What RPD Bought And Sold During March 2025

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

My Context

My secure income covers 2/3 of my spending budget. The secure income includes social security, a pension, and a collection of annuities.

Nearly all those sources have escalators of either 2% or inflation. My dividends from “Go-Fishing” positions — very secure firms likely to grow dividends at least with inflation — could cover the rest of my spending.

At the moment, the other third comes from various paid work. So if work stopped or when it stops, current spending is covered without drawing down the portfolio.

In the meantime I will use those dividends to grow the portfolio and to provide early legacy spending. That will include some funds to the kids each year, which started last year.

The rest of the portfolio pays additional dividends (though not from all positions). These also will help grow the portfolio.

In recent years, my active-investing portfolio has included an income bucket intended to throw off growing dividends, an upside bucket intended to increase portfolio growth, and an illiquid bucket of long-term, private investments made years ago.

I have recently added a medium-risk bucket to the portfolio. It will pursue gains from market mispricing of blue-chips or other quality companies. The Quality Gains bucket will better align with the interests of many subscribers, and frankly will be more fun to manage than the bucket holding very secure dividend stocks.

Dividends are the goal but we also know that chasing yield is a losing game. And we know that growth of portfolio market value can be a path to affording larger total dividends.

The following contains updates throughout, but much of it is a repeat of my last monthly update. All the images are newly updated, in case you just want to skim.

REITs This Month

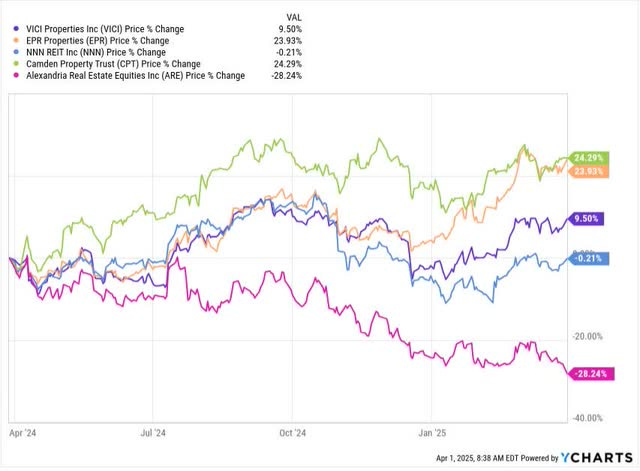

Here is how the prices of several of my REIT holdings changed over the past year:

Overall, the premature enthusiasm over interest-rate cuts pushed prices up into September, but both prices and that hope faded.

Still, Camden Property Trust (CPT) and EPR Properties (EPR) are up by a quarter over the year. Those two did turn in good results, in my view.

VICI Properites (VICI) is up a bit, on not much news. NNN REIT (NNN) is flat despite a bit of market panic about some tenant problems.

Meanwhile, Alexandria Real Estate (ARE) keeps diving. That stock is down 28% and the yield is up to 6%.

I still see Alexandria Real Estate (ARE) as by far the most undervalued blue-chip. But pessimism makes some sense if you think the current administration will tank the economy and prevent the recovery of life science, preventing ARE from leasing up their 2027 completions. My perspective is that I’m getting paid well to wait and that the dividend is unlikely to be cut.