What RPD Bought And Sold In January 2026

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series, as it often discusses many of our individual holdings.

My main purpose this month is to share my 2026 “Go-Fishing” Portfolio, as promised in the chat. I did make two trades, and will describe them first.

One of my goals for this quarter is to increase my holdings of REITs. My target is REITs I see as very-low-risk income sources.

From my perspective, the point is defense. My view is that we are in a reprise of fiber and bandwidth in the 1990s and of US railroads in the 1870s.

The economic fallout is likely to be severe. But it will not affect all sectors. As an example, REITs soared in the early 2000s while the rest of the market struggled.

Quality REITs are likely to continue to pay dividends and perhaps to grow them, even if the economic fallout is massive. They also may provide useful capital to pursue opportunities.

This month, I increased my holdings of AvalonBay (AVB) and of Regency Centers (REG) to 5% positions. Those REITs, in my view, are the most secure REITs in their sectors, running the best business models.

I also established a 3% position in Realty Income (O), to complement my 5% position in NNN REIT (NNN). I’m not much of a fan of Realty Income from a growth standpoint, but I do see the dividend as secure.

It is likely that more REITs will come into my portfolio in the next month or two.

My 2026 Go Fishing Portfolio

Unsplash

Questions from hands-on real estate investors prompted me to begin this portfolio, three years ago. At the time, it was entirely focused on REITs. I added energy investments, a big part of my overall portfolio, in 2025. I will share the energy companies here but will not discuss them at any length.

Those hands-on real estate investors hoped to give up the required legwork. They often would rather see income from actual earnings and not from the airy-fairy behavior of stock markets. They wondered what sort of yields they could get.

But the application is much broader. Many retirees don’t want to occupy all day every day investing. If they are lucky, they have enough funds to use bond ladders or annuities to provide their desired income.

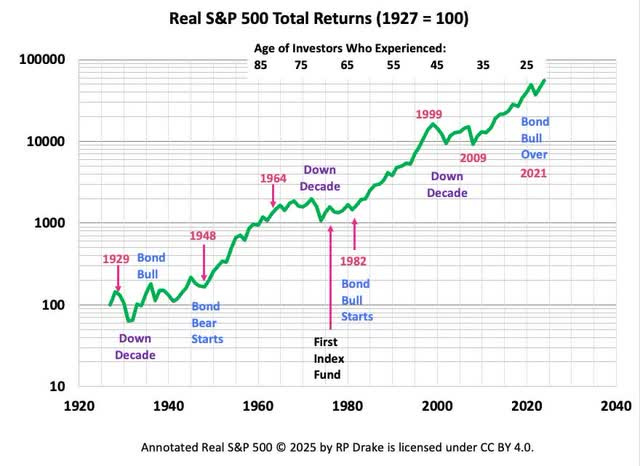

Or perhaps they are happy following the standard advice to hold a 60/40 portfolio using index funds and to do the archetypal 4% withdrawals, escalating with inflation. However, a thoughtful look at the real pricing of the S&P500 might give them pause. Down decades are common and we seem due for one now.

RP Drake

Why Earnings from Hard Assets?

My focus areas involve companies whose earnings come from the economic use of hard assets. To my mind, this is key.

A company offering services can see its products overtaken by the next generation, or just the next fad. Remember MySpace?

Or their management can make a bad decision, burning up shareholder capital. Often this involves debt-driven expansions, as we’ve seen with countless restaurant chains including Boston Chicken. It also can involve really dumb decisions, such as the one by Hertz to go all in on EVs.

A company offering products can easily find their products obsolete. Once mighty Intel (INTC) is struggling to cope with that today.

In contrast, well-managed hard assets are less vulnerable. Real estate assets retain value so long as they can be rented for more than operating costs.

This is not a sinecure. We have seen some malls and some office buildings become non-economic during the past decade. But more often troubled buildings are carrying too much debt and do have an economically viable future after that debt is quenched by bankruptcy.

Similarly, there is an enduring demand for energy, to power human activities. Energy transport systems (especially pipelines and associated infrastructure) serve that demand, are cheap to maintain, and rarely will become obsolete.

[And if you think renewables are going to displace that, then do some research. They will not.]

In those cases, too much debt can again cause trouble. Investors must pay attention to that.

I personally tend to avoid utilities. They do serve enduring demand but are often very impacted by local politics via state-level, public service commissions. And today they are adding a lot of leverage, adding risk.

Looking for Stability

Recall that the point here is to find companies that can be ignored for a year at a time, so that you can spend your time fishing and not investing. There is a great Warren Buffet quote relevant to this:

I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.

Of course, you don’t want to invest in one if you know an idiot is running it. But you want to be OK if it turns out, a year later, that one has been.

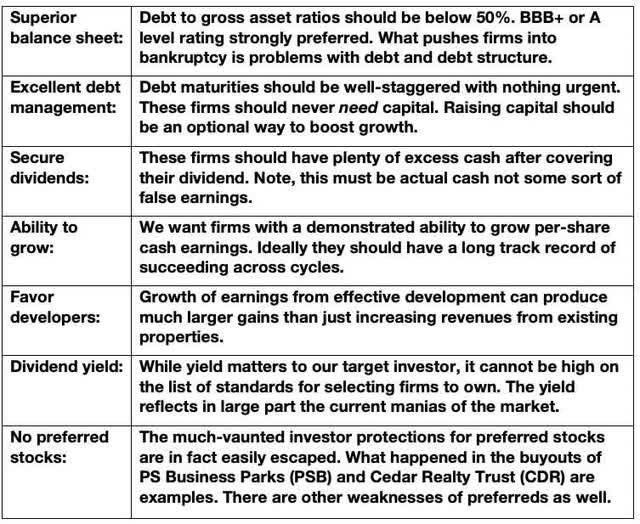

My criteria for finding such companies are these:

RP Drake

There are two connected kinds of risk for such a portfolio. First, a dividend might be cut, reducing your income. Or you might choose to sell for other reasons.

To assure that real income will remain above spending on timescales above 20 years, you need to start with surplus income. A surplus of 10% is sufficient for 21st-century rates of dividend cuts, and you get a lot more cushion going up from there.

The goal of this exercise is to choose companies that will not cut their dividend over the next year. Alas, I failed at that once in 2024 and another time in 2025.

Details are discussed further below. Notably, those two companies were each included despite some unease on my part. That should be a lesson going forward.