Top 5 Picks for 2026

Quick Announcement

I am very happy to finally share some news that has been years in the making. After more than three years of work, my book The REIT Advantage is officially out and available for sale on Amazon.

This project has been a major personal commitment for me. I wanted to write the book I wish I had when I first started investing in REITs, one that clearly explains why REITs are such a powerful long-term investment, and how to invest in them the most effectively.

I was also honored to receive a foreword from Edward Pitoniak, CEO of VICI Properties, along with endorsements from several prominent REIT CEOs. Their support means a great deal to me and reinforces my belief that this book fills a real gap in the REIT investing space.

“Askola has produced one of the most insightful books on REIT investing in the last two decades. This is a must-read for potential REIT investors at every level.”— Joey Agree, CEO of Agree Realty Corporation

“Not since Ralph Block’s seminal work on REITs have I found a resource that is both this comprehensive and this succinct. This is an essential addition to every REIT and income investor’s library.”— Aaron Halfacre, CFA, CAIA, CEO of Modiv Industrial

“This book reflects the same passion and analytical rigor that make him such a trusted voice in the REIT space.”— Vikaash Khdloya, Former CEO of Embassy REIT

“Readers will walk away empowered to make informed investment decisions in REITs.”— Daniel Oberste, CEO of BSR REIT

“Askola’s accessible evaluation does as fine a job as I have ever seen of showing the relative benefits of public REIT investing.”— Christopher Volk, Former CEO of STORE Capital

“His systematic approach offers both institutional and individual investors a practical framework for navigating this complex sector.”— Anthony Coniglio, CEO of NewLake Capital Partners

“I am honored to contribute this foreword and can highly recommend Askola as your guide to why and how to invest in REITs.”— Edward Pitoniak, CEO of VICI Properties

Available now on Amazon

I am obviously biased in saying this, but I genuinely believe this is the best book on REIT investing available today. I have read all of them, and in my view, most focus far too much on theory and far too little on what actually matters in practice.

In this book, I focus on practical insights gained from more than a decade of active REIT investing, including lessons learned the hard way and mistakes that cost me real money.

For roughly twenty dollars, I do not think you can find a better investment in improving your understanding of REITs and real estate investing.

You can order your copy directly on Amazon by clicking here.

(Note that the above link is for Amazon US, but the book is also available on Amazon in other countries.)

Thank you again for your continued trust and support. I truly believe this book will help you better understand REITs, our strategy, and how to invest in this asset class more effectively over the long run.

Let me know if I can help with anything else, and Happy New Year!

Jussi

Top 5 Picks for 2026: Kimco Realty

Transaction:

We bought another 120 shares of Kimco Realty (KIM), increasing our position size by 20%.

------------------------------------------------------

In our recent article highlighting the retail property sector, we noted that the sector was enjoying historically strong fundamentals with very low vacancy rates and steady rent growth.

Too little new retail space has been built over the past decade, and as a result, the sector is now severely undersupplied.

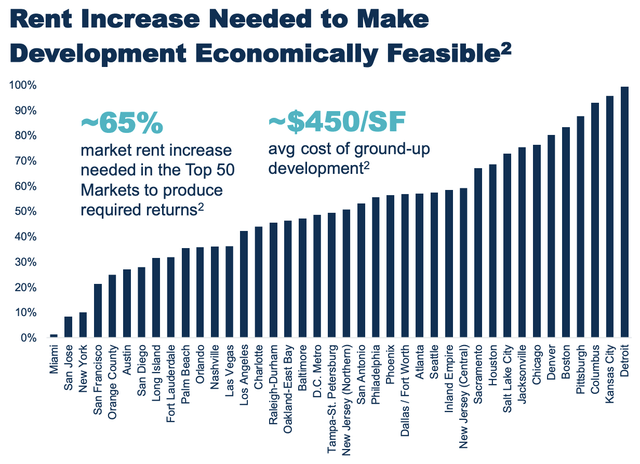

And this is unlikely to change anytime soon, as the reason for the muted construction of retail space is that rents have not risen enough yet to justify building new space. According to Kimco (KIM), retail rents would need to rise by about 65% on average in its markets just to make new development projects economically feasible:

A material drop in construction costs is very unlikely, and therefore, rents will need to gradually adjust higher before we face a new wave of supply.

To quote Cushman & Wakefield:

There is virtually no supply risk in retail over the next several years, ensuring minimal disruption to occupancy and income streams for investors.

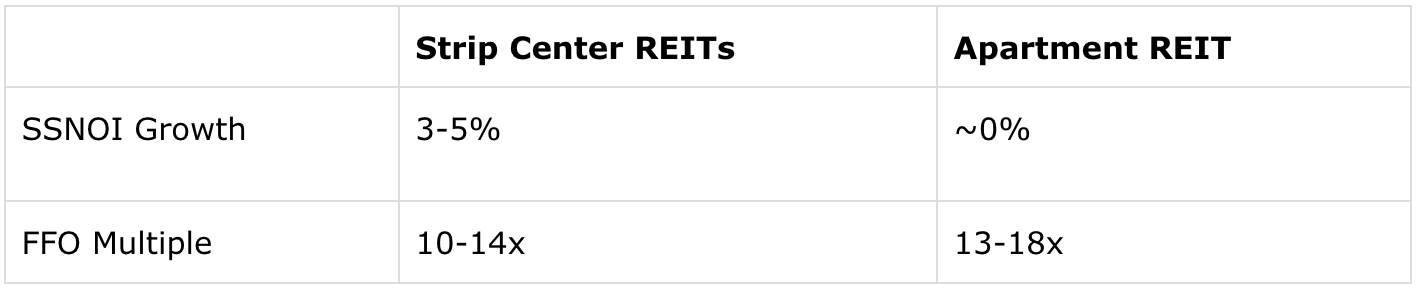

This means that unless we face a severe recession or any other black swan event, high-quality retail properties are likely to enjoy steady, strong same-property NOI growth for years to come. Whitestone REIT (WSR), as an example, has provided a multi-year guidance of 3-5% same-property NOI growth going forward.

Normally, when a property sector is doing so well, it will trade at relatively rich multiples that reflect this strength, but oddly, this has not happened in the case of most retail REITs.

They are currently even cheaper than Apartment REITs, which have been dealing with persistent oversupply and stagnating rent growth for years:

Why are they so cheap then?

It seems that there are two things that concern the market about retail REITs.

First, the consumer and labor markets have been weakening, and as a result, increasingly many investors have become worried that we could be facing a recession in the near term. This would lead to lower sales, weakening retailers’ performance, and reducing the demand for retail space.

Second, there is policy chaos on trade with tariff rates changing all the time, and this is unquestionably going to hurt retailers. This is already a very challenging business, and the constant changes are only making it harder. It could lead to weaker demand for retail space in the near term if this continues.

While both are fair concerns, I would note that they only relate to the near-term demand outlook and don’t have any impact on the long-term supply and demand imbalance that currently exists in the retail space.

In other words, these factors could potentially hurt the demand side in the near-term, but they won’t solve the long-term undersupply issue, which is the main reason to be investing in retail REITs today.

I will gladly trade more near-term uncertainty for a lower valuation to capitalize on a clear long-term tailwind. Since most of the market is excessively focused on short-term prospects, this is enough of a reason to significantly discount retail REITs, despite them enjoying a very solid long-term outlook.

Big private equity firms know this, and this is why the private market for retail assets has now become very competitive, and cap rates have been compressing.

Public REIT M&A has also been heating up with Blackstone (BX) acquiring Retail Opportunities Income Corporation (ROIC) earlier this year, and MCB Real Estate offering to acquire Whitestone REIT (WSR).

These private equity firms are taking the long-term view, recognizing that retail REIT valuations are too low given their compelling long-term prospects.

But what’s the best retail REIT to buy today?

Until recently, we thought that it was Whitestone REIT (WSR), and it is still one of our favorites.

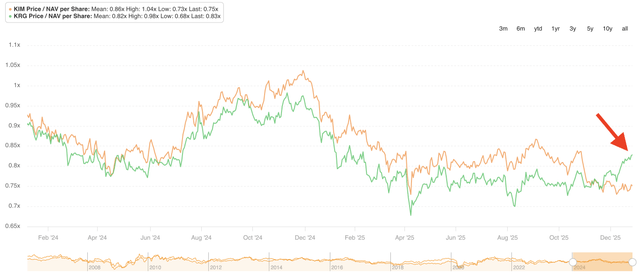

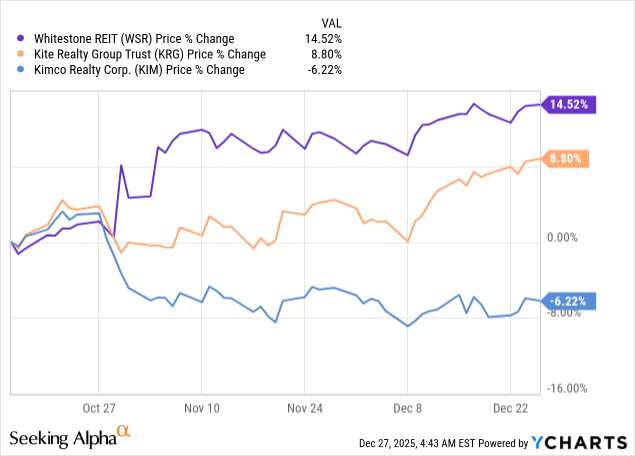

However, our new Top Pick is now Kimco Realty (KIM). Over the past months, it has underperformed its close peers for no good reason and as a result, it is now offered at a historically low relative valuation:

This recent divergence would seem to indicate that Kimco might have delivered poor Q3 results, but it is actually the opposite.

The REIT hiked its full-year guidance, now expecting to grow its FFO per share by 6% in 2025. It also hiked its dividend by another 4% and announced another $750 million share buyback plan, which they are very likely to use given that they have been buying back shares throughout 2025. Their Debt-to-ETBIDA also dropped to 5.3x, which earned them a second A- credit rating.

Its current average rent is just above $20, but it is signing new leases in the $26-30 range, which bodes well for the future as more of its leases gradually expire.

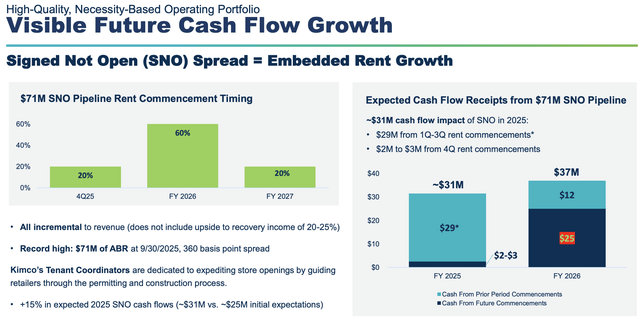

So everything is going great for Kimco, and the management expressed strong confidence about 2026, given that they are today sitting on the largest “signed but not open” spread in their entire history at $71 million. These are new leases that have been signed, but rent payments have not yet started:

Plus, Kimco’s large size, A- credit rating, and clear focus on grocery-anchored properties make it safer than most of its peers.

Historically, this was rewarded with a premium valuation relative to smaller and riskier REITs like Kite Realty (KRG), but following its recent underperformance, this premium has now turned into a discount, which is truly rare:

According to the consensus estimates of analysts, Kimco is currently trading at a 25% discount to net asset value, but some analysts show clear anchoring bias, lowering their NAV estimates in synch with the share price, when in reality, retail NAVs have been rising over the past year as a result of cap rate compression and strong same-property NOI growth.

We estimate the discount to be closer to 30-35% at the current share price, which is quite exceptional for an A-rated REIT operating in an undersupplied property sector with attractive long-term growth prospects.

We expect the NAV to keep rising over the coming years, and the discount to eventually close down as the trade policy stabilizes and the market moves past the tariff fears.

This could result in 30-50% upside, depending on where interest rates land, and whether the broader REIT market also regains popularity. While you wait, you earn a safety-covered 5.1% dividend yield, which still allows the REIT to retain 30% of its cash flow to fund highly accretive share buybacks.

I like the long-term risk-to-reward a lot, and for this reason, we are today buying another 120 shares of the company.

What are our other Top Picks for 2026?

We’ve just released them, and for a limited time, you can join High Yield Landlord for $100 off, plus get a 30-day money-back guarantee!

Offer ends soon! With the 30-day money-back guarantee, you have everything to gain and nothing to lose. Our approach has earned us 500+ five-star reviews from satisfied members who are already seeing the benefits.