Earnings Update: Retail REITs (Q3 2025)

Important Announcements:

Just a quick heads up:

We will share our third Top Pick for 2026 on Friday. Stay tuned!

We expect to interview the management of HASI very soon. Let us know if you have any questions for them.

I will host another live Webinar in a few weeks. Let me know if there are any specific topics that you would like me to cover.

------------------------------------------------------------------------———-

Earnings Update: Retail REITs (Q3 2025)

The status of retail real estate has not changed significantly since our Q2 2025 Earnings Update for Retail REITs.

Here’s how we summarized the current situation in that report:

Occupancy is historically high, as vacancies in high-quality centers are quickly backfilled, typically at double-digit lease-over-lease rent increases. Essential retailers continue to enjoy steady sales growth, foot traffic, and rent coverage ratios. And the development pipeline for retail real estate remains extremely limited, as development economics remain unfavorable for new construction.

... Currently, the forward trajectory of retail real estate seems to be highly dependent on the broader economy, trade policy, and how retailers respond to a stabilization in tariff rates.

Of course, the US Supreme Court is currently considering a legal challenge to President Trump’s sweeping implementation of tariffs via the IEEPA authorization. If they strike down this tariff authorization or significantly curtail it, then there may be more trade policy chaos and uncertainty for a while, which could further delay a rebound in retail leasing demand.

As of now, the status of US retail real estate could be summarized as “strong but stagnant.”

Like the US labor and housing markets, there is no material weakness to speak of, but there is also extremely little turnover or churn, which in turn limits upside for retail landlords.

Some charts will help to illustrate this.

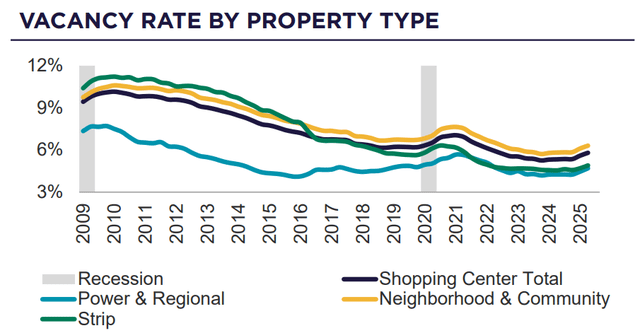

The vacancy rates for all sub-sectors of retail have rebounded slightly over the last year, but they remain near their lows over the last two decades.

Cushman & Wakefield

Strip centers (your average, mid-sized, open-air shopping center with 1-2 anchor spaces) have staged an extraordinary turnaround since the peak of the Great Financial Crisis pain in 2009, going from over 11% average vacancy to about 5%.

Power/regional centers (larger open-air shopping centers with multiple anchors) have always enjoyed the highest tenant demand, and since they require a large amount of land in highly populated areas, there are significant barriers to entry preventing competing centers from being built.

Neighborhood/community centers (smaller and single-anchored or unanchored open-air centers) are the opposite of power centers. They require less land, and thus more of them can be built. Since they are more numerous, they create more competition for tenants and tend to experience the highest level of vacancy.

So, each sub-sector of retail remains near historically low vacancy rates, which signifies the strength of the sector right now.

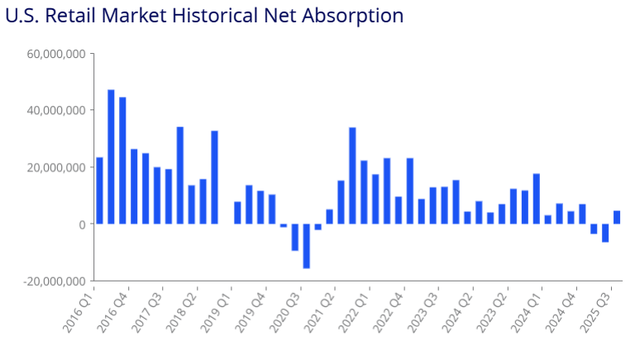

At the same time, net absorption (move-ins minus move-outs) has been very muted over the last year or so.

Colliers

The first half of this year saw some occupancy loss for the first time since the pandemic in 2020, but net absorption rebounded back into slightly positive territory in Q3.

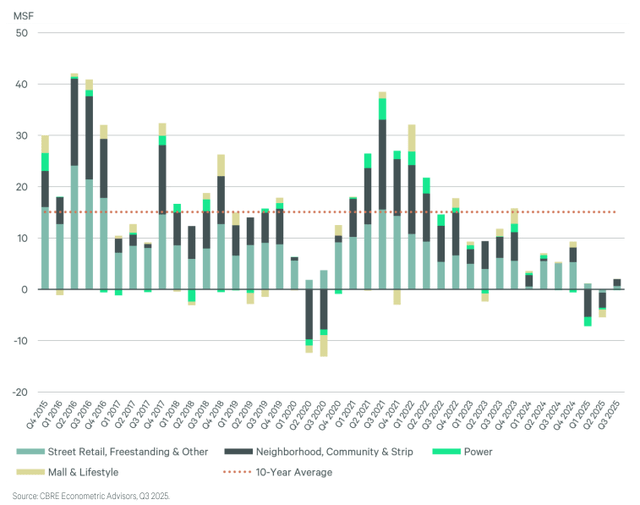

Here’s a breakdown of net absorption by sub-sector from CBRE, which shows just how slight the Q3 positive net absorption was.

CBRE

This chart also adds in malls as well as “street retail” (ground floor shops in mixed-use buildings in urban areas) and freestanding retail, which would typically be categorized as net lease. Most of this category is freestanding/single-tenant retail.

About half of total retail leasing is typically for this freestanding space, but that demand has almost completely disappeared this year.

Most of the negative net absorption experienced in the first half of this year was concentrated in shopping centers, where weak tenants like Party City, Big Lots, and Joann’s were closing stores.

Most of these mid-sized box spaces will be backfilled at nice rent uplifts, but broader demand for space has definitely cooled in recent quarters.

Part of the reason for that is limited available space in desirable centers. If that reason alone accounted for the drop in net absorption, then rent growth would remain strong and getting stronger.

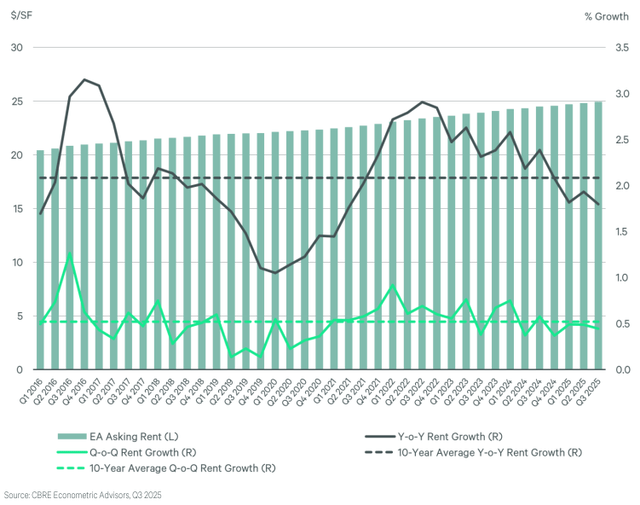

But rent growth has actually been gradually softening since its post-pandemic peak in 2022:

CBRE

This suggests that underlying demand has softened. It isn’t merely a problem of too little available space.

The most likely culprits for the softness in retail tenant demand are tariffs and financial fragility among low- to middle-income consumers.

Hence why we see centers catering to affluent consumers performing better right now than the average shopping center.

Perhaps the biggest positive for the retail sector continues to be the lack of new supply coming to market.

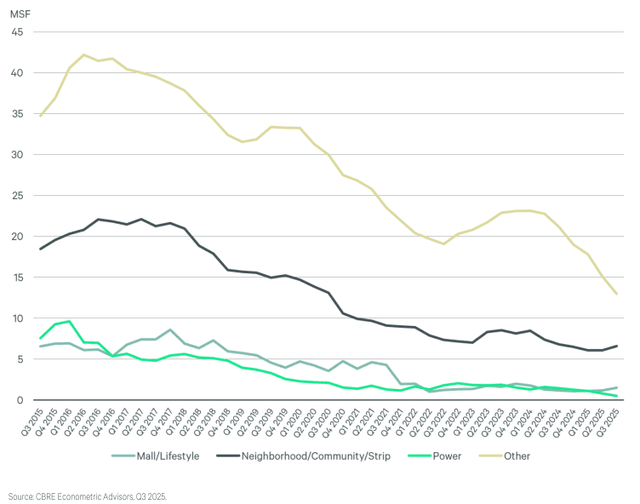

Here’s a chart showing the square footage (in millions) of the major sub-sectors of retail currently under construction:

CBRE

“Other” is predominantly freestanding single-tenant buildings.

Virtually zero new malls or power centers are being built today, while construction of shopping centers remains near its lowest point in a decade and development of freestanding retail buildings appears to be collapsing.

Unlike other commercial real estate sectors like office, the reason for this muted construction of retail space is not low occupancy and weak demand. It is that rent rates have not risen enough yet to justify building new space given current construction and capital costs.

A material drop in construction costs is unlikely, and a material drop in capital costs would require interest rates to significantly decline. The latter would likely require a recession, which itself would suppress the development pipeline.

In other words, while retail demand is muted, the almost complete lack of new supply coming to market greatly increases the sector’s stability and resilience.

To quote Cushman & Wakefield:

There is virtually no supply risk in retail over the next several years, ensuring minimal disruption to occupancy and income streams for investors.

With that, let’s get to the Q3 2025 earnings updates for our five retail REITs: