem.

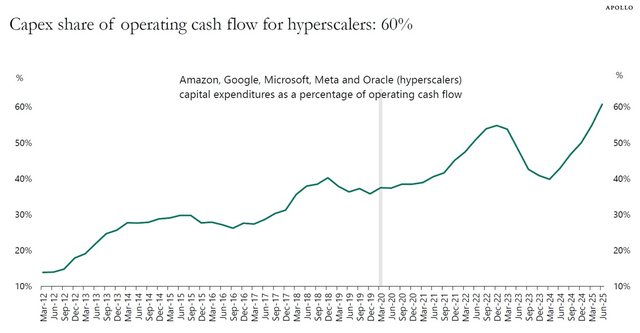

On the over-investment piece, consider the incredible fact that the largest 5 hyperscalers are now spending over 60% of their (considerable!) operating cash flow on capex:

These five hyperscalers collectively generated about $550 billion of operating cash flow over the last 12 months, which means that they’re spending roughly $330 billion on an annual basis on capex.

And there is no end in sight to that level of spending. It’s only going higher in the coming years.

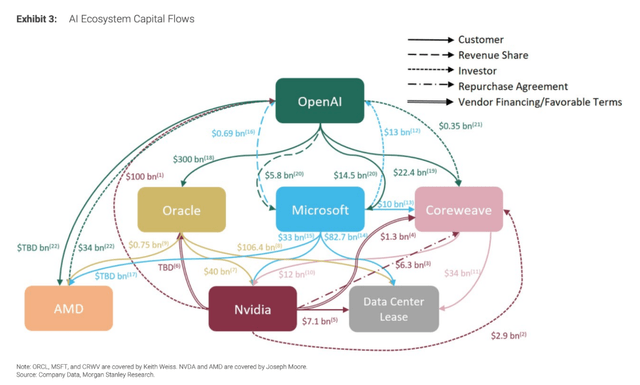

Both the over-investment and the overvaluation appear to be partially the product of the widely discussed round-tripping (circular flow of spending and investment) within the AI ecosystem.

For the most part, it isn’t identical to the vendor-financing witnessed during the Dot Com bubble, but it does tie the fates of all the major names in this space up with each other.

It reminds me of the complex interweaving of national alliances in Europe before the start of World War I (or “The Great War,” if you prefer). On the surface, there didn’t seem to be any problem with this system of alliances. But when a 19-year-old Serbian nationalist shot Franz Ferdinand, it set off a chain reaction that quickly engulfed the entire continent in the most devastating war the world had ever seen.

That’s a dramatic analogy, I admit, but I think it illustrates the danger of this multi-channel interconnection of all the major players in the AI ecosystem.

Their fates are tied together. If one falls, they all fall.

It’s a “systemic” risk.

If, somehow, one of them went down, would it be declared systemically important and deserving of a government bailout like the big banks in 2008?

I digress.

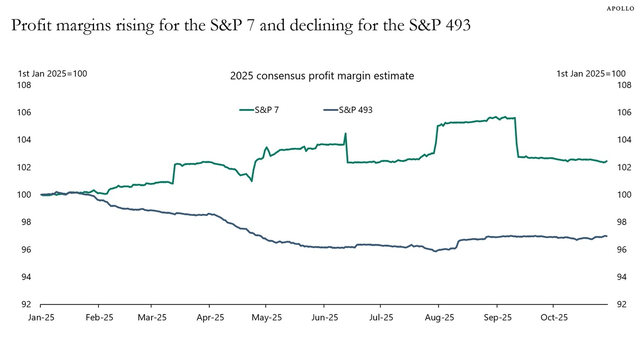

Anyway, it bears mentioning that most of the biggest players in the AI ecosystem have massive cash flows and high profit margins. In fact, for the biggest corporate giants in the S&P 500, those profit margins have only gone higher this year, while the profit margins for the rest of the index have declined:

Cloud storage and software-as-a-service are phenomenal business models. With greater scale in these models comes greater efficiency and margins.

It’s also worth mentioning that the source of these massive cash flows and high profit margins are not (yet) any AI products or applications but rather the pre-AI business segments like cloud and SaaS. All of the AI capex investment being done right now is based on the assumption that AI will be profitable and capable of justifying all of the current and coming infrastructure investment.

I’m no tech expert and cannot say with any certainty whether this assumption is reasonable.

But I can look at history and see that virtually every revolutionary new technology has come with a bubble that included over-investment and overvaluation.

This time might be different. But it sure would be surprising and unique if it is.

Quarterly Income Still Growing

It does sting a little to be left out in the cold as a dividend investor, watching the AI party from outside with my nose pressed against the glass.

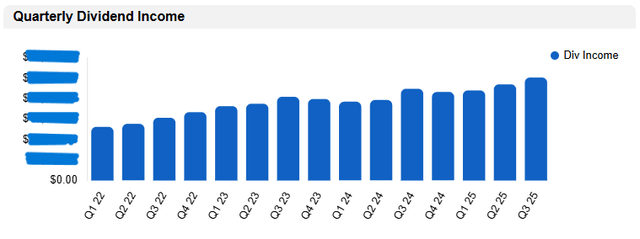

But I do take solace in one thing: My passive income continues to grow steadily, quarter by quarter.

In Q3 2025, my total portfolio income grew 12.2% year-over-year and 7.1% quarter-over-quarter.

To be clear, this comes from dividend growth, reinvested dividends, the occasional portfolio recycling, and monthly infusions of surplus labor income.

By my rough estimate, my ~5%-yielding portfolio’s average dividend growth rate is about 4-5% annually. Add in another 4-5% from reinvesting all dividends as well as another 1-2% from investing surplus labor income, and my total portfolio income growth should exceed 10% per year.

That, of course, assumes no significant dividend cuts.

The slight dip in late 2023 and early 2024 largely came from the unexpected W.P. Carey (WPC) dividend cut.

While the ideal would be to see uninterrupted quarter-over-quarter growth in total income, the more important achievement is significant and generally consistent long-term growth in passive income.

I have achieved that, and that means more to me than capital gains from unprofitable AI ventures.

(I am self-conscious, though, of how much that sounds like “copium.”)