What RPD Bought And Sold In August 2025

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

Market Movements

My goal is NOT to beat any particular index, but rather to produce growing dividends that can cover my spending when part-time income stops. Still, dividend payers rise in price over time as dividends increase.

This may or may not follow the broad trends in various markets. A rising economic tide can lift all boats. But at times there are divergences.

Friday was such a day, with the broad markets down even as my portfolio rose in market value. It seems that the market is enthused about REITs, likely because of the anticipated interest rate cuts. That seems far from certain to me, as the 10-year rates that matter for REITs could chart a different path than the one the Fed imposes on short-term rates.

In contrast, my energy stocks overall have a lot of gearing to the price of oil, which is not at the moment moving dramatically. So they aren’t either.

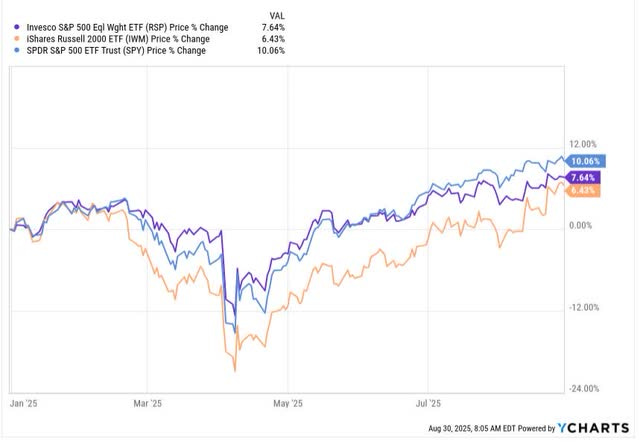

Still my holdings are mostly “small-cap” companies and overall these have been moving up faster than the S&P 500 (SPY). This has prompted another round of “their time is (finally) here” articles. But this is all short-term, as we can see in this YTD plot:

The Russell 2000 ETF (IWM) follows the overall small-cap market. Since April it has moved up 14% relative to the SPY. Today, for the year so far, the gains are 10% for the SPY, 6.4% for the IWM, and 7.6% for the equal-weighted S&P 500 (RSP).

My portfolio is up 7.9% over the same interval. Works for me. We will see what the rest of the year holds.

What is Going On?

Markets AM in the WSJ brought us another reminder that we don’t have a clue what the future holds, and neither does anybody else.

Think of a period when individual investors ruled markets and reaped riches doing it. The meme-stock frenzy of 2021 might come to mind. But 2025 isn’t far off.

It’s been difficult to deny the growing power of the so-called “dumb money” this year. Individual investors now account for about a fifth of the options market, according to JP Morgan. They’ve brought back meme stocks, turbocharging shares like GoPro and Opendoor. They’ve bought every dip, effectively propping up stocks through April’s tariff turmoil.

That’s left plenty of Wall Street pros wondering what individual investors will do next and what that will mean for the market. The problem: It’s difficult to say.

Understanding everyday investors is a bit like trying to make sense of the U.S. economy: a survey here, a dataset there, all assembled into a mosaic and filled in with anecdotal evidence. Plus, some gauges are limited in what they show.

Take the weekly survey released by the American Association of Individual Investors. Who are these folks? The average member is 70 years old, with an average portfolio size of $4.8 million. Most are retired. These aren’t the traders posting MicroStrategy memes or scooping up Krispy Kreme shares.

That might explain why bearishness, as measured by the AAII survey, peaked the week of April 3 this year–the opening of the trade war–with 62% of respondents expecting stock prices to fall.

Yet individual investors poured $4.7 billion into the stock market at that time, according to JP Morgan analysts. That was a record, until retail traders went on a $4.8 billion buying spree about a week later.

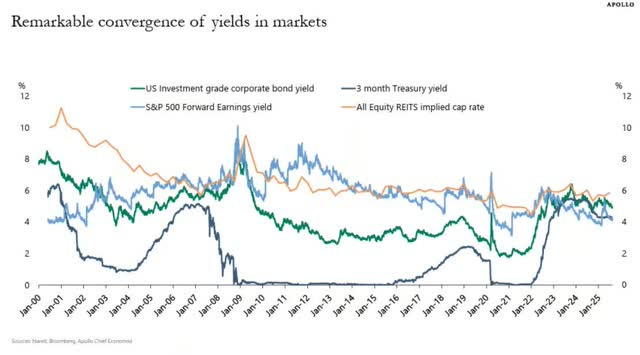

This is underscored by this plot that showed up in CRE Daily:

Right now the “yields” are the same for everything. If you have a definite view of the future, that tells you what to do.

If the future will be like the present, hold T-bills in money market funds.

If interest rates are sure to drop, hold long bonds or REITs.

If the economy will boom hold REITs, energy, or other firms that will grow well.

If we will see a true depression, hold long bonds.

If we will see enduring severe stagflation, hold TIPS.

If you believe that AI will take over the world, growing without bounds, hold Nvidia.

If you want to be on defense, a mix of these things might be a good choice. I’m personally not there yet, but do think times per week about adding more defense. I did add a small TIPS position in July.

Across all these possibilities my view is that quality REITs with low leverage will do better than most other options. My portfolio doesn’t hold a lot of them at the moment, but when it is time to move toward a portfolio less oriented to intermediate-term trading, the REIT fraction will go up a lot.

The following contains updates throughout; much of it is a repeat of my last monthly update.

My Context

My secure income covers 2/3 of my spending budget. At the moment, the other third comes from various paid work.

The secure income includes social security, a pension, and a collection of annuities. Nearly all those sources have escalators of either 2% or inflation.

My dividends from “Go-Fishing” positions — very secure firms likely to grow dividends at least with inflation — also could cover more than a third of my spending. So if work stopped or when it stops, current spending is covered without drawing down the portfolio.

In the meantime I will use those dividends to grow the portfolio and to provide early legacy spending. That will include some early inheritance funds to the kids each year.

The rest of the portfolio pays additional dividends (though not from all positions). These also will help grow the portfolio.

My portfolio today includes four buckets.

There is an income bucket, which includes mainly “Go-Fishing” stocks. These are from firms that only need monitoring once a year, if that.

There is a “medium-risk” bucket, pursuing gains and income from market mispricing of blue-chips or other quality companies and holding high-yield positions for which I have some concerns about the dividend.

There is an upside bucket, holding small, speculative positions for which I see the potential of gains of 50% or more.

There is an illiquid bucket of long-term, private investments made years ago, valued at my cost. It stands at 13% of the portfolio value.

Most often I hold little cash. At the moment I have 4.2% in cash.

Dividends are the goal but we also know that chasing yield is a losing game. And we know that growth of portfolio market value can be a path to affording larger total dividends.

Before I go onto details, there is so much beauty here in northern Michigan at this time of year.