PORTFOLIO REVIEW - Q4/2025

Table of Contents

Opening Notes

Changes Portfolio Holdings

Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

1. Opening Notes

Happy New Year! I wish you all a lot of success, health, and happiness going into 2026.

It is wild for me to think that this marks the eighth New Year since launching High Yield Landlord back in 2018.

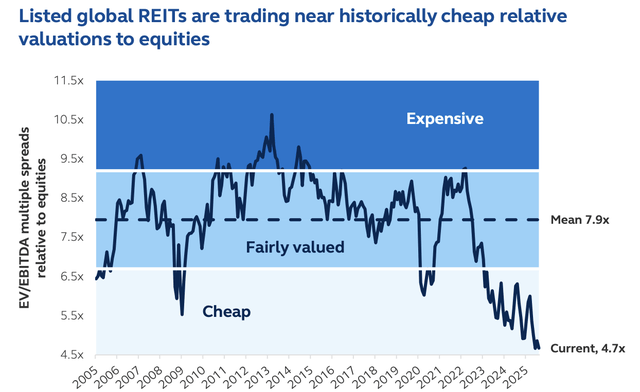

Looking back, it is safe to say we haven’t been particularly lucky. This last seven-year period has been one of the worst in REIT history, with the pandemic first triggering a major market crash back in 2020, which was then shortly followed by the historic surge in interest rates. This led to a multi-year bear market and pushed REIT valuations to historic lows.

More sophisticated long-term-oriented investors will know that these are the best times to be accumulating positions, while more short-term-oriented investors, particularly newer ones, will gradually lose patience and move on to chasing other, more popular investments.

Despite the challenging market conditions, we have kept following our simple strategy of gradually buying more shares of undervalued REITs, week after week, as we remain more confident than ever in our investment thesis.

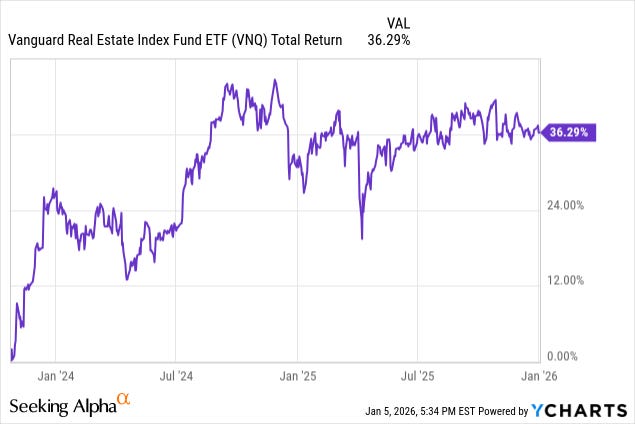

The pandemic-related stimulus checks and supply chain disruption led to a one-time surge in inflation and interest rates, which hurt the REIT sector. Since then, we have been gradually returning to the pre-COVID environment, with the Fed already cutting interest rates 6x, pushing REITs nearly 40% higher on average:

As a result, our steady accumulation of recent years has now started to pay off, but we think that this is still just the beginning, and 2026 could be the year when REITs finally fully recover from this bear market.

There is a simple reason for this.

I am convinced that AI is going to be the most powerful deflationary force of the century, and if that’s true, it will have profound effects on interest rates and the relative attractiveness of long-duration assets such as REITs.

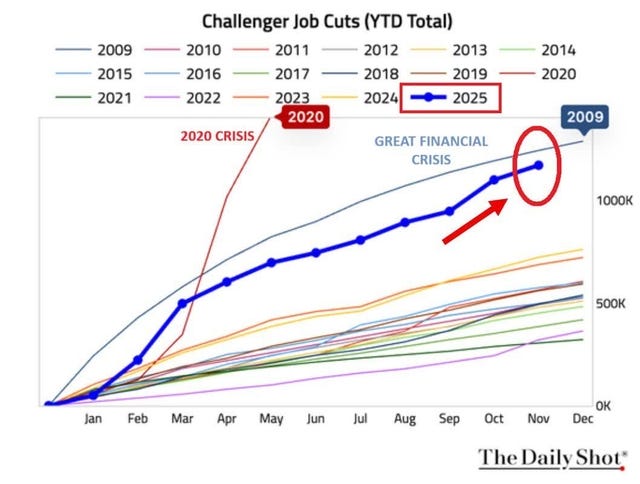

Just consider that last year, we had as many job layoff announcements as during the Great Financial Crisis:

Some of this has to do with trade policy uncertainty, but I believe that an even bigger factor is the AI revolution, which is now eliminating more jobs than it creates. This is evident if you look at the surging unemployment rate of fresh college graduates, who are the easiest to replace with AI:

This explains why the Fed cut interest rates 3 times in late 2025, despite fears of a potential tariff-induced surge in inflation. The labor market is rapidly deteriorating, and the Fed needs to do something about it.

Importantly, we are still in the early phases of this revolution, with many more jobs likely to be eliminated in 2026, 2027, and beyond. While AI promises significant long-term wealth creation, we risk facing a painful transition period, with far more people losing their jobs and struggling to find new ones in the near-to-mid term.

This would be highly deflationary and likely result in much lower interest rates across the board. The market has not recognized this yet, and that is why I think that REITs offer a lot more upside potential from here.

But there’s one small caveat: not all REITs will benefit equally as much. If our expectations come true and we face a difficult transition process with rising unemployment and a weakening consumer, some REITs will undoubtedly suffer from that. Think about hotel, office, or mall REITs, for example. Such cyclical assets could face declining cash flows in such an environment, negating the potential benefits of lower interest rates in some cases.

However, you should remember that most REITs are today invested in defensive property sectors that are recession-resistant. Hotel, office, and mall REITs only make up about 10% of the REIT market today.

Most REITs now own things like cell towers, data centers, e-commerce warehouses, self-storage, apartment communities, single-family homes, grocery-anchored strip centers, net lease properties, farmland, medical office buildings, senior housing, skilled nursing facilities, etc.

Most of these assets will do just fine in a recession. Their demand is not particularly cyclical, and their cash flows are typically protected by long-term leases during times of economic uncertainty.

Therefore, I would expect most REITs to greatly benefit from this scenario as interest rates return to lower levels as a result of the AI revolution.

But even if I am wrong, and interest rates remain where they are, there are plenty of high-quality REITs that are priced to deliver double-digit total returns, all while throwing off meaningful income, and providing valuable diversification in an increasingly risky environment.

So heads, I win big. Tails, I still win, just not as much.

If I did not believe that, I would not invest 50% of my net worth into these companies. I could just as well run this same newsletter with a much smaller fraction of my portfolio invested in REITs, and most of you likely wouldn’t care.

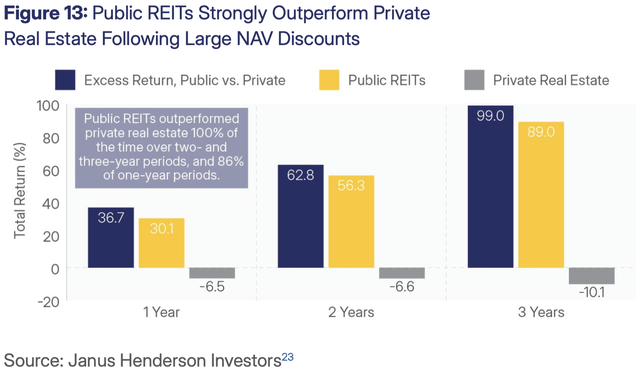

The reason why I invest so heavily in this sector is simply that I cannot think of a better risk-to-reward in today’s market. Buying real estate at a steep discount via REITs has always paid off handsomely over the long run, and I don’t think that this time will be different:

The recovery from this bear market has, of course, taken longer than we had anticipated, but 2026 could be the year when this finally changes, and we hope to accumulate a lot more shares at these discounted levels before REITs finally recover.

We just recently shared our Top 5 Picks for the new year, and over the coming weeks, we expect to share another 5 “honorable mentions”, so stay tuned for that:

Finally, I want to remind you that our book, The REIT Advantage, has just been released, and we are giving it for free to all members of High Yield Landlord. I strongly encourage you to take the time to read it, as I truly believe it can help you make better investment decisions in 2026. You can claim your copy by clicking here.

Happy New Year!

==============================

2. Updates to Our Portfolio Holdings:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.