Top 5 Picks For 2026 - Pick #2 (Incl. Trade Alert)

Quick Note:

As the end of the year is approaching, many of you have been asking me to do a new series highlighting my Top 5 Picks for 2026.

I am personally not a fan of these series because I cannot predict how any REIT will perform over such a short time period, and even if I thought I could, I still would not want to invest based on such a short-term horizon. It encourages a short-term mindset, favoring companies with immediate catalysts and ignoring other long-term opportunities whose full potential may take more than a year to play out.

Moreover, it is impossible to pick 5 REITs that suit everyone, as the selection would depend heavily on your risk profile and objectives. As an example, Alexandria Real Estate (ARE) could be a Top 5 Pick for someone with a higher risk tolerance and long-term horizon following its recent crash. However, it certainly wouldn’t make the list of investors seeking stable income with lower volatility. This makes it very challenging to put together a list of Top Picks.

Finally, under no circumstance would I want to hold just 5 companies. Risk factors will eventually play out, leading to inevitable losses. For example, RCI Hospitality (RICK) crashed this year due to allegations of tax fraud. Very few people, if any, could have predicted this. Such risks exist for every company, and that is why diversification is so crucial. 5 companies just isn’t enough.

With all of that in mind, this new list will focus on what I view as the best risk-to-reward going into 2026, considering their near-term upside potential, and based on my own objectives and risk tolerance.

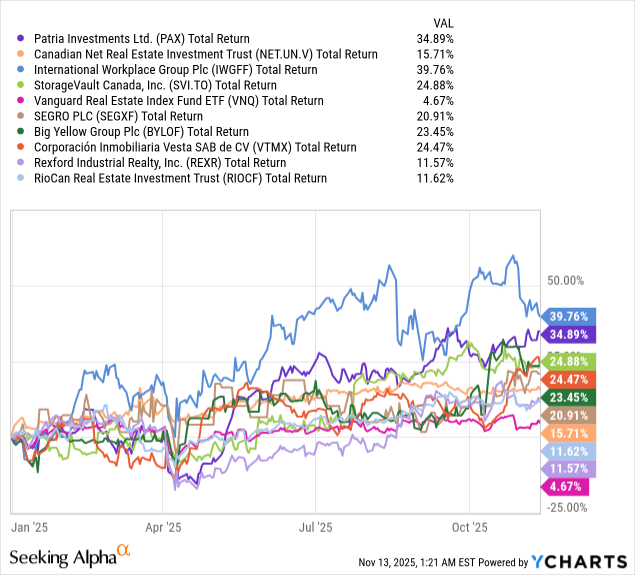

Before getting started, let’s still quickly review the results of our Top 5 Picks for 2025 series, which we posted a year ago.

As a reminder, we initially shared 5 companies, and then added another 5 as “honorable mentions”. Here is the entire list, along with links to our investment theses:

Top 5 Picks For 2025 - Part 3: International Workplace Group

Top Picks For 2025 - Honorable Mention #2: Rexford Industrial Realty

All of them, except one, significantly outperformed the broader REIT market (VNQ). The one missing is, of course, RCI Hospitality (RICK), which crashed about 50% after it was announced that they were charged with tax fraud in New York State.

Ignoring RICK, nine out of ten of our picks earned market-beating returns, with the weakest performer (REXR) earning 2x higher returns and the strongest (IWG / OTCPK:IWGFF) earning about 10x higher returns than the VNQ ETF. Fortunately for us, that strongest performer happens to be our single-largest investment, representing 13% of our Core Portfolio.

While I remain very bullish on all of these companies, my selection would be very different going into 2026, especially following the recent market volatility.

Last week, we shared the first pick of this list, and you can read that article by clicking here.

Today, we switch to our second pick, which is Blue Owl Capital (OWL). Below, we share our latest thoughts on the company and explain why we are happy to buy the dip at these levels.

Top 5 Picks for 2026 - Part 2: Blue Owl Capital

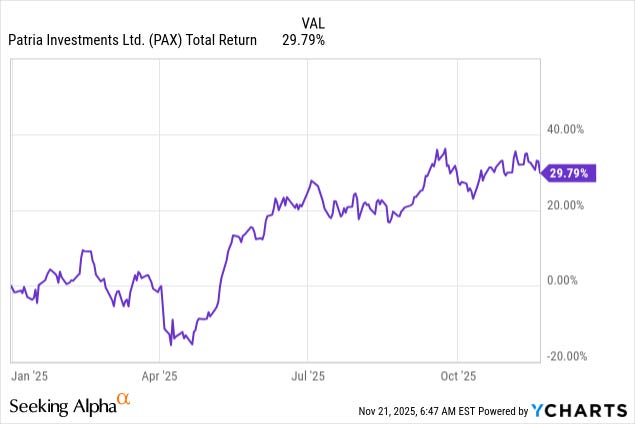

One of our Top Picks for 2025 was Patria Investments (PAX), and it has nicely recovered since then, resulting in significant market outperformance:

We remain very bullish on it even at these levels and expect a lot more upside over the coming years.

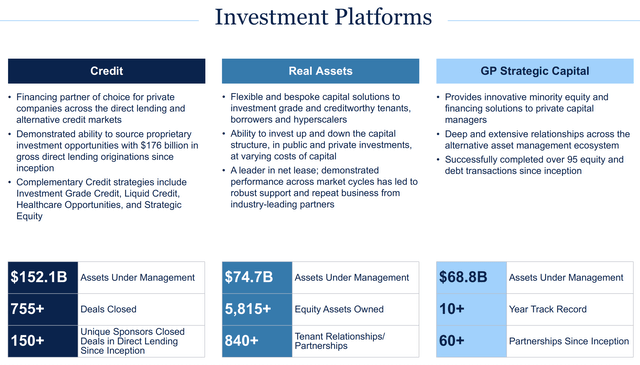

However, we think that an even better opportunity amongst asset managers is Blue Owl (OWL) right now.

It has recently sold off along with most other asset managers, especially those that focus on private credit. Blue Owl is one of the leaders in this space, so it sold off a bit more than its peers:

The market fears that cracks are starting to form, and private credit losses could spike from here as the economy deteriorates and more companies file for bankruptcy.

But here’s the thing: this is just a media narrative at this point.

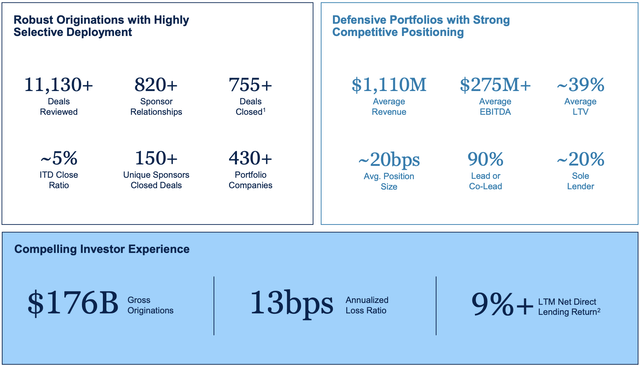

Blue Owl’s management has said loud and clear that their credit portfolio continues to perform just fine. Samuel Smith, who runs our sister service, High Yield Investor, recently had the chance to interview Blue Owl, and here is a brief summary of what they said about their private credit business:

Summary: Every so often, public markets become very narrative-driven. If you’re around long enough, you see repeated instances where price detaches from reality. We think that’s where we are today. Headlines are loud, and the stock price has diverged from fundamentals. That creates opportunity, similar to when our stock price plunged to $10 a few years ago. From a fundamental perspective in our private credit business, the headlines have focused intensely on a handful of situations. Some appear fraudulent, some aren’t even private credit–related, and the rest are extremely small in the context of the broader market. Among high-quality direct lenders, including us, we’re not seeing systemic stress. In our portfolios, revenue and EBITDA growth remain strong, non-accruals are low, defaults are low, losses are low, and our watch list is not expanding. There’s nothing suggesting a thematic crack or systemic problem. For the few isolated issues that exist, we don’t see anything broader. I’m happy to go deeper if you want.

(By the way, if you want to read the full interview, Seeking Alpha is currently running a special Black Friday sale for our sister service, High Yield Investor. This is how I managed my non-real estate investments, and you can sign up now with an extra 20% discount and a 30-day money-back guarantee - click here to learn more)

To be clear, this does not mean that Blue Owl won’t face any losses. They certainly will, as this is part of the business.

But as of right now, nothing suggests that conditions would be materially worsening. On the contrary, the company has repeatedly expressed strong confidence over the past weeks when questioned (see here, here, and here), and we think that they are right to be confident when you consider that:

Their loans are primarily senior unsecured with low-30s LTVs, meaning that a lot needs to go wrong for them to lose money.

Their borrowers, while private, are largely big, profitable companies with resilient businesses in sectors that don’t generally experience rapid changes from one year to the next.

Their loans have relatively short terms at 3-4 years, reducing the risk of relying on borrowers who gradually degrade over the long run.

They did not suffer major losses even during the pandemic or the period of rapidly rising inflation and interest rates that followed. Their average annual loss rate has historically been just 13 basis points. Even at a multiple of that, the returns of this strategy would remain very attractive.

Finally, it is worth remembering that Blue Owl, unlike many of its peers, manages primarily permanent capital, meaning that investors cannot simply redeem it from one day to the next. It results in much more consistent and predictable fee income.

Again, this is not to say that Blue Owl won’t face any losses, but there appears to be a major disconnect between the fundamentals of the business and the current media narrative, focusing on a handful of bankruptcies, which are not representative of the broader market.

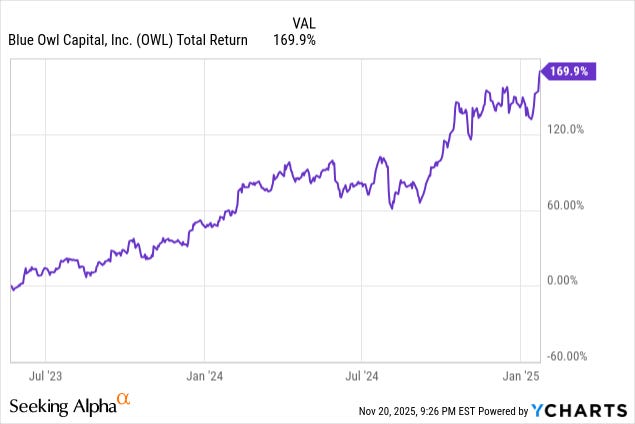

Similarly, Blue Owl sold off in 2022/2023 when interest rates surged, and this was expected to lead to a wave of defaults. That of course didn’t happen, and Blue Owl then strongly recovered, nearly tripling in value over the next year and a half:

The market always has something to worry about, and negative media headlines get a lot more clicks.

We think that this time, once again, the market has likely overreacted, and we expect to see a strong recovery over the coming years as Blue Owl keeps growing its cash flow at a rapid pace.

In fact, the company reaffirmed its guidance for 20% distributable earnings per share growth over the next half decade on their recent earnings call, as well as in Samuel’s recent interview.

One of the key reasons why they are so confident in their rapid growth prospects is their AI infrastructure business, which is now scaling at a rapid pace.

There has been a lot of very positive news on this front lately, but this has gotten overshadowed by the recent private credit fears.