What RPD Bought And Sold In July 2025

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

My investing is focused primarily in REITs and Energy. These are niche markets often considered treacherous by the ignorant, but also prone to mispricing, which provides opportunity.

My goal is to invest only in firms I know well through deep study. Most of my investments have been in quality companies that were undervalued in the markets. Only a small fraction have been in riskier firms where I see good potential for stronger upside.

Recent Earnings

The Q2 earnings season is more than halfway done. That makes this a good opportunity to make some comments on firms that have reported to date. These are not intended to be comprehensive, but rather to reflect firms I follow for one reason or another.

Overall, these comments are not the result of close scrutiny of current financials. They are instead my take on the earnings releases in the context of previous detailed analysis.

Alexandria Real Estate (ARE): The life science property markets are starting to recover from their wave of oversupply. Alexandria turned in a solid quarter, sustaining occupancy and growing rents.

While all is not golden, there is no brewing disaster either. Despite the misleading financials they produce, the dividend is pretty safe. Occupancy would have to drop 700 bps to necessitate dividend cuts, which could theoretically happen but is highly unlikely.

This one will keep paying you quite well until those property markets recover. I own a lot of it.

EPR Properties (EPR): EPR is finally past the challenges and lumpiness produced first by the pandemic and then by the writers’ strike and by the Regal bankruptcy. Their current guidance is for growth of their FFOAA at 4.3% at the midpoint. This is excellent based on their business model and shows that at the moment there are minimal headwinds.

What’s more, the EPR price is high enough that they could issue stock and invest accretively in new properties (at the high cap rates they target). Still they are not at a place to grow FFOAA very fast.

The EPR dividend today is less than 100 bps above that of NNN REIT (NNN). It should be that way, because EPR holds riskier properties and is less diversified. This aspect is why they are in my medium-risk bucket.

I own EPR and see it as a solid income stock but don’t expect much upside.

Camden Property Trust (CPT): Earnings numbers for this sunbelt-focused apartment REIT are flat YOY. Occupancy is up incrementally.

They have done well as new supply passes the peak. The coming period of undersupply should drive strong rent increases.

Impressively, they have 6 development communities coming into the approaching demand surge. I hold CPT to benefit from that demand surge.

AvalonBay (AVB): This REIT is focused primarily on coastal cities, although they are slowly adding sunbelt exposure. They had this to say:

Our balance sheet is in terrific shape, having raised $1.3 billion of capital year-to-date at an initial cost of 5.0%. And attractive cost of capital relative to our uses and particularly to yields of north of 6% on new development projects.

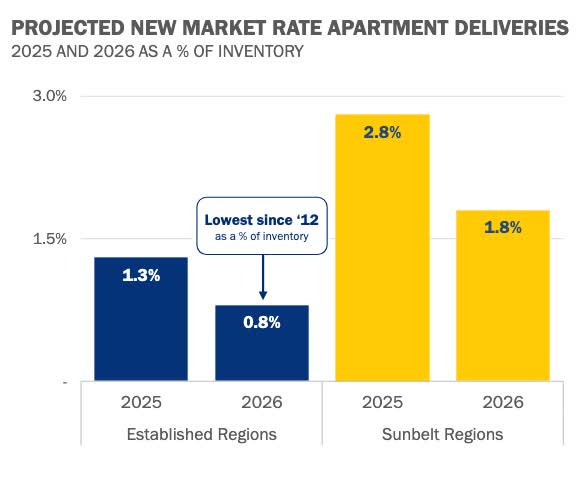

Avalon Bay showed this very interesting plot:

What intrigues me is that deliveries in 2026 will be down by about a third in both their established (i.e., coastal) regions and their sunbelt regions. Also considering the narrative about sunbelt growth, the difference between the two types of region surprises me.

What is really significant is their projected initial stabilized development yields of 6.5%, 100 to 150 bps above underlying cap rates. They are very active in development, putting 18 communities into lease-up from later this year through 2027.

Both asking rents and bad debt projections are now worse than the initial outlook, but not enough to seem crazy to me. In this unhappy market, the stock has dropped 10% over the past week.

I don’t own AVB, but would not mind doing so.

Regency Centers (REG): Regency is one of my favorite REITs at the moment. Looking at their press release, progress is excellent as expected. Two notable items:

1. "As of June 30, 2025, Regency's in-process development and redevelopment projects had estimated net project costs of $518 million at a blended estimated yield of 9%." That is a big number for development projects by any REIT.

2. Guidance for the upper limit on same-store NOI growth has been lifted to 5%. Very few REITs will manage that.

I am happy to own REG.

The following contains updates throughout; much of it is a repeat of my last monthly update.

My Context

My secure income covers 2/3 of my spending budget. At the moment, the other third comes from various paid work.

The secure income includes social security, a pension, and a collection of annuities. Nearly all those sources have escalators of either 2% or inflation.

My dividends from “Go-Fishing” positions — very secure firms likely to grow dividends at least with inflation — also could cover more than a third of my spending. So if work stopped or when it stops, current spending is covered without drawing down the portfolio.

In the meantime I will use those dividends to grow the portfolio and to provide early legacy spending. That will include some early inheritance funds to the kids each year.

The rest of the portfolio pays additional dividends (though not from all positions). These also will help grow the portfolio.

My portfolio today includes four buckets.

There is an income bucket, which includes mainly “Go-Fishing” stocks. These are from firms that only need monitoring once a year, if that.

There is a “medium-risk” bucket, pursuing gains and income from market mispricing of blue-chips or other quality companies and holding high-yield positions for which I have some concerns about the dividend.

There is an upside bucket, holding small, speculative positions for which I see the potential of gains of 50% or more.

There is an illiquid bucket of long-term, private investments made years ago, valued at my cost. It stands at 13% of the portfolio value.

Most often I hold little cash. But at the moment I have 6.0% in cash. This is discussed further below.

An addition to my income bucket this month is that I bought some TIPS. They can be a good choice in the event of serious stagflation.

Dividends are the goal but we also know that chasing yield is a losing game. And we know that growth of portfolio market value can be a path to affording larger total dividends.