MARKET UPDATE - Where The Economy Stands At The Beginning Of 2026

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent “Portfolio Review“ was shared with the members of High Yield Landlord on January 5th, 2026. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

MARKET UPDATE - Where The Economy Stands At The Beginning Of 2026

Forecast: Severe chart storm headed your way. Prepare for lots and lots of charts.

As we wade into 2026, we’d like to provide a detailed snapshot of where the US economy stands, and we have a bevy of charts to help us illustrate this.

The “too long / didn’t read” version is this:

Economic growth has been surprisingly resilient, and it will likely continue to chug along at a low but steady pace unless there is an unforeseen shock.

Growth is being driven primarily by affluent consumer spending and AI infrastructure capex, both of which appear poised to continue unabated.

Tariffs have been less disruptive than initially feared, largely because of import workarounds and resilient affluent spending.

The US stock market is in the midst of a rare technology boom that renders major indices top-heavy and expensive, but earnings growth keeps the party going.

The combination of a few more Fed rate cuts and elevated levels of “cash on the sidelines” will likely fuel a rebound in REITs and other income equities in the near future.

Let’s dig in and see what the charts have to show us.

Resilient Growth Picture

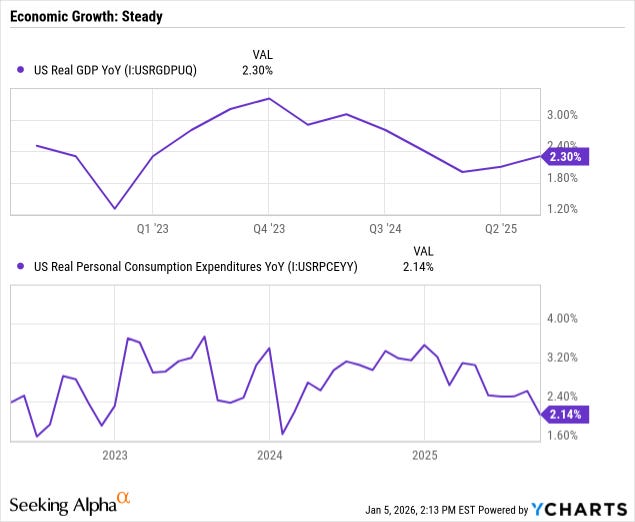

Economic growth in the US has been surprisingly solid in recent years.

Since mid-2022, which is when the post-COVID, stimulus-fueled boom ended and interest rates began rising, both real GDP growth and real personal consumption growth have been fairly resilient.

These are coincident indicators of the health of the economy. GDP and personal consumption only trend down as the economy is sliding into recession. So we don’t see these charts as a forward indicator.

But as backwards-looking and coincident indicators of the economy, we can see that both have been quite steady. Real consumption has slid somewhat over the course of 2025, but that may be due to tariff-related price hikes.

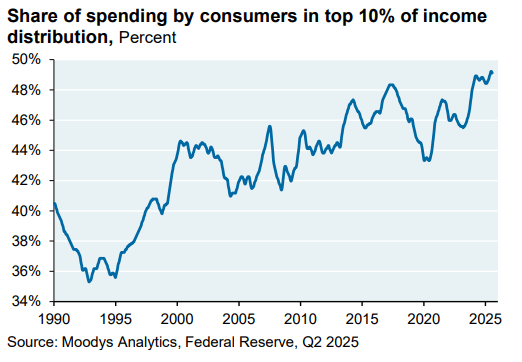

One big reason why the economy and consumption (which accounts for 2/3rds of US GDP) have been so resilient is because a huge portion of them are driven by the top 10-20% of households by income.

The top 10% of households account for almost 50% of total consumer spending.

JP Morgan - Eye on the Market

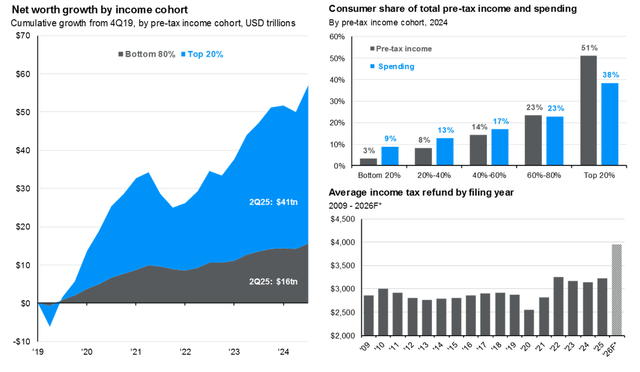

As the US economy veers further and further away from manufacturing and more into technology, finance, and services, the highest skilled workers in these fields command higher and higher wages.

Furthermore, since the highest income households own the lion’s share of equities, the stock market’s strong performance over the last five years or so has boosted the wealth of the top 20% far more than that of the bottom 80%.

JP Morgan - Guide to the Market

Notice in the chart on the top right above, the top 20% of US households earn a little over half of total pre-tax income but account for only 38% of total spending (still a considerable amount!). This is partially because of taxes but also because the rich tend to save and invest more.

The bottom 60%, according to this data from JP Morgan, account for a greater level of spending than their respective shares of pre-tax income. That doesn’t necessarily mean they spend more than they earn, because the size of these two numbers are not necessarily similar.

Nevertheless, the chart is a good illustration of why we’ve roughly split American consumers into the two broad categories of the “Paycheck-to-Paycheck” class (bottom 60% of earners) and “Affluent” class (top 40% of earners).

The consumption of the top 40%, especially the top 20% and especially the top 10%, is a big reason why US economic growth has become so steady and resilient.

As long as the American affluent are employed, and as long as the stock market is appreciating, they continue to spend.

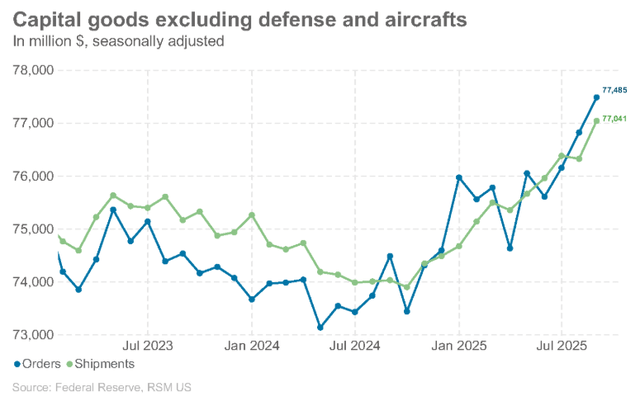

The other major driver of steady economic growth over the last several years has been AI infrastructure capex and all the second- and third-tier spending that goes along with it.

Daily Chartbook

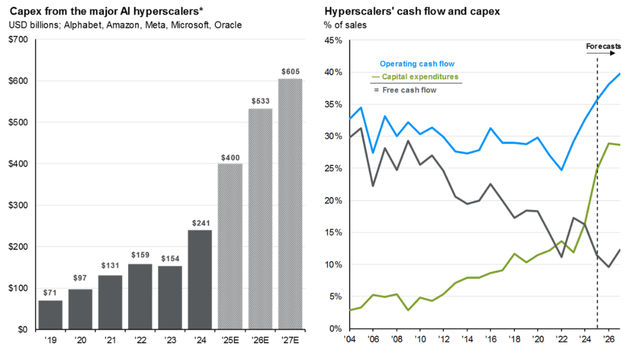

The locus of AI infrastructure is the data center, where server racks and semiconductors are stored. Nvidia’s (NVDA) CEO Jensen Huang calls them “AI factories.” These are the facilities housing the massive amounts of digital data used by AI applications.

Big Tech companies like Alphabet (GOOG, GOOGL), Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT), and Oracle (ORCL) are investing heavily into new data centers in order to capture as much of the expected future AI market share as possible.

These five hyperscalers alone plan to up their capex from a collective ~$400 billion in 2025 to over $600 billion by 2027.

JP Morgan - Guide to the Market

But as you can see from the chart above on the right, these Big Tech giants are enjoying a surge in operating cash flow that is going a long way in funding these AI infrastructure investments.

Of these five, only Oracle is taking on significant levels of new debt to fund data center construction.

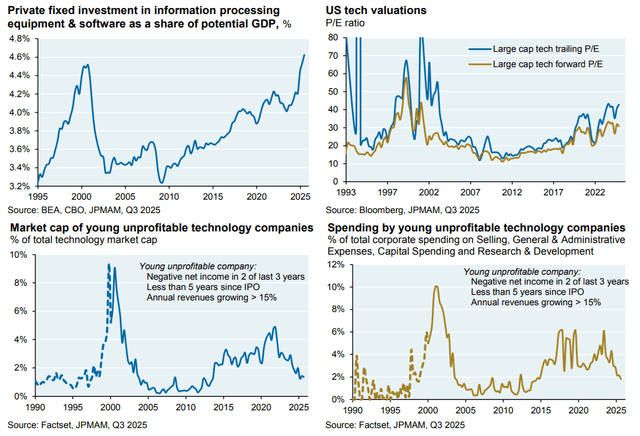

Below, on the top left, we can see that total technology capex as a share of GDP is now higher than it was during the Dot Com bubble of the late 1990s:

JP Morgan - Eye on the Market

And yet, in the bottom right chart, we find that, unlike the Dot Com bubble era, corporate spending by unprofitable tech companies is low and falling.

There are few AI equivalents to Pets.com and other Internet startups with no revenues or business plan.

That makes the current AI bubble, if it is one (or if it will become one), much different than the Dot Com era.

When it comes to AI, cash-rich Big Tech corporations are leading the charge and shouldering much of the costs. And where smaller companies like Blue Owl Capital (OWL) are also investing in data centers, these investments are typically backed by long-term leases with one or more of the Big Tech companies.

It isn’t necessarily that nothing will or could go wrong with this gargantuan level of spending on AI infrastructure.

Rather, if something does go wrong -- if there is overbuilding or other types of excesses -- it will almost certainly look different than the Internet bubble looked in the late-1990s.