TRADE ALERT - Core & International Portfolio March 2025

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on March 4th, 2025, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

============================

TRADE ALERT - Core & International Portfolio March 2025

Earlier this month, we sold our position in Farmland Partners (FPI) to unlock capital to buy the dips. We remain bullish on FPI, but our investment thesis has mostly played and its discount to NAV has compressed even as that of some other REITs has expanded significantly.

If you haven't followed the news, the stock market is selling off right now because there are growing fears that we could be facing a recession.

Tariffs, tensions with allies, government layoffs and cuts are all contributing to the uncertainty.

As a result, the S&P500 (SPY) has almost dipped into a correction:

But there is a silver lining in this for REITs.

The greater economic uncertainty is bringing interest rate cuts back on the table.

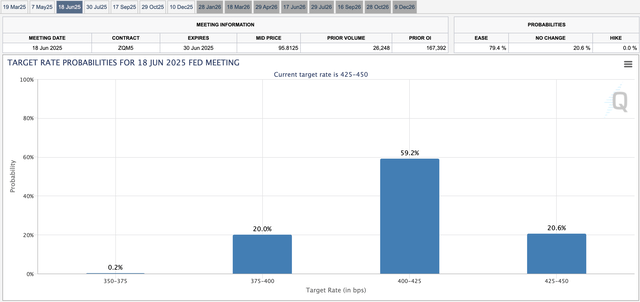

There is now an 80% chance of a cut in June:

Moreover, the market is now pricing three rate cuts in 2025, bringing interest rates down to just 3.5% by the end of this year:

This is very good news for REITs (VNQ), and it explains why they have remained mostly stable even as the rest of the market sold off:

The market knows that most REITs are recession-resistant and the positive impact of rate cuts would likely surpass the negative impact of a recession, especially given that REITs already trade at decade-low valuations:

Therefore, most of our holdings have held up well in this latest sell-off.

However, some exceptions dropped with the rest of the market and we are today redeploying some of the proceeds from the FPI sale into these fresh opportunities.