What RPD Bought And Sold In April 2025

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

Value Investing as Markets Drop

One of the challenging aspects of being a value investor is what to do while some stock, or even the entire market, is continuing to slide. Paraphrasing something an investor said to me recently, regarding the poster child for this at the moment, Alexandria Real Estate (ARE):

I am confident in this company and have 3% in the stock, but still my cost basis is far above the price that ARE is at now. Does one just add at the current price near $70, or wait for a much lower price such as the $50 RPD said we might see? How to play this situation?

My thoughts follow.

Your cost basis only matters if you are thinking about selling, because it is really important to resist realizing losses. This, to me, is the significance of Buffet’s Rule No. 1, “Never lose principal.” As you probably know, “moving on” from disappointing stocks is the origin of the abysmal average performance of retail investors.

Otherwise, though, what matters is the economic principle that “sunk costs are sunk.” From this perspective, cost basis is completely irrelevant. And “averaging down” is a really bad concept.

The only thing that matters today about a specific company is the value proposition, to you, of any stock you do own or might own. So for ARE today, priced in the $70s, the value proposition is a dividend yield above 7%, safe unless occupancy drops more than is likely, and a fair value more or less twice the current price. Then, in a portfolio context, there are questions of balance and diversification too.

But even so, how do you seek to invest? If you are like Jussi, this is fairly easy. You have steady savings and some dividends to invest, and so you can do the most opportunistic thing today.

If, in contrast, you are retired, you are likely to have to somehow raise cash to buy a tranche of some specific stock. And then at what price do you buy?

To my mind, the first requirement is to buy at prices for which you will be satisfied to hold long-term, no matter how much further the stock drops. My own highest priced tranche of ARE is at $120. When I bought I was satisfied with the combination of payout and upside. Still am.

When things start dropping hard, many investors including me tend to focus on yield. For example, I think a getting yield of 5% on Regency Centers (REG) would be a great result. They are rock-solid and poised to grow.

In 2020 my dry powder ran out early, because I bought stocks at great yields, only to see them drop a lot more and go to even greater yields. This time around, I sold some things early to raise cash and am using a few percent of the cash for each significant downward step by companies I like. It helps that cash pays more now than it did then.

For example, I have a limit order in for REG at $60. If that fills, I will put one in for $50. One can go crazy with doing lots of limit orders in advance, but my own pace is more measured.

It is easy to go crazy thinking about how much upside you miss in buying on the way down. But the reality is that you never know how far a stock will fall, and in addition the moves off the bottom are often very rapid and very large.

The main thing is that if you buy at good value, another huge drop in the price after that does not change the fact that you got good value. Focus on the value.

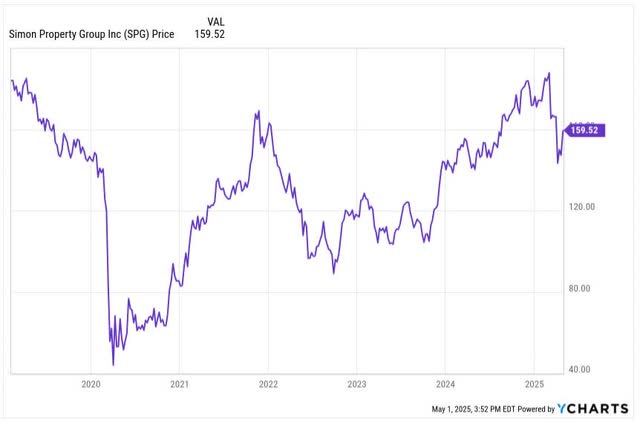

I have fond memories of Lawrence Tucker and me being very excited, talking about getting Simon Property Group (SPG) at $100. Then it fell below $50. But in the end we did well.

The following contains updates throughout, but much of it is a repeat of my last monthly update.

My Context

My secure income covers 2/3 of my spending budget. At the moment, the other third comes from various paid work.

The secure income includes social security, a pension, and a collection of annuities. Nearly all those sources have escalators of either 2% or inflation.

My dividends from “Go-Fishing” positions — very secure firms likely to grow dividends at least with inflation — also could cover more than a third of my spending. So if work stopped or when it stops, current spending is covered without drawing down the portfolio.

In the meantime I will use those dividends to grow the portfolio and to provide early legacy spending. That will include some early inheritance funds to the kids each year.

The rest of the portfolio pays additional dividends (though not from all positions). These also will help grow the portfolio.

My portfolio today includes four buckets.

There is an income bucket, which includes mainly “Go-Fishing” stocks. These are from firms that only need monitoring once a year, if that.

There is a “medium-risk” bucket, pursuing gains from market mispricing of blue-chips or other quality companies and holding high-yield positions for which I have concerns about the dividend.

There is an upside bucket, holding small, speculative positions for which I see the potential of gains of 50% or more.

There is an illiquid bucket of long-term, private investments made years ago. It stands at 13%.

Most often I hold little cash. But at the moment I have 7.4% in cash. This is discussed further below. h

Dividends are the goal but we also know that chasing yield is a losing game. And we know that growth of portfolio market value can be a path to affording larger total dividends.