What RPD Bought And Sold In November 2025

Important Announcements:

Just a quick heads up:

We will share our fourth Top Pick for 2026 on Friday. Stay tuned!

We expect to interview the management of HASI very soon. Let us know if you have any questions for them.

I will host another live Webinar in a few weeks. Let me know if there are any specific topics that you would like me to cover.

--------------------------------------------------------

What RPD Bought And Sold In November 2025

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series, as it often discusses many of our individual holdings.

A tumultuous earnings season finally ended, with remarkably little impact on my portfolio.

My investing is focused primarily on REITs and Energy. These are niche markets often considered treacherous by the ignorant, but also prone to mispricing, which provides opportunity.

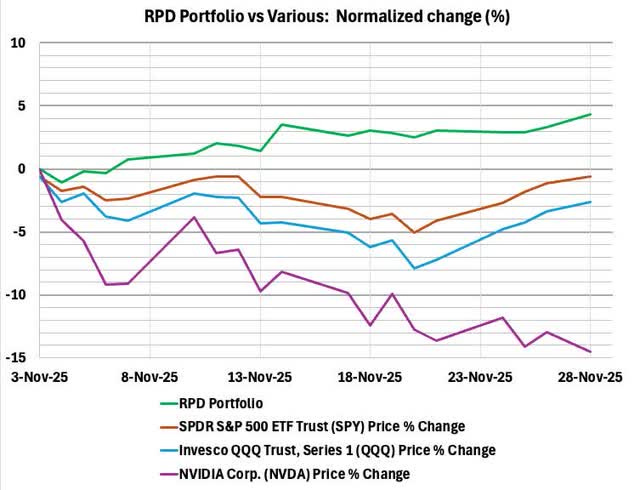

My goal is to invest only in firms I know well through deep study. Most of my investments have been in quality companies that were undervalued in the markets. Only a small fraction have been in riskier firms where I see good potential for stronger upside. The active portfolio reached a new high several times in September but drew back just over 4% across October. Then it recovered most of that during November, as you can see here:

RP Drake

What satisfies me most is that the very secure portion of my dividends would more than cover my spending needs if all paid work stopped.

Markets this Month

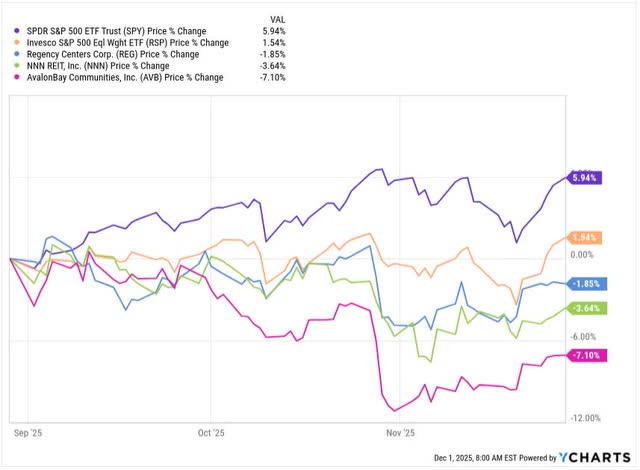

In contrast to a lot of action in response to earnings releases in October, November saw gradual price increases in a lot of REITs and energy investments. Here is a comparison of what three REITs did vs the cap-weighted (SPY) and equal-weighted (RSP) S&P 500:

YCHARTS

It may be that the gradual price increases for NNN REIT (NNN), Regency Centers (REG), and AvalonBay (AVB) reflected the expectation of further rate cuts by the Fed. Having dropped more than 5% in response to their earnings call, AVB made most of that back.

My view is that these REITs and many others are not undervalued by a lot, but (with reference to my concerns below) they are really good defensive investments, for income and for appreciation over time. Looking ahead, I would like to own more REITs.

Not my favorite November

Like many athletes, I was a bit crazy. Among other sports, I used to row a single shell, a brutal activity. Yet my most satisfying days were the ones where, at the end of my row, I would crawl onto the dock and have to lie there for several minutes before being able to move.

Health issues put an end to that, and to professoring, and dumped me into investing. Here at the end of November, I feel just as beaten up by events, but far less satisfied.

This is despite the fact that my portfolio “outperformed” the major indices in November, as you can see above. Doing that is not a focus or a goal for me.

One reason for feeling beaten up is that much of this year has been about playing defense, which is not my natural emphasis. What I want to be doing is buying quality stocks at far below fair value, but this is getting harder in today’s environment.

What to do?

I find myself hesitant to sacrifice quality and buy stocks that have dropped a lot in price. This approach may work, but my desire is to see fundamental value.

For me, instead, times like these spur a focus on defense. So last summer, I thought at length about various options. I ended up buying some long-dated TIPS, which will produce big profits in the event of sustained stagflation.

My attention this fall turned to the incredible current excesses in the growth of AI infrastructure. I purchased some long-dated, inexpensive puts that might pay off handsomely (but it does not matter if they don’t).

Then, at the end of October, came the disastrous earnings call from Alexandria Real Estate (ARE). It was truly bizarre, with management seeming to beg their Board in public for a substantial dividend cut.

We await their Investor Day on December 3. Meanwhile, last week I read the JLL Q3 life-science, property-market report. It is significantly more negative than the one from Q1 was, in the sense of expecting that it will take more time for the sector to recover. My view remains that there is and will be a lot of value in ARE above the current stock price, but we may be looking at 5 years to realize it.

Then on top of that, the repeated “going concern” warning by Orion Properties (ONL) reflected the status of their revolver. The final maturity date is in May and they do not have the cash to pay it off. In my view, this will not end well for common shareholders. I sold and took the loss.

So I’m tired of focusing on defense, and two of my upside positions imploded in close succession. Despite all that, my current portfolio is up 9% YTD. So why am I complaining?

My message to myself: “Patience, Grasshopper.”