MARKET UPDATE - Disinflation Is Likely To Resume In 2026

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent “Portfolio Review“ was shared with the members of High Yield Landlord on January 5th, 2026. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

MARKET UPDATE - Disinflation Is Likely To Resume In 2026

After a year and a half period of rangebound CPI inflation, the post-COVID disinflationary trend appears poised to resume in 2026.

Now, we (by which I mean Austin, HYL’s macro analyst) continue to lick our wounds from missing just how big the post-pandemic inflationary surge would be. We, along with a lot of other economists and forecasters, completely underestimated how much inflation would be catalyzed by the wave of fiscal stimulus and money supply growth during the pandemic.

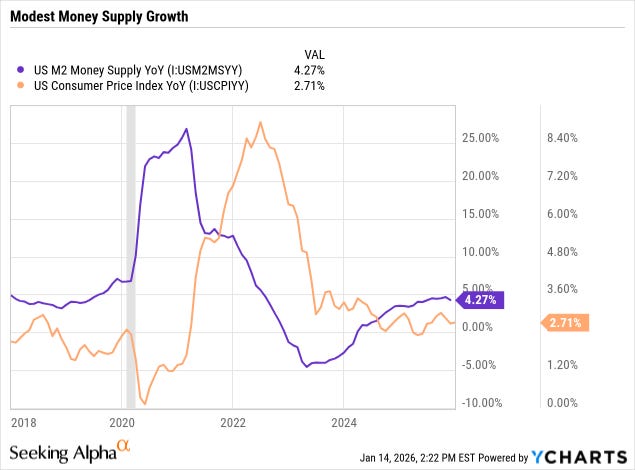

We learned valuable lessons from that experience, and we won’t repeat those mistakes. Our biggest mistake was paying too little attention to the massive growth in the money supply.

It’s rather obvious, if you think about it, that a rapid increase in dollars circulating within the economy would result in price increases. It’s more money chasing too few goods.

Believe us when we say: We are now quite focused on the money supply as a key forward inflation indicator.

And right now, that forward indicator is consistent with low inflation.

With nominal GDP growth (real GDP + CPI) still over 5%, there is no upward pressure on inflation being exerted by growth in the money supply. If anything, there is probably very slight downward pressure on inflation from M2 growth that is lower than nominal GDP growth.

The most recent inflation data, both from the government and from private sector sources, confirms the disinflationary trend.

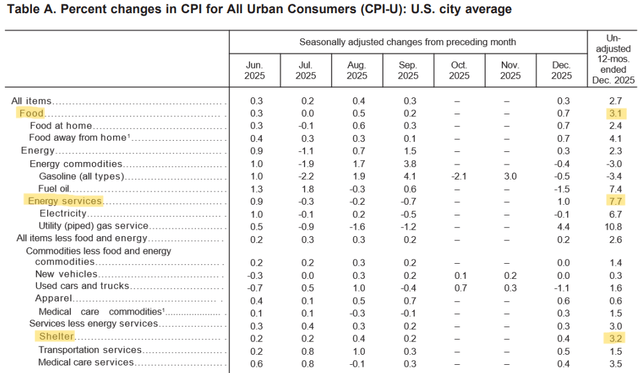

The December CPI report painted a picture of mostly tame inflation in the US:

Bureau of Labor Statistics

Food price growth of 3.1% is over the 20-year average of about 2.5% but is by no means out of control.

Energy is a mixed picture, with gasoline prices low and in a multi-year downtrend but utilities (most importantly electricity) high and in an uptrend.

Shelter disinflation has continued over the last several years, and all indications suggest that it is likely to continue into 2026.

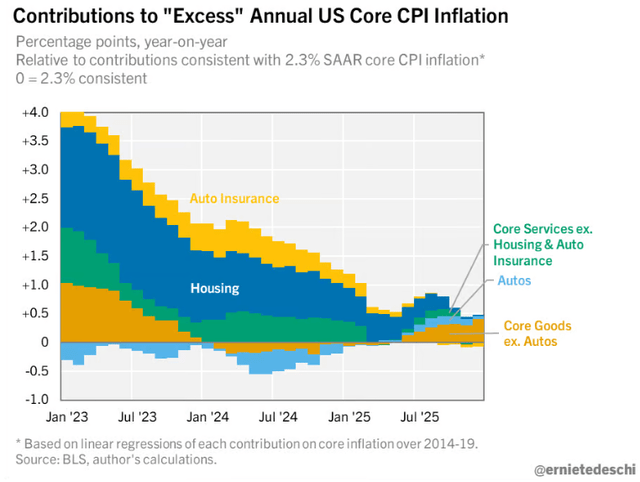

This helpful chart from January 2023 through December 2025 shows the CPI contributors to “excess” inflation (above the long-term average of 2.3%), and it tells an interesting story.

Ernie Tedeshi

Up until about the middle of 2025, remnants of the post-COVID stimulus-fueled inflation continued. Housing, auto insurance, and services inflation were coming down but remained higher than usual.

Then, over the course of 2025, as tariffs gradually trickled down from importers to businesses to consumers, price growth for all sorts of goods, including cars, picked up. At the same time, excess inflation for housing, auto insurance, and other services fizzled out.

While tariff costs are being passed through to US consumers, we do not believe tariffs have the power to offset the disinflationary trends elsewhere in the CPI and cause another uptrend in the index.

Recent research from Deloitte indicates that only about 10% of total consumer spending is tied to tariff-susceptible imports.

If that is accurate, then 90% of consumer spending is not directly impacted by tariffs.

There will undoubtedly be second- and third-order impacts of the tariffs, including on consumer prices, but it will take years for those to fully emerge.

Truflation corroborates this view. As of mid-January, its year-over-year inflation gauge has fallen well below 2%:

Truflation

This is partly due to base effects. (You can see that last January, Truflation showed inflation over 3%, so current readings have a high comparable.)

But it is not merely due to base effects. As we will see below, there is plenty of evidence to corroborate the disinflationary thesis.